SEC’s approval for Bitcoin ETF makes it official that Bitcoin is an asset – because ETFs are created only out of assets (or asset classes, apart from indexes). Ergo you have Sensex ETF, S&P500 ETF, Gold ETF, Crude Oil ETF.

Crude oil ETFs

— KK (@KrishnakuKumar) February 8, 2024

Since ETF is not a thing for currencies, it implies that Bitcoin is not a currency.

Wait what? Didn’t Satoshi Nakamoto launch Bitcoin as a cryptocurrency?

Yes, but…

I speculate that Bitcoin was always meant to be an asset and was merely positioned as a cryptocurrency. Ditto Ethereum and all the other cryptocurrencies that followed. In other words, Bitcoin and other assets used cryptocurrency as a marketable item.

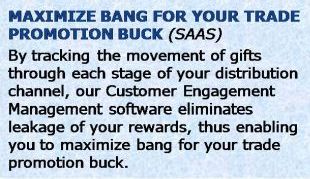

Marketable Item is a packaging of product features and service capabilities into a compelling reason to buy that resonates with the target market’s pain areas and hot topics. If it doesn’t create gain, it must solve pain. See the exhibit on the right for an example.

Marketable Item is a packaging of product features and service capabilities into a compelling reason to buy that resonates with the target market’s pain areas and hot topics. If it doesn’t create gain, it must solve pain. See the exhibit on the right for an example.

As explained here, product ≠ marketable item. As a matter of fact, a single product will often have multiple marketable items, depending on industry and geography at which it is targeted, and the zeitgeist in which it is taken to market.

Bitcoin was launched via Satoshi Nakamoto’s white paper in October 2008.

At the time, there were tons of assets including stocks, bonds, commodities, real estate, and so on.

Selling bitcoin as yet another asset would have been a tough task, just as selling yet another CRM would be a nightmare when there are so many CRM products in the market.

We advocate creating marketable items to cut through the noise in a crowded market. Why wouldn’t Satoshi, huh?

Picture the world, especially western world, when bitcoin was launched. It was the aftermath of Great Financial Crisis. Banks foreclosed on homes because NINJA homebuyers could not repay their subprime mortgages. (For the uninitiated, NINJA stands for No Income No Job or Assets). One after another bank faced a liquidity crisis. Fed and central banks in UK, Germany, and other western countries stepped in as the “lender of last resort”, as they were required to do by law, and advanced loans to help banks tide over their liquidity crisis.

These were not grants. As I highlighted in Calling BS On The Meme “Banks Privatize Profits And Socialize Losses”, banks repaid every penny of those loans along with high interest a few years later. However, the popular narrative spun this as taxpayer-funded bailout. As a result, there was huge amount of hate against banks among J6P.

Disrupting banks had huge appeal – aka product zeitgeist fit – in this world.

While Product Zeitgeist Fit is basically a Consumer Tech concept because it involves culture etc., it does apply to a few Enterprise Techs also:

* No Code / RAD

* Reusability

* Containerization / SOA

* Write Once Run Anywhere / Cross Platform— Ketharaman Swaminathan (@s_ketharaman) January 2, 2020

Fintechs postured that they would kill banks with superior UX of their websites and apps. It’s quite likely that Satoshi thought of using an alternative currency as the way to disrupt banks. In other words, positioning bitcoin as an alternative currency was a low hanging fruit for cutting through the noise and being heard in the world of 2008.

That comes close to our canonical definition of marketable item.

Sixteen years after the Bitcoin Whitepaper was published, bitcoin is not used to buy goods or services. Far from becoming a legal tender, it’s become “illegal tender”.

The comeback of cryptocurrencies is occurring in a more regulated environment, which is guiding their transition from illegal tender to an asset class – Economic Times.

Ergo I’m convinced that Bitcoin as Cryptocurrency was a marketable item rather than product. Ditto, by extension, Ethereum and all the other cryptocurrencies that followed.

On a related note, many people use the terms asset and asset class interchangeably while referring to Bitcoin. I’ve always wondered whether bitcoin is an asset or asset class. According to ChatGPT, it’s both.

Bitcoin is often considered both an asset and an asset class. As an asset, it holds value and can be bought, sold, or invested in, much like stocks or commodities. As an asset class, it represents a category of assets with similar characteristics and behaviors.

Ditto other cryptocurrencies.

Cryptocurrencies form their own asset class within the broader spectrum of investments. They have their own unique features, market dynamics, and correlations, which differentiate them from traditional assets like stocks, bonds, or real estate.

I must hasten to add that, according to SEC’s current thinking, Bitcoin is not a security whereas ethereum and almost all other cryptocurrencies are (per Howey Test).

Having hit the jackpot with returns of 60% (YTD) and 240% (TTM), hodlers of Bitcoin may not bother about whether it’s a product or marketable item. Since they’re busy laughing all the way to the bank – er cryptowallet! – I doubt if they care whether their pot of gold is is a cryptocurrency or asset class or some other thingamajig.