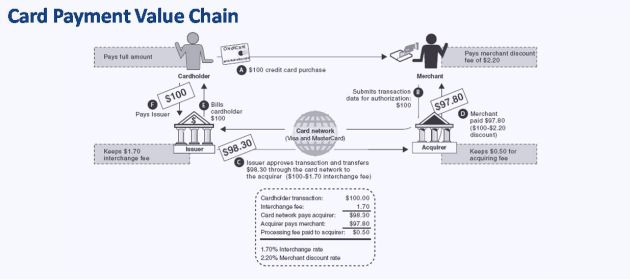

Among others, the credit card value chain comprises the following entities:

Consumer (aka Customer, Cardholder), who uses the credit card to pay for the purchase

Consumer (aka Customer, Cardholder), who uses the credit card to pay for the purchase- Merchant (aka Store, Retailer), who sells what the consumer purchases

- Issuer Bank, which issues the credit card to the consumer

- Acquirer Bank, which issues the POS terminal and Merchant Agreement, the combination of which enables the merchant to accept credit card payments.

The way it works in the credit card industry, the acquirer owns the POS terminal and rents it to the merchant, who places it in its physical premise. Ergo, even though the common man sees a “POS machine” at a store, the POS is not owned by the storeowner.

Information gathered by merchant

There are three types of credit card acceptance practices followed by merchants:

- Normal practice

- Not-so-normal practice

- Sharp practice

The information gathered by the merchant differs in each case.

Normal practice

When a credit card is dipped into / tapped on a POS terminal, a lot of information like Card Number (aka PAN or Primary Account Number), Expiry Date, Cardholder Name, Merchant ID, and Transaction Amount are captured. It goes via Leased Line / Internet directly to the acquirer. In theory, the merchant gets none of it.

However, in practice, one or more of the following things happen at the checkout during a credit card payment:

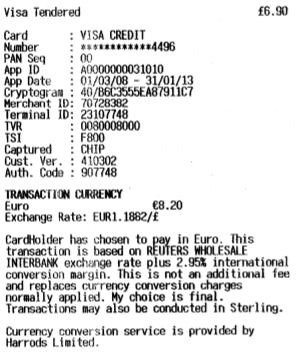

The POS terminal prints out the so-called chargeslip when the transaction is complete. As shown in the exhibit on the right, the chargeslip contains credit card number, expiry date, and a ton of other information. While the merchant is obligated by card network rules to hand over the customer copy of the chargeslip to the cardholder, he’s free to free to print out the merchant copy and retain it for his records.

The POS terminal prints out the so-called chargeslip when the transaction is complete. As shown in the exhibit on the right, the chargeslip contains credit card number, expiry date, and a ton of other information. While the merchant is obligated by card network rules to hand over the customer copy of the chargeslip to the cardholder, he’s free to free to print out the merchant copy and retain it for his records.- Some merchants take a close look at the credit card / chargeslip and type the credit card # – and who knows what else – into their billing system. I don’t know if this is kosher per card network rules but it happens regularly at many Merchant Establishments.

As a result, the merchant does get access to at least a part of the credit card info in a normal credit card transaction.

On a side note, contrary to popular narrative, the SMS alert sent by the issuer bank to the cardholder is NOT proof of payment, only the printout of the chargeslip is.

Not-so-normal practice

It’s not widely known that, according to card network rules, credit card number and expiry date are the only two pieces of information required to process a credit card payment. It’s entirely up to the merchant agreement between the acquirer bank and merchant whether to use cardholder name, CVV, in the payment workflow. Contrary to what the average credit card holder thinks, CVV, PIN and OTP are there to protect the interest of merchant and issuer bank, not cardholder. Click here for more details. That being said, in two factor authentication jurisdictions like India, most credit card payments in practice do involve CVV and PIN / OTP.

With one major exception: MOTO mode. (More on tokenization in a bit.)

Card networks introduced the Mail Order Telephone Order mode of credit card payment to enable people to place orders off of shopping catalogs by mail (i.e. snail mail) or telephone. In the MOTO mode, the customer writes / speaks out the credit card number and expiry date on the order form or telephone respectively and the merchant enters them into their POS terminal (or computer system). The payment goes through without PIN, CVV, OTP or any other form of two factor authentication.

Even as recently as four years ago, MOTO accounted for 7.3% of US retail sales (as against 9.7% for ecommerce).

% of US retail sales:

* Ecommerce: 9.7%

* MOTO: 7.3% .Didn't know "Mail Order Telephone Order" was still so big.https://t.co/asWbw7Jl1O via @WSJ

— Ketharaman Swaminathan (@s_ketharaman) September 13, 2019

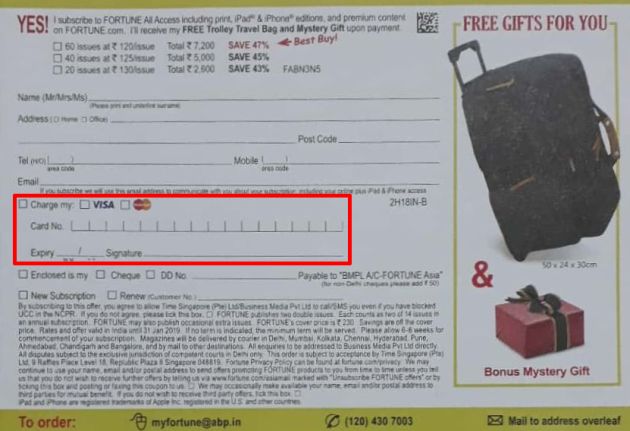

Surprisingly, even though Catalog Shopping never took off in India, the enabling MOTO mode works on Indian POS terminals – despite the fact that India is a 2FA jurisdiction. I’ve used it to pay monthly fees for my coworking office when I was traveling on the due date. It’s also used by magazines for subscriptions e.g. FORTUNE magazine, as you can see from the following exhibit.

In a Mail Order Telephone Order (MOTO) transaction, the merchant gets to know the credit card number, expiry date and cardholder name.

Sharp practice

Then there are sharp practices followed by some merchant establishments viz.:

- Cashier at a store takes a peek at the CVV

- Waiters in restaurants that don’t use Mobile POS terminals ask diners to write down the PIN # of the credit card on the back of the bill while collecting their credit card to be processed at the till.

In these cases, the merchant gets to know the entire credit card info.

Information gathered by bank

The issuer bank receives credit card number and expiry date from the merchant’s POS, which it uses to authorize (or decline) the payment.

As we saw earlier, the POS also collects cardholder name, merchant ID, purchase value, and other information, all of which is available to the issuer bank.

If the store is an outlet of a chain, banks get to know the address of the chain’s HQ that signed the merchant agreement (but not the address of the specific store at which the credit card was used).

Banks don’t know what items (i.e. SKUs) were purchased. While they know the total bill value, they do not get to know the the SKU-wise rate or quantity. Exception: Some banks offer customized merchant agreements where merchants get a disount on MDR if they share such info with the bank. (For the uninitiated, Merchant Discount Rate (MDR) aka Merchant Service Charge (MSC) is the fee incurred by merchants to have their credit card transactions processed by the credit card company. It’s typically 2-3% of the transaction value. More here.)

Tokenized credit card

Increasingly, credit cards are used in their tokenized form e.g. ApplePay, merchant websites that are “ready” for RBI Reg CofT.

It’s not clear what information reaches the issuer bank if the credit card is used in this form.

Some industry players say token obfuscates the credit card number, thereby rendering it impossible for the issuer bank to carry out CVV, volume and velocity checks, three key fraud detection and prevention algorithms.

(1) A couple of months after Apple Pay was launched, there were rising fraud of this nature. IIRC Apple introduced some check (OTP?) before it let the same credit card to be added to different iPhone handsets.

(2) If I'm mistaken about #1: When Apple Pay DAN obfuscates PAN, let…— Ketharaman Swaminathan (@s_ketharaman) August 27, 2023

However, when asked how the issuer bank is able to carry out basic authorization check without knowing the credit card number, they don’t seem to have an answer. For the uninitiated, authorization is the answer to the question “Is there enough credit limit in the credit card account to honor the transaction?”

As I highlighted in Credit Card Versus Debit Card / UPI / A2A, credit card and debit card differ from each other in many significant ways. But, in the context of this post, whatever I’ve said about credit card above is equally applicable to debit card.

Quora Link: https://qr.ae/pv4YTf