Ten Revolutionary Things About AI – Part 2

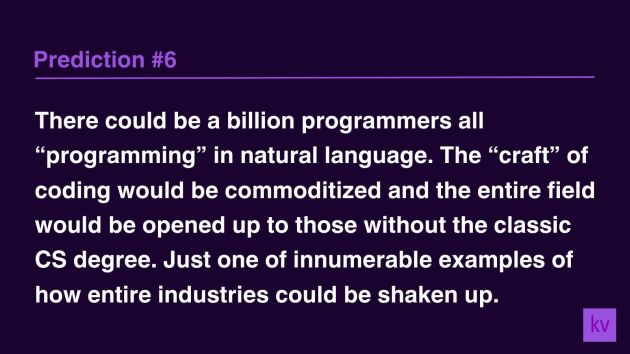

In Ten Revolutionary Things About AI – Part 1, we described five gamechangers about ChatGPT and other Generative Artificial Intelligence platforms. In this Part 2, we shall cover five more revolutionary things about AI. 6. Weird Regulatory Proposals There are broadly two lobbies for regulating Gen AI: A) Closed Source (via Sam Altman and Vinod … Read more