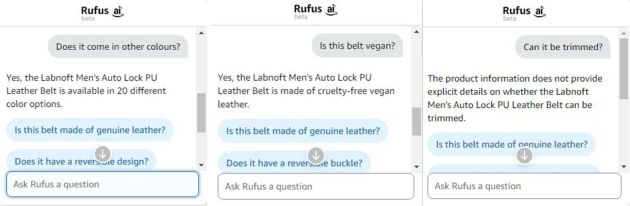

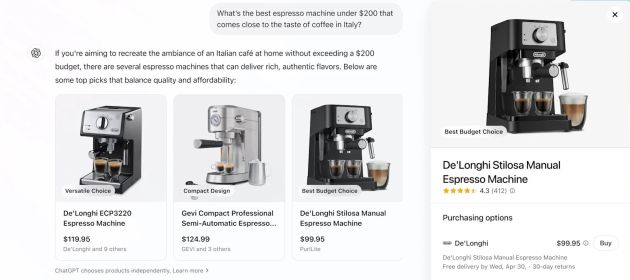

Rufus v. ChatGPT

Rufus is Amazon’s Generative AI chatbot. Whenever you have a question about a product you’re browing on the Amazon website or app, you can click the Rufus button and ask away. You can converse with Rufus in normal language (Natural Language) just as you’d with ChatGPT. Around six months ago, I was in the market … Read more