According to common wisdom, middleman adds a margin, so his price will be higher than the original manufacturer’s price.

Why do D2C brands price their products higher on their own website and make them cheaper on marketplaces like Amazon?

I always assumed buying from their website is cheaper, given they save on commissions.

What's the rationale behind this pricing? pic.twitter.com/sYZtBUR5AQ

— Dharmesh Ba (@dharmeshba) December 27, 2023

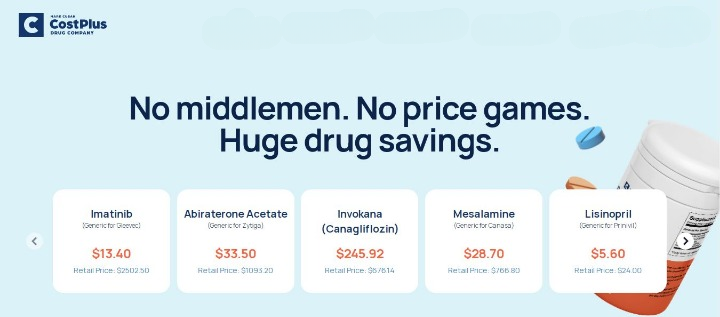

Given that it has become common wisdom, this belief must be true in general. Ergo, kill the middleman is the founding principle of startups in finance, pharma, and many other industries e.g. Mark Cuban Cost Plus Drug Company.

It’s another story that most of these technologies and businesses actually replace the old middleman with a new middleman. Notwithstanding that, they’ve been getting away with their kill the middleman posturing because their purveyors have managed to project themselves as more a transparent and / or benevolent middleman than the middleman they replaced.

However, there are many exceptions to this rule. We’ll cover five of them in this blog post.

- Printer is cheaper from Dealer than OEM

- FT is cheaper via Revolut

- BNPL price is lower than Credit Card price

- Netflix is free via Airtel

- Everything is free via Apple News+

Let’s get on with it.

1. Printer is cheaper from Dealer than OEM

When I was working for a leading computer OEM (Original Equipment Manufacturer), a new financial services company placed an order for a printer with us. The price was ₹30,000 and the delivery period was four weeks. It didn’t receive the product even after eight weeks. Whenever the company’s CEO chased his sales rep for the ETA, the most he got was “We’ll let you know the delivery date in three days”. Mind you, he was not promised delivery in three days, only that he’d be provided information about the delivery date in three days. Since this was happening on top of an inordinately long delay, the CEO got frustrated with my company.

Then, one day, he saw a computer store as he was driving to his office. He stopped and walked in to the store. He was pleasantly surprised to find the printer available ex-stock for only ₹24,000. He paid the amount with credit card and walked away with the printer in the trunk of his car. This store was a dealer of my company.

In short, the middleman was cheaper than the OEM.

This pricing paradox happens because the middleman i.e. dealer buys way higher volumes than retail, gets a hefty quantity discount, and passes on part of it to the customer whereas the OEM sells at list price without giving any discount. Then there are other trade incentives like TAB (Target Achievement Bonus) and OTAB (Over Achievement Bonus) that incent the dealer to give even more discounts and thereby exacerbate the said paradox even further.

For legal and business reasons, OEMs in many industries cannot dictate max and min prices at which their dealers can sell their products, so here we are.

On a side note, this causes a lot of angst among brand owners whenever they stumble upon a seller on online marketplaces who sells their goods, often at a lower price!

+

permission for a third party to sell its products. In fact, if brand stops someone from selling its products, it could be treated as restrictive trade practice, which is illegal. Infringement occurs only if seller claimed to be authorized reseller of the brand. Has it?— Ketharaman Swaminathan (@s_ketharaman) December 28, 2023

2. FT is cheaper via Revolut

Over at LinkedIn, Alexander Peschkoff in UK complains:

Financial Times subscription costs £35/month on its website but you can buy a Revolut Metal plan for £15 a month and get that FT subscription for free (along with tons of other benefits!).

Contrary to what the OP says in a subsequent comment, it’s not that the OEM / FT is charging 2X more. It’s that the Middleman / Revolut is charging 10X less.

For all we know, Revolut may be buying the subscription from FT at full price of £35 and bundling it with its £15/mo. plan, and eating the loss. Since it’s backed by VC, Revolut may be under no pressure to make profits and can probably give stuff away for free for the forseeable future, just like how I get to use so many software products and platforms for free due to VC Subsidy e.g. Hootsuite, Miro, WordPress.

Being a traditional business that doesn’t raise funds from VC, FT cannot sell at a loss when a customer approaches it directly.

3. BNPL price is lower than credit card price

I recently went to an outlet of a large chain store to buy a fridge. The model I selected had a sticker price of ₹30,000. The price was the same whether I paid with cash or credit card. As I was about to go to checkout, a sales rep from a financial services company ambushed me and offered a discount of ₹1,500 if I signed up for his BNPL product and opted to pay with it.

For the uninitiated, Buy Now Pay Later is a relatively new method of payment in which white goods and other big ticket items are financed via consumer loans payable in equated monthly installments (EMIs) spread over 3-6 months without any interest. BNPL is also known as Point of Sale financing although I like the term Point of Aisle financing better (even if I say so myself).

If I pay with a credit card, I get interest-free deferred payment of 20-50 days depending on date of purchase and my billing cycle. If I opt for BNPL, I get free credit for 90-180 days. Logically, the BNPL price should be higher than the credit card price to compensate for the longer credit period. But, it is lower in this case!

This is because the BNPL provider wants to steal market share from incumbent methods of payments like cash and credit card, and is willing to spend marketing dollars to subsidize my purchase.

4. Netflix is free via Airtel

There’s a growing trend of OTT and other subscription providers bundling their subscriptions with MNOs and other utilities. For example, I got a Netflix subscription free along with my Airtel mobile plan whereas it would cost me some money to buy it from Netflix. Given that my mobile plan includes many other things such as – duh! – mobile plan, this doesn’t make any sense.

Here’s my conspiracy theory to explain this pricing paradox: RBI’s Reg Emandate on recurring payments, which came into effect a year and half ago, is applicable when I buy directly from Netflix because my payment is processed by payment gateways and acquirer banks, which are regulated by RBI. However, when the same sub is bundled with a mobile phone plan and autorenews after the free period is over, it will dock my telephone bill. Since RBI does not have jurisdiction over telcos, this hack subvents Reg Emandate! I call this the Utility Subscription Trap.

5. Everything is free via Apple News+

Apple News+ is the mother of all pricing paradoxes.

It includes hundreds of magazines and leading newspapers for one subscription.

If you buy individual subscriptions of these magazines and newspapers directly from their respective publishers, you’d run up a bill of over $1,300 a month. You’d logically expect the Apple News+ subscription to cost $1,300 + Apple’s markup of (say) $200 = $1,500 / month.

But Apple News+ costs only $12.99/month.

That’s not only 100X less than $1,300 but is even lower than the price of many of the individual subscriptions bought directly from their publishers! (For the uninitiated, NYT, WSJ and many other publications charge a very low price for an initial period, after which their subscription prices balloon, somewhat like balloon mortgages that became famous during GFC.).

On a side note, the fact that Apple News+ is a subscription product is an indication that, while Apple unbundled music 25 years ago by selling individual tracks on iTunes, it has not been able to unbundle news by selling individual articles.

Going by the above examples, it’s clear that pricing paradoxes exist.

In a follow-on post, we’ll examine if they’re a problem and whether something needs to be done about them. Watch this space!