In Poor Communications: The Seventh Deadly CX Killer, I described the painful experience of activating the new credit cards I recently received from my bank.

To recap, I didn’t get a paper PIN mailer as was customary during the previous renewals, and the instructions given by the bank on how to activate the new cards on its digital channels were totally confusing, if not contradictory in parts.

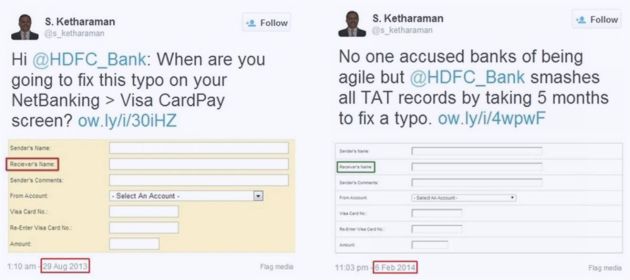

I don’t have any inside track into what happened. But I’ve encountered sloppy communications from this and other banks several times in the past. Cf. Tap’s Loss Is Dip’s Gain – Or The Attitude That Will Kill Contactless Payments and Warts And All, The System Works for highlights of my past experience with poor language.

Going by all that, I attribute the chaos on this occasion to a casual attitude of the bank towards customer communications.

By missing out crucial steps in the activation journey, somebody in the bank probably thought they were keeping things simple.

Sadly, that was only true for itself. Its casual attitude towards communications actually made things complex for its customer.

This is yet another instance when a company conflates simplicity for itself with simplicity for its customer. Like many other companies, the bank failed to appreciate that a service provider / supplier / vendor needs to do a lot of complex stuff in order to keep things simple for the customer / user.

The simpler something feels to use, the harder it was to create.

It took more time and debates for the maker(s) to get it right.

That’s why you shouldn’t study makers to imitate their creations.

Study makers to figure out how they make things.

— Hiten Shah (@hnshah) December 10, 2018

In short, the bank forgot a cardinal principle of Customer Experience:

Simple for developer is compex for user. Simple for user is complex for developer.

Why does this matter?

When faced with friction in the new card activation journey, many cardholders put off activating their new credit cards. Either they go back to cash or they divert their spends to their other credit cards as I did. In both cases, the bank loses interchange revenue, if not the customer altogether.

So, for any bank, ensuring timely activation has to be a high priority task.

What can a bank do?

Going back to paper PIN mailer may not be an option due to the high costs involved in printing and shipping. Good news is, it does not need to do that. A bank can improve communications and design a frictionless digital card activation journey such that customers don’t miss the paper PIN mailer and yet have a superior CX.

One way to do that is with a Card Activation Wizard.

Card Activation Wizard personalizes the card activation journey for each customer. This is possible since the customer is logged in and the bank knows the identity of the customer who is trying to activate his or her card. The wizard pulls together just the required features to activate the new card instead of dumping the customer inside its online banking jungle with misleading instructions. The activation screen should pre-populate the cardholder name, new card number and expiry date fields, all of which are known to the bank. The customer should only have to look up the cards they’ve received by snail mail, verify that they match the details displayed on the screen, click a button to set a new PIN and activate their new card. (As I highlighted in Part 1, instore use of credit cards in India – as in Europe and other parts of the world – require a PIN, so setting a PIN for the new credit card is an integral part of the new card activation process.)

Going by past experience, it might take a while for a bank to build out such a card activation wizard.

In the interim, the bank should at least stress test its communications and minimize scope for confusion between its welcome letter, email and website. QR codes can be used to make the omnichannel journey across these channels seamless. Click here and here to read the case studies of how we helped two leading BFSI companies in this endeavor.

As we can see, poor communications mars Customer Experience; and improving communications can enhance Customer Experience.

It’s not only me.

In his two-part blog post entitled Want to Create Greater Customer Centricity? Start with Customer Language, Augie Ray, Gartner VP for Customer Experience, emphasizes the importance of language thusly:

Language has a lot to do with CX. So how can one individual help to transform their corner of the organization to be more customer-centric? One place to start–and a particularly powerful strategy for marketers–is to begin to use the language of people and not business. This isn’t merely a matter of style. Language matters.

Don’t underestimate communications. It could be your low hanging fruit for enhancing Customer Experience.