I’ve been asked many times to write about my Blockchain experience. That is not strictly true. I’ve been asked only twice, most recently by a man in Mumbai, Maharashtra.

I’ve been asked many times to write about my Blockchain experience. That is not strictly true. I’ve been asked only twice, most recently by a man in Mumbai, Maharashtra.

How can I write about the Blockchain experience, I asked myself on the Deccan Queen returning to Pune, when most of the founders of Blockchain companies are too busy writing white papers about their dApps and the few of them that have launched their dApps are too daunted by their UIs to let anyone other than their Blockchain programmers use them?

(Fans of Joseph Heller might find a striking resemblance between the above paragraphs and the opening paragraphs of Good As Gold, one of my all time favorite novels. I apologize in advance to the Estate of Heller for taking the liberty of paraphrasing what’s one of the most captivating novel starts that I’ve ever read.)

After claiming to be a Blockchain startup, this fintech co uses wire-transfer for USD-INR remittance. Bet Theranos is its role model!

— GTM360 (@GTM360) November 18, 2015

All that changed when I recently read about AXA Fizzy on Finextra.

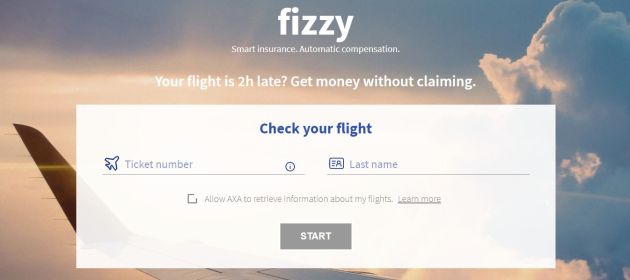

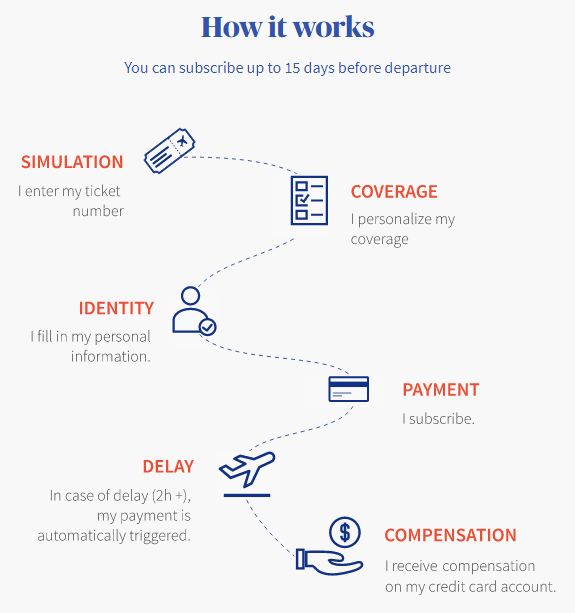

Fizzy is a blockchain-based “parametric insurance” product that pays out compensation for flights delayed beyond two hours.

It’s already live. You can buy a policy right now if you have a valid ticket on a CDG-USA sector. Or that’s what it says on its website. I’m not in a position to validate it – as a Lufthansa Miles & More member and an ex-Frankfurt resident, I’m more likely to transit to the US via FRA, so I’ll be excluded from the target audience of the product that’s currently available only for flights to and from Paris.

I was stunned when I first first heard of AXA Fizzy.

I’ll need to go back nearly two decades to explain why.

When I lived in Frankfurt, I’d booked a holiday to Paris for my family. Memory serves, it was via Expedia.de. While making the booking, I’d forgotten to uncheck the box next to “Kaufen Reiseversicherung” (buy travel insurance). As a result, I’d unwittingly bought travel insurance.

As luck would have it, a day before we were to fly out, one of my family members had a stomach upset. We had to cancel the trip.

I thanked my stars for thrusting travel insurance upon me. (On second thoughts, stars had nothing to do with it. I should have thanked the unchecked checkbox on Expedia’s website – something that I learned later was called “Dark Pattern”). I also assumed that, now that Expedia was alerted of my cancellation, it’d process my refund of airfare and hotel charges automatically.

How naive I was.

It was a major PITA to claim the insurance.

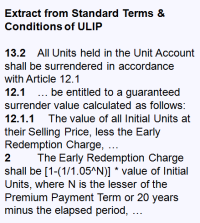

First, there was the question of eligibility. Like any insurance product, Expedia’s travel insurance policy also came with its own list of inclusions (items covered under the policy) and exclusions (items not covered under the policy).

First, there was the question of eligibility. Like any insurance product, Expedia’s travel insurance policy also came with its own list of inclusions (items covered under the policy) and exclusions (items not covered under the policy).

It’s hard enough to understand insurance fineprint in English. It was virtually impossible to do it with my then level of proficiency in German language. Thankfully, there were many native German-speaking coworkers in my office. I could take their help in combing through the German-language insurance contract and ascertain that the reason for my cancellation was indeed included in the policy – under the “serious illness of one of the travelers” risk.

Then came the claim procedure. I had to write a justification for my cancellation in German and attach a medical certificate from an Expedia-empanelled doctor certifying that my family member was too ill to travel.

When I got past that, I faced a few more hurdles that I don’t recall now, since all of this happened nearly 15 years ago.

Long story short, I had to jump through so many hoops to get my money back that I vowed to myself that I’d never buy travel insurance again. I kept that promise during the following decade and a half.

But I might break it because of AXA Fizzy.

The way it works, AXA Fizzy checks flight arrival times published in the public domain (FlightStats.com, if my guess is right). If the flight is delayed by two hours or more, it automatically pays out the predetermined compensation to the credit card used to buy the insurance.

AXA Fizzy doesn’t make the claim process frictionless. It eliminates the claim process altogether.

It doesn’t have any exclusions. As its website says, “NO EXCLUSION: We cover you, whatever the cause of your delay : Snow, strike,”… even “alien attack…”!

With these key differentiators, AXA Fizzy raises the appeal of travel insurance to the next level, which could potentially create a manifold increase in the size of the market for travel insurance products. Especially after it expands worldwide this year and adds flight cancellation, lost baggage and other travel-related products to its portfolio of offerings.

Ergo AXA Fizzy is stunning.

Now, that’s the marketer in me talking.

The techie in me started wondering what stopped someone from developing a similar flight delay insurance product on a traditional centralized database architecture (as against the decentralized Blockchain architecture used by AXA Fizzy).

I took this up on Finextra by posing the following question:

On a side note, can anyone throw some light on the dependency of such an insurance product on Blockchain. Is there any intrinsic shortcoming with a centralized database architecture that compels one to launch this product only on the distributed database architecture facilitated by Blockchain?

I didn’t get any reply.

I forgot about my question until I read “Blockchains vs Centralized Databases”. In this article, author Gideon Greenspan of MultiChain compares the traditional centralized database architecture with the decentralized database Blockchain architecture and asserts that whatever you can do on a Blockchain you can also do on a centralized database. “In terms of the types of data that can be stored, and the transactions that can be performed on that data, blockchains don’t do anything new.”, he adds.

I forgot about my question until I read “Blockchains vs Centralized Databases”. In this article, author Gideon Greenspan of MultiChain compares the traditional centralized database architecture with the decentralized database Blockchain architecture and asserts that whatever you can do on a Blockchain you can also do on a centralized database. “In terms of the types of data that can be stored, and the transactions that can be performed on that data, blockchains don’t do anything new.”, he adds.

After reading this, my question started haunting me whenever I read anything about Blockchain and dApps. I couldn’t ignore it anymore and raised it on a few other forums.

I started getting replies from a few Blockchain pioneers, including a detailed one from Gjermund Bjaanes, author of a brilliant article titled Understanding Ethereum Smart Contracts.

The overall takeaway from my interactions with them is:

- If you need Confidentiality and Performance, select Centralized Database.

- If you need Trustlessness and Robustness, go for Blockchain.

In a follow on post, I’ll share my thoughts on how these general guidelines play out in the specific context of a B2C product like AXA Fizzy. Watch this space!

Meanwhile, please feel free to share your thoughts in the comments below.