Open Network for Digital Commerce seeks to increase the penetration of digital commerce in India by enabling companies to plug into its open and interoperable ecommerce protocol and thereby complete their ecommerce solutions.

Setting up an e-commerce platform requires putting together diverse elements and working towards making each element a success. ONDC, on the other hand, provides you with an opportunity to grow via e-commerce by connecting you with other network partners that will complete your e-commerce solution. (Source)

Incorporated as a private sector Section 8 company with the Quality Council of India and Protean eGov Technologies Limited as initial promoters, ONDC has committed funding from Bombay Stock Exchange Investments Limited, HDFC Bank Limited and State Bank of India among other companies.

The participants of ONDC include ecommerce companies, standalone online sellers, buyer apps, seller apps, logistics companies and payment service providers.

ONDC envisions the following operating model:

- Buyers can go to ONDC and discover products that are listed not only on their go-to ecommerce app but also on all other ecommerce apps, online sellers and seller apps plugged into ONDC

- Sellers on one ecommerce app or seller app can access buyers on all other ecommerce apps and buyer apps plugged into ONDC

- Buyers and sellers can both access a wide choice of providers of digital commerce-adjacent services like cataloging, payments and logistics.

The way ONDC works, a user of Ecommerce App A can order a product sold on Ecommerce App B or Online Seller C or Seller App D, pay for it with Payment Service Provider App E, and have it delivered to her via Logistics Company F.

By letting virtually anyone join as buyer or seller, ONDC endeavors to “democratize ecommerce”, as TechCrunch puts it.

Let me hasten to add that ONDC is not a platform but a network / protocol.

ONDC does not endorse any of the buyer applications. ONDC is not a party to any transaction made by anybody through these buyer applications, and does not offer any terms, or make any representations or warranties regarding such transactions, the applications or their services. – ONDC

Unified Payments Interface (UPI) is India’s implementation of Account-to-Account Real Time Payment where money is transferred from a sender’s bank account to a receiver’s bank account in realtime. Operated by National Payments Corporation of India, a Section 8 private sector company, UPI supports P2P (person to person) and P2M (person to merchant) payments initiated from Walmart PhonePe, Google Pay, and other frontend apps.

The keywords “open”, “interoperable” and “democratize” in the description of ONDC evoke an immediate comparison of ONDC with UPI.

The explainer video on the home page of ONDC reinforces the comparison by drawing an explicit parallel between ONDC and UPI: “Sender and Receiver can have accounts in different banks and transact with different payment apps but UPI enables them to send and reeive payments seamlessly”.

The comparison is fair: Both ONDC and UPI are multi-corner marketplaces. The participants of ONDC are buyers, buyer apps, ecommerce companies, standalone online sellers, seller apps, logistics companies and payment service providers. The participants of UPI are payers / consumers, payees / merchants, issuer banks, acquirer banks, and payment service providers. Both networks are subject to “network effects”.

However, there’s a risk in stretching that analogy too far since there are many differences between ONDC and UPI:

- ONDC relates to physical goods whereas UPI handles digital payments.

- Indians enjoy great UX and CX with incumbent ecommerce apps when ONDC has come along but they had a lousy experience with incumbent digital payment methods like credit card, debit card and NEFT before UPI entered the scene.

- Nobody goes to UPI to discover whom to pay whereas ONDC is positioned as a network that enables buyers and sellers to discover more of each other. In other words, the trigger for using UPI exists outside and before UPI whereas the trigger for using ONDC is created inside and after ONDC. This means that while UPI apps will always be at the end of the shopping journey, ONDC will eventually be the destination app where consumers begin their online shopping journey like Google Search (On a side note, this reminds me of how Klarna and other fintech BNPL apps position themselves as shopping apps, just with built-in facility for payment and installment credit).

- Network effect is good after you have it but bad before you have it.

But that’s not to say that ONDC cannot be as successful as UPI.

ONDC is gamechanger for Ecommerce. ~ LinkedIn.

In this blog post, we’ll speculate on how ONDC can instantly replicate the success of UPI.

Anyone who has followed the rise of UPI would have observed a few factors that existed alongside its “to the right and the top” trajectory:

- Huge fillip given by government diktat

- Low credit card penetration

- Low POS terminal penetration

- Brute force distribution

- Heavy friction and high rate of failed credit card and debit card payments, caused by two factor authentication

- Cooling period and other cumbersome features of NEFT online payments

- Majority of retail payments are made without queues

- Low penetration of desktop / laptop and broadband

- Zero MDR

- Low privacy expectations.

More at Don’t Go Global Without Cracking The Value Proposition For Foreign Markets.

While there’s no suggestion of cause-effect, I don’t think that there’s any doubt that these factors have bolstered UPI.

Let’s see how they can be leveraged to drive overnight success of ONDC.

Government diktat

In November 2016, government of India demonetized high value currency notes. This caused a huge cash crunch and drove both buyers and sellers to digital payments at scale. Per anecdata, India made more progress in digital payment adoption in six months after demonetization than it would have made organically in six years without demonetization. To provide a similar boost for digital commerce:

Step 1: Shut down all brick-and-mortar stores.

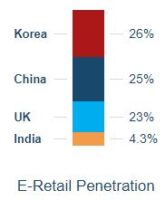

According to ONDC, digital commerce has a penetration of only ~4% in India. (IIRC, this is quite close to the penetration of digital payments before demonetization.) If you ban khirana stores and outlets of big box retailers, a huge chunk of the 96% of retail sales will automatically move to ecommerce.

Brute force distribution

As I highlighted in Banks Have Not Lost The UPI Plot, A2A RTP systems like UPI move money instantly from the payor’s account to the payee’s account and thereby deprive banks of float income. As a result, banks have never volunteered to implement these systems anywhere in the world, and A2A RTPs have been set up by statutory edict wherever they exist today e.g. The decree from Office of Fair Trade that resulted in establishing Faster Payments Systems in UK in 2008.

Ditto India. But the big difference between India and other trillion dollar democracies is that a vast majority of banks are owned by the government in India whereas they’re in the private sector in USA, UK, Germany, etc. Accordingly, banks onboarded UPI in India in a fraction of the time that it took for A2A RTPs to achieve critical mass distribution in other countries (at last count, there are 60 of them.)

In January 2020, the government passed Reg ZeroMDR which zeroed the MDR of UPI from 0.8% to 0% and totally decimated the business case for banks in UPI. Still, being majority government owned, banks could not protest too much and continued to support UPI.

Accordingly, UPI was able to achieve brute force distribution in India.

On the other hand, distribution is a major challenge for ONDC. According to its CEO T Koshy:

ONDC has no issues in terms of tech or design. Our challenge is expanding our market. The biggest challenge…is onboarding sellers of different sophistication levels.

– Inshorts

This is called the coldstart problem and plagues marketplaces all over the world.

Marketplace Holy Grail cracked by @anishamydala: Solve one side's pain & SIMULTANEOUSLY deliver gain to other side.

— Ketharaman Swaminathan (@s_ketharaman) January 14, 2016

UPI was able to solve it quickly for reasons mentioned above.

But it’s a different ball game in the case of ONDC since its participants are private sector companies and are under no compulsion to join ONDC. (I could not find any reference to the Top 2 ecommerce companies in India – Amazon, Flipkart – on ONDC.)

However, brute force distribution can be replicated in ONDC with the following step:

Step 2: Mandate that all ecommerce companies must join ONDC.

If this appears outlandish, let me refer you of the series of regulations that have impacted the ecommerce sector in the last five years or so e.g. Ecommerce companies cannot own stake in sellers on their platforms, which led to Amazon divesting its stake in Cloudtail.

Step 2 will overcome the challenge of onboarding sellers on ONDC.

As we saw earlier, Step 1 would ensure that buyers would onboard ONDC at scale.

The combination of these two steps would help ONDC get over its cold start problem.

Heavy friction for competing payment methods

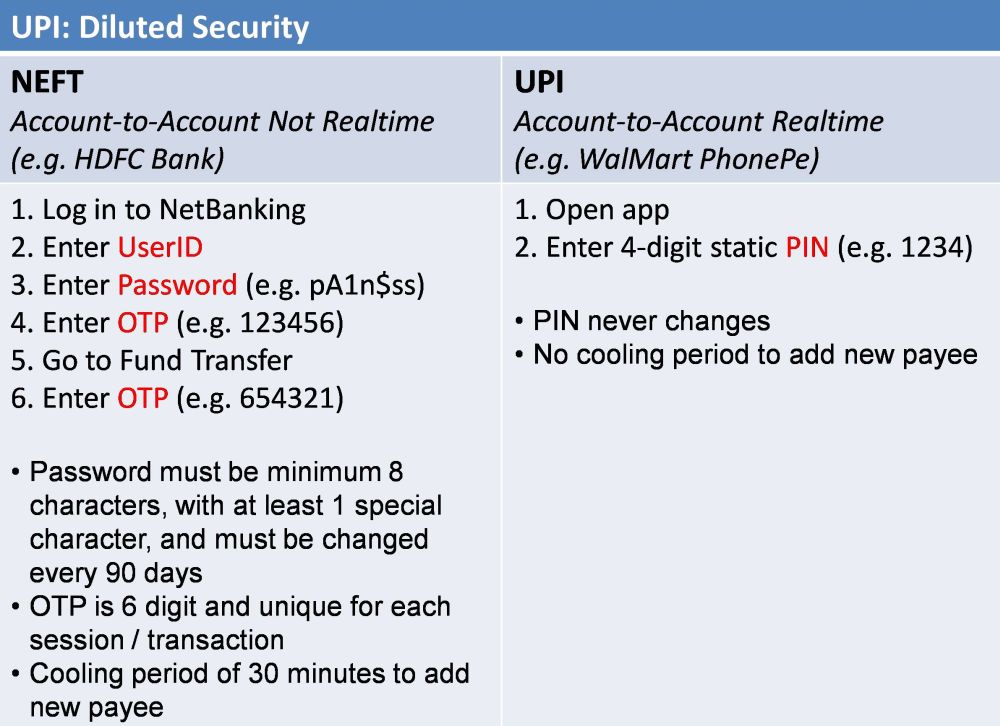

When UPI was launched in 2007, competing MOPs had severe friction:

- Credit Card and Debit Card: Two factor authentication

- NEFT: Cooling period for adding payees and frequent password changes

Down the line, a series of regulations added even more friction:

- Credit Card and Debit Card: Emandate, Card on File Tokenization (CofT)

- Cheque: Positive Pay

On the other hand, UPI removed friction in digital payments, as illustrated in the following exhibit:

This helped improve the UX and CX of UPI and thereby take its volumes to another level (UPI did close to $1.6 trillion of TPV in 2022.)

On the other hand, Indians have been enjoying great UX and CX with incumbent ecommerce apps. To create a level playing field for ONDC:

Step 3: Decree that all orders placed outside ONDC must be confirmed with hard copies signed by consumers in wet ink and snail mailed to the ecommerce companies by speed post.

This friction hotspot would nudge consumers to migrate from their Amazons and Flipkarts to ONDC.

Lest you think this is farfetched,

- In the mid-1990s when ecommerce had just started in India, pioneers Fabmall, IndiaShopping and Rediff.net had to send printouts of all orders exceeding INR 2000 to credit card issuers for manual authorization

- Even today, after e-filing income tax return on ITD portal, you need to send a hard copy with wet ink signature to Central Processing Center.

More choice for buyers

One of the founding premises of ONDC is that the average customer is shortchanged by the limited choice of products available on her go-to ecommerce app and would greatly welcome the larger universe of sellers available via ONDC.

Based on personal experience and anecdata, I have mixed views on this.

When I shop online, I search for the item, add it to the shopping cart, checkout – that’s it. In other words, I don’t browse at all. After 25 years of shopping online, I have enough items in my order history and click the Buy Again button from there. In other words, I don’t even use search all that much nowadays.

It’s not only me. This shopping style is so popular that it has its own name: spearfish shopping.

On a side note, I’m a big fan of instant / 10 minute grocery delivery – with a very limited assortment, the Dunzos and Swiggy Instamarts take spear-fish shoppability to the next level.

Kudos to @TheKenWeb for getting that small assortment (< 2000 SKUs) is the secret of success of 10 min / instant grocery delivery companies – and not their shortcoming. https://t.co/ObUdk9gjpc .#Dunzo #Swiggy #Zepto #MoreIsNotBetter pic.twitter.com/wfccTYA3vD

— Ketharaman Swaminathan (@s_ketharaman) September 20, 2022

But I concede that n00bs to digital commerce might have a different shopping style and could appreciate more choice. However, that’s not necessarily a good thing for sellers. According to many studies of consumer behavior, it’s counterproductive to present more than three alternatives since consumers get confused by too much choice and bail out, thus leading to the loss of sale.

Ergo product assortment is somewhat like security: Everybody wants more of it but only until they get it.

But to safeguard ONDC’s founding premise, herewith the next step.

Step 4: Rule that consumers must compare at least 10 products before they can buy one.

This will create a huge source of differentiation for ONDC since other platforms apparently display only three products per search. Since ONDC operates in a time rich market, most people won’t crib about the extra effort required. And, for all we know, the added choice might sometimes prove beneficial to the consumer, as ONDC posits.

This step will also undermine the Winner Takes All outcome driven by ecommerce, rideshare, edtech and other VC-backed industries where 80% of the value is captured by 20% of the players. When they must view ten products before they can buy one, consumers can no longer continue to shop like before assuming that they “can get everything” from the Top 3 ecommerce companies.

Bigger market for sellers

Another founding premise of ONDC is that it expands the market for sellers by providing greater visibility on multiple ecommerce apps by registering on only one.

While true, this is a benefit only for small sellers who cannot afford to invest in their own marketing.

While true, this is a benefit only for small sellers who cannot afford to invest in their own marketing.

Large sellers can and do invest in marketing (apart from warehouse, logistics and customer service), always like to own their customers and never cede their customer relationship to third parties (like ONDC in this case).

While a rider might love to have a single app to book a Uber / Ola / BluSmart cab, the fact is Uber wants you to book a ride only on Uber App, not iXigo aggregator app. Likewise, Amazon wants you to traverse the entire AIDA journey on the Amazon app or website, not ONDC.

This is one reason why companies that tried what I call “Uber Aggregation” in Rideshare, OTT and other industries with big players flopped. Click here for more.

This is a biggish problem and needs two steps to solve:

Step 5: Ban advertising and all forms of customer engagements by ecommerce companies.

This will stymie the ability of ecommerce companies to build customer relationships.

Step 6: Ban ecommerce companies from using their own logistics units for making deliveries.

For example, Amazon cannot use Amazon Logistics to deliver its own consignments and must use a third-party logistics company like Delhivery to have them delivered.

When an ecommerce company uses a third-party to make deliveries, it can’t control the end-to-end experience, which significantly erodes its ability to retain customer relationships.

This is the classical unbundling move in antitrust action: Break down big companies by dismantling their forward and backward integrations. This has been happening since the times of Standard Oil, AT&T, and Microsoft (Internet Explorer can’t be bundled with Windows, Teams can’t be bundled with Office).

I also wonder if this step has already been implemented:

My last three Amazon orders were delivered by Delhivery, which is a third-party logistics company. The first time that happened, I got a PUSH notif on my housing complex’s My Gate gate pass app to allow a “Delhivery delivery agent” to deliver a consignment. I hit NO since I had not ordered anything from this company. The delivery agent called me from the gate to say that the was delivering my Amazon consignment.

My last three Amazon orders were delivered by Delhivery, which is a third-party logistics company. The first time that happened, I got a PUSH notif on my housing complex’s My Gate gate pass app to allow a “Delhivery delivery agent” to deliver a consignment. I hit NO since I had not ordered anything from this company. The delivery agent called me from the gate to say that the was delivering my Amazon consignment.- ONDC has a stated goal to unbundle ecommerce.

I’m guessing that the above playbook can drive instant success of ONDC.

If the six steps given above don’t suffice, ONDC can take its unbundling mission to the next level by decreeing that catalog, warehouse and other building blocks of digital commerce must be separated from the core activity of order management.

"Govt Launches New Portal For Artisans, Weavers With 0% Commission" ~ https://t.co/ULGJlOSHYE.

Can't they just be plugged on to ONDC? pic.twitter.com/jz2nn3SRtn— Ketharaman Swaminathan (@s_ketharaman) April 25, 2023

That said, there’s more than one way to skin the proverbial cat and there could well be other ways of driving success of ONDC without invoking the UPI playbook. Only time will tell how this plays out.