Credit Card and Debit Card are both “cards”.

Credit Card and Debit Card are both “cards”.

Both are digital payment methods.

Both are issued by banks.

Both of them work on card rails owned by Visa, MasterCard, China Union Pay, RuPay and other card networks.

Because of these similarities, many people tend to believe that there’s no difference between credit and debit cards.

They’re wrong.

Credit card offers several benefits over debit card:

- Float From Deferred Payment

- Rewards

- Greater Fraud Protection

- Lower Cost of Loss

- Better Redressal Against Fraud

- Credit History

- Ideal for Emergency

Let me elaborate.

#1: FLOAT FROM DEFERRED PAYMENT

When I pay with a credit card, I get 30–45 days to settle my bill. During this period, my money stays in my account and earns interest. In the industry parlance, I enjoy “float”.

When I pay with a debit card, the money leaves my bank account immediately. I lose interest.

#2: REWARDS

I get reward points for my credit card spend. I can redeem these reward points for air tickets, gifts, and so on.

Very few debit cards give rewards.

The monetary value of rewards can be computed from the formula given in the following exhibit.

#3: GREATER FRAUD PROTECTION

Since he goes through the same security steps (e.g. CVV, VbV / MSC / OTP where applicable) for making both debit card and credit card payments, the common man tends to believe that debit card is as secure as credit card.

That’s not true.

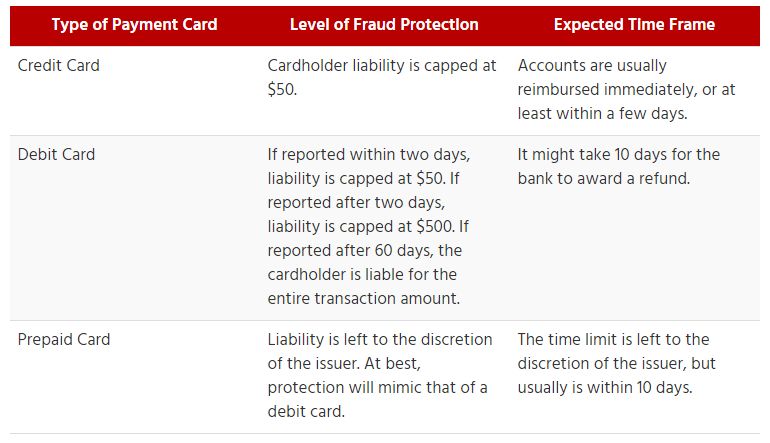

As you can see from the following table on ChargeBacks411 website, in the event of fraud, credit card offers greater protection than debit card.

According to Ted Rossman, industry analyst at Master Life’s Financial Journey, “If you’re saving debit card information and that gets hacked that’s money missing from your account. That’s a lot worse than your credit card. With a credit card, that’s zero liability and it’s not actual money that’s left your account.”

#4: LOWER COST OF LOSS

Both credit card and debit card are equally susceptible to fraud.

But the similarity ends there.

When a credit card is used fraudulently, the fraudster steals money from the bank.

When a debit card is used fraudulently, the fraudster steals money from you.

If your credit card is used fraudulently, the charge is only debited to your credit card account. Since that’s different from your bank account, you don’t actually lose any money.

OTOH, if your debit card is used fraudulently, the money leaves your bank account immediately. Your bank balance falls unexpectedly. And, as we all know, when that happens, you get into all kinds of mess like bounced cheques, overdraft fees, and so on.

The important point to note is that, these problems are caused not just by premeditated fraud but even due to human errors such as when the wrong amount is entered into the POS terminal while swiping / dipping / tapping the debit card.

$hit happens in all payment methods, whether it’s caused by human error or premeditated fraud. But when it happens in Debit Card, FPS, NEFT, UPI, Zelle, or any payment method that’s linked to a bank account, entire bank balance can be wiped out instantly.

#5: BETTER REDRESSAL AGAINST FRAUD

To reverse a fraudulent or erroneous credit card or debit card transaction, you need to file a dispute with the Merchant and / or Bank. But, when you do that, your money is still in your bank account in the case of credit card whereas, with debit card, it has already left your bank account.

To reverse a fraudulent or erroneous credit card or debit card transaction, you need to file a dispute with the Merchant and / or Bank. But, when you do that, your money is still in your bank account in the case of credit card whereas, with debit card, it has already left your bank account.

As anyone with a basic understanding of human psychology will appreciate, it’s easier to wage the war to retain your money (credit card fraud) than to regain it (debit card fraud).

Besides, some banks (e.g. AmEx) reverse the charge on credit card disputes immediately. Click here to know more on this topic.

#6. CREDIT HISTORY

You build a credit history by using credit card, but not debit card.

The traditional benefit of credit history is that it helps you qualify for loans and mortgages, should you ever need them.

There’s a new benefit of credit history: Jobs. A number of companies are reportedly carrying out credit checks of potential employees, and rejecting “no file” and “thin file” applicants i.e. people with zero or minimal credit history respectively. So, no credit card could mean no job.

Yet another reason why people use credit card even though they have cash: Build a credit history so that their job applications are not rejected by companies that increasingly carry out credit checks of potential employees. https://t.co/ett4ge62fP

— Ketharaman Swaminathan (@s_ketharaman) August 26, 2019

#7. IDEAL FOR EMERGENCY

The maximum amount you can spend on a Debit Card is limited to your bank balance. That can be a huge problem in an emergency.

Whereas, with a credit card, you can spend up to your credit limit, which often exceeds your bank balance. As a result, credit card helps you tide over the emergency and gives you a month or more to arrange for the funds before your credit card bill becomes due. This is best illustrated by the following Twitter Thread.

"Made for Credit Card" Moment. https://t.co/WwWenfkadb

— Ketharaman Swaminathan (@s_ketharaman) June 13, 2020

Let me also share a personal anecdote of using a credit card to tide over an emergency of a slightly different form.

The tax year end was fast approaching. I wanted to open a Public Provident Fund account (India’s equivalent of pension) to save income tax. I didn’t have the money. I took a cash advance on my credit card, used that money to fund the PPF account opening. I paid the outstanding in full the next month. Of course, I incurred exorbitant interest charges. But the amount of tax I saved was 5X the amount of interest I paid. I doubt if I’ve ever achieved such a high return in one month in any other pursuit. As stated in my Quora Answer, this is one of the best uses of credit card I’ve ever made.

In my +30 years of using credit cards, I’ve never used a debit card for shopping or bill payments even once.

The only reason why I use a debit card is to withdraw cash from ATMs.

After receiving the new bunch of NFC contactless cards, I feel insecure about debit cards. For reasons highlighted in my post entitled PINless Card Payments – Innovative Or Harebrained?, I’ve removed all my debit cards from my wallet and take them out of the house only when I’m going to visit an ATM.

I recently learned from an ex-Banker that customers can opt for a “pure-ATM card” i.e. a card that can only be used to withdraw cash from an ATM and not for shopping and bill payments. I’m planning to cancel all my debit cards and get them replaced by these pure-ATM cards.

Many of these benefits of Credit Card are also valid when compared to UPI / NEFT / IMPS (India), FPS (UK), Zelle / Venmo (USA), Alipay / WeChat Pay (China), and other Account-to-Account Real Time Payments (A2A RTP).

Quora Answer: https://qr.ae/TWyICN

UPDATE DATED 14 SEPTEMBER 2020:

I stumbled upon another misconception about credit card in the comments section of my Quora Answer https://qr.ae/TW9i4l: People having money in the bank will not pay with credit card.

It probably stems from the mistaken belief that “credit card means debt means interest, why not pay with cash and avoid interest cost”.

It’s totally wrong. People with money in the bank do use credit card – because credit card offers several advantages over cash (and debit card and UPI, etc.) e.g. rewards.

In a famous example, Hong Kong billionaire Liu Yiqian won the auction for a famous painting and paid the ~$175 million tab with his American Express credit card. If he didn’t have money, he wouldn’t have been invited to the auction. He earned enough reward points from this transaction that he and his family get unlimited number of free first class tickets from anywhere to anywhere in the world by any airline for their entire life. See Billionaire earns first-class travel for life by putting Modigliani nude on Amex for more details.