Teardown Of "Direct To Consumer" Business Model

… Take Economic Times for example: In its article titled D2C Brands on Funding High Since ’20, India’s largest business daily defines D2C thusly:

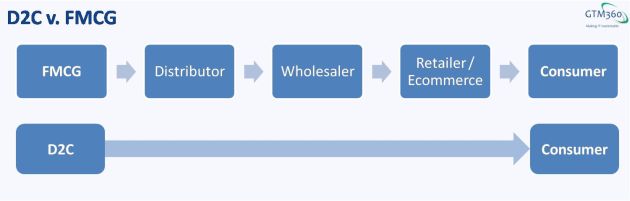

D2C brands refer to businesses that have the majority of their revenues or customer acquisition from direct to consumer online channels or started with online first distribution before going omnichannel.

This definition is wrong in more ways than one.

Firstly, the “D2C = online D2C channel” framing is wrong: Online channel already has a name: It’s called online. It shouldn’t be conflated with D2C, which can – and does – operate via brick-and-mortar stores. As