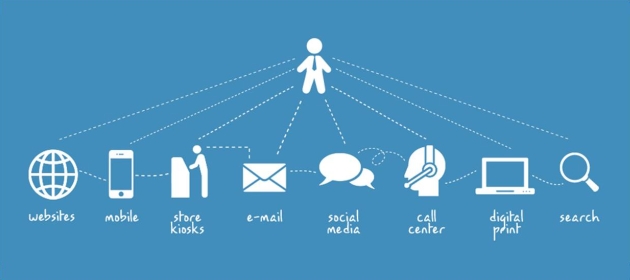

Omnichannel Couponing Drives CEM Success - Part 2

… was a breeze, not only because I’d prior experience with the bottle but also due to the detailed instructions that PayTM was able to print on the sachet.

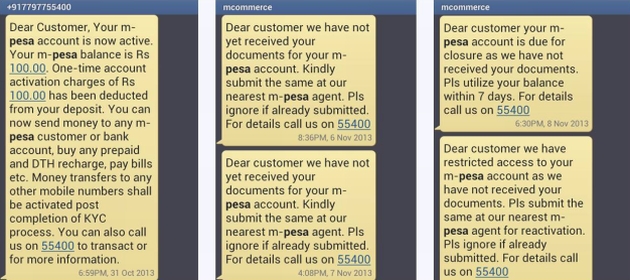

As with the bottle, PayTM faced a challenge in the couponing process with the sachet. The solution it used in this case was to trigger a hop to the phone channel.

By following the omnichannel approach to couponing, I’m sure PayTM has improved the success rate of its CEM campaigns. While I can think of a few areas of improvement – e.g. print the coupon on the outside surface of