Atlas Etherisc – Another New Kid On The Blockchain

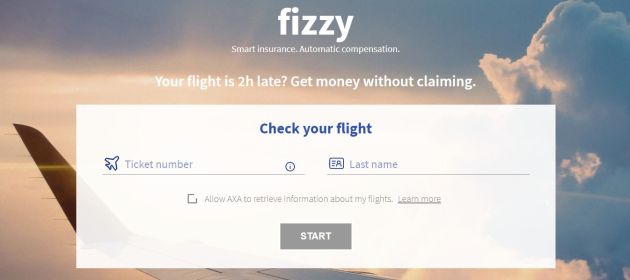

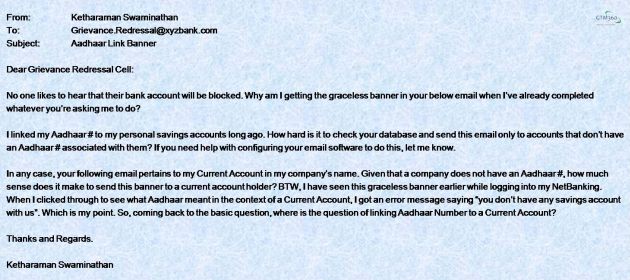

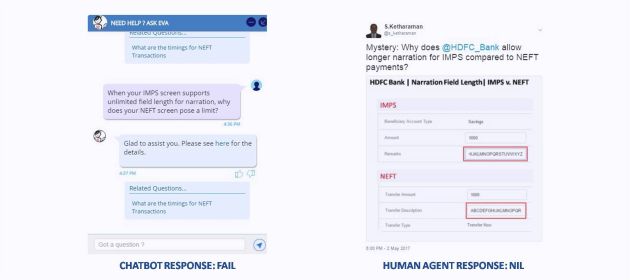

At the end of my blog post entitled AXA Fizzy – The New Kid On The Blockchain, I’d promised to answer the “Why Blockchain?” question in a follow-on post. I’m not fulfilling that promise yet. Frequent readers of this blog would be aware that it’s light on research and heavy on personal experience and anecdotal evidence. … Read more