Media, OTT, SaaS and other recurring-revenue businesses generate revenues from subscriptions funded by credit card- (or debit card-) based standing instructions that automatically charge the cardholder’s account every month.

As their consumer, if you want to stop a subscription, you’d want to click a cancel button on their website or app and be done with it.

However, in practice, it may not be as simple as that.

DARK PATTERNS

Tricks used in user interfaces of websites and apps that make consumers do things that they didn’t mean to, like buying or signing up for something.

– Deceptive Design

Many merchants make it hard to cancel a subscription by not having a cancel button at all, burying the cancel button below three screen levels, locking you out of their websites closer to renewal dates, and by using other dark patterns described in our blog post entitled What Is Subscription Trap?. The rogue’s gallery of merchants who set such so-called Subscription Traps includes New York Times, Wall Street Journal, ZEE5, and hundreds of well known names in the world.

In UK, subscribers have always been able to escape subscription traps by going to their credit card issuer’s website and canceling the standing instruction for the merchant whose subscription they wish to cancel. Subscribers have been able to do the same in India since RBI enforced Reg Emandate on 1 October 2021.

While the implementation of the mandate has been sloppy as we noted in Revisiting Recurring Payments On The First Anniversary Of RBI Emandate, RegEM does provide a practical way for people to beat subscription traps by turning to their credit card companies.

Every so often I understand why the RBI imposed such a draconian autopay mandate.@DisneyPlusHS auto-renewed my subscription even though I had manually renewed it. How hard is it to check if the sub is active before applying the payment? Now customer support calls beckon 🙁

— Ritesh Banglani (@banglani) January 15, 2023

Barring collusion between banks and merchants, the day is not far when it’d no longer be possible for unscrupulous merchants to set subscription traps as we know them.

In an ideal world, subscription traps will become extinct as dinosaurs in the near future.

However, in the real world, I’ve started seeing signs of merchants colluding with TELCOs and other strange bedfellows to trap consumers in subscriptions in new ways that are more vicious than the subscription traps that we’ve seen so far.

This is an unintended consequence of RBI Emandate.

I recently ported out of a Mobile Network Operator that I’ve been with ever since I got my first mobile phone connection 20 years ago. The sales rep of the new MNO pitched free OTT subscriptions as a key benefit of its family plan.

After my new mobile connection got activated, I redeemed the free Amazon Prime Video subscription bundled with my mobile plan by tapping a few buttons on the MNO’s mobile app. Maybe because I’ve been through a similar journey with my old MNO – whose plan had bundled Disney+ Hotstar subscription – I was able to activate the Prime Video subscription offered by the new MNO quite easily.

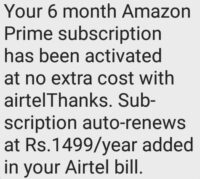

Then came the gotcha: After confirming that my Prime Video was activated, the Amazon website told me that the subscription would renew automatically after six months at the normal price of ₹1499 per year, which amount would be added to my mobile phone bill.

Then came the gotcha: After confirming that my Prime Video was activated, the Amazon website told me that the subscription would renew automatically after six months at the normal price of ₹1499 per year, which amount would be added to my mobile phone bill.

Wut? I spotted two shady things here:

- Neither the sales rep nor the MNO’s app had qualified that the Prime Video subscription would last only six months (With my previous MNO, the OTT subscription lasted as long as I continued my basic mobile plan).

- Worse still, neither had mentioned that the Prime Video subscription would be subject to autorenewal.

I certainly didn’t want the subscription to autorenew since we already have another Prime Video subscription in the family.

I went to the Amazon website to cancel the subscription but I couldn’t do so – Amazon said the subscription was provided by a third party and I couldn’t manage it on its website.

I went to the Amazon website to cancel the subscription but I couldn’t do so – Amazon said the subscription was provided by a third party and I couldn’t manage it on its website.

I then tapped around the MNO app but I couldn’t find the cancel button anywhere. I smelled a Subscription Trap.

I then went to the brick-and-mortar store of the MNO and asked the sales rep how to prevent its Prime Video subscription from autorenewing. He gave me a sheepish smile and showed me a tiny cancel link buried four levels below the app’s splash screen. (As I highlighted in Six Hacks To Escape Subscription Trap, even Apple has moved the cancel command from -1 to -3 level on iPad / iOS.)

My suspicion about subscription trap was right.

Had I missed the message about autorenewal on Amazon’s website, I wouldn’t have gone looking around for the cancel button on the MNO’s app, let alone click it on time to cancel the subscription from autorenewing. After six months, the MNO would add ₹1499 to my bill. If I refused to pay, it might cut my mobile connection.

As you can see, this is more vicious than conventional subscription traps that I can beat by canceling the standing instruction on the credit card company’s website. Worst case, even if I’d to cancel the credit card itself, I can easily survive with my other credit cards (not to mention cash, UPI, and other methods of payments.) Whereas, if I lose my mobile phone connection, my whole life would come to a grinding halt.

Maybe I’m jumping to conclusion from a single datapoint but this reminds me of the VAS scams in the early days of mobile phone in India when telecom companies would tack on random charges for ringtone and other value-added services to mobile phone prepaid balances and postpaid bills – just that they were single or low double digit charges whereas mobile plans have become ~20 times cheaper since then and ₹1499 for Amazon Prime “VAS” can be close to six months of the basic mobile bill.

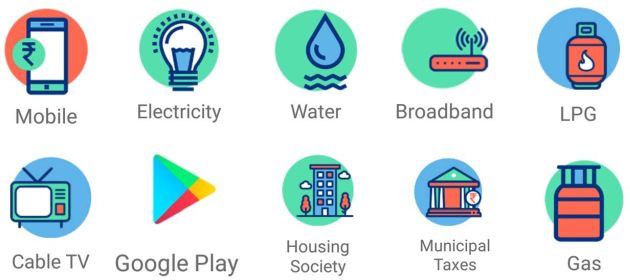

Here’s a Public Service Announcement: Watch out for media, OTT, SaaS and other subscription-based industries to sidestep RBI-regulated credit card as the funding source and move their subscription traps to mobile phone, electricity, and water companies. Utilities like these not only offer an alternative funding source that’s outside the control of RBI but also exert a greater grip over our everyday life compared to credit card companies.

Since I don’t believe in throwing the baby out with the bathwater approach, the purpose of the above PSA is not to discourage you from availing yourselves of the free subscriptions that come with utilities, housing society, municipality and other non-traditional sources of goodies. By all means, go ahead and redeem those targeted offers – but look out for dark patterns in the redemption journey and take corrective actions in time so that you don’t get nickel-and-dimed by unscrupulous merchants.

UPDATE DATED 4 JANUARY 2024:

There has been talk of UNSUBSCRIBE Act – the Reg Emandate of USA – for the last one year or so but, as of now, Americans can cancel their subscriptions only via the respective merchants / service providers. To that extent, unscrupulous merchants in USA can – and do – continue to use banking rails for setting subscription traps.

In spite of that, T-Mobile and a few other MNOs have started bundling Hulu and other OTT plans with their cell service plans in USA.

You can find out more about the reasons, drivers and outlook of this practice in the following excerpt from The Briefing by Martin Peers newsletter dated 4 January 2024 from The Information:

Phone Companies’ Streaming OffersTV executives are fretting about ways to keep consumers from chopping and changing their streaming services. But there is a solution: letting cellphone carriers package their plans with a streaming service. T-Mobile said it would include Disney’s Hulu service in the bundle of no-extra-cost streaming offerings included with T-Mobile cell service.The telecommunications company already offers Netflix, Apple TV+ and others. Verizon, its biggest rival, has lately taken steps to get into the same game, introducing an offer that includes Netflix and Warner Bros. Discovery’s Max with its services. Typically under these deals, the cellphone provider pays the entertainment company for those who sign up, although details vary. It’s a marketing expense for the telecom firm and a great way for the streaming service to sign up subscribers. One issue is that the deals don’t always last, although T-Mobile has offered Netflix for years now. The phone company might find it hard to take Netflix away!