Dear Editor of Economic Times:

This has reference to the twin op-ed entitled “IT GIVES THE CREEPS” by Ateesh Tankha and Mythili Bhusnurmath in today’s edition of The Economic Times.

This article reminds me of similar opinions expressed on these very pages in the 1990s regarding equity. Despite all the doomsday prophecies made by pundits 25-30 years ago that stock markets will become casinos, the sky has not fallen, and public company shares have become a new, vibrant asset class worth $3.5 trillion in India.

Leading banks in the world have been slapped with billions of dollars in fines for violating antimoney laundering laws over the last few years. All of that washing happened in the dollars and euros of the world. So it’s not that money laundering can happen only via cryptocurrencies.

Leading banks in the world have been slapped with billions of dollars in fines for violating antimoney laundering laws over the last few years. All of that washing happened in the dollars and euros of the world. So it’s not that money laundering can happen only via cryptocurrencies.

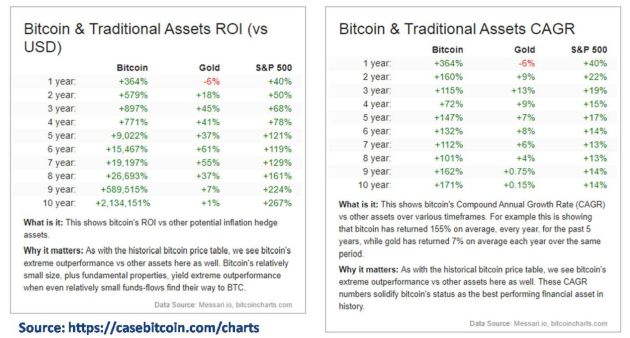

While cryptocurrencies have entered the public discourse only in the recent past, the first cryptocurrency, Bitcoin, was founded in 2009. All through its 12 years of existence, Bitcoin has been the best performing asset class in history, with a 10-year CAGR of 171% versus 0.15% for Gold and 14% for S&P 500 / BSE Sensex 30 (Source: Below exhibit from https://casebitcoin.com/charts).

Therefore, Bitcoin is not a fly-by-night operator by any stretch of imagination. Unlike eucalyptus plantation, emu bird farming and other outright scams that flamed out in a couple of years and left gullible investors high and dry, Bitcoin has stood the test of time and generated massive wealth for people who have invested in it judiciously. On the other hand, enough people have lost money even on so-called blue chip stocks (I’m looking at you DLF, Tata Motors, and Yes Bank).

I agree with the authors that cryptocurrencies are quite inscrutable and highly volatile. But that doesn’t mean that they’re fake. Instead it suggests that people and governments should examine those traits as an intrinsic feature, not bug, of a new technology-enabled asset class. If they did that, they might stop telling people to “invest only what you can afford to lose in crypto”, just as they stopped saying the same about stock market 20 years ago!

"Invest only what you can afford to lose". They said that for stock market & angel funding once upon a time. Now they're saying the same thing for crypto! Different asset class, same advice!! pic.twitter.com/xCXtOU7jGZ

— Ketharaman Swaminathan (@s_ketharaman) January 16, 2018

I also agree that it’s difficult to regulate crypto. The government shouldn’t even try.

For the above reasons, I strongly advocate that cryptocurrencies should neither be banned nor regulated, and instead left to market forces and caveat emptor.

Thanks and Regards.

KETHARAMAN SWAMINATHAN

18 November 2021

A condensed version of the above piece was published by Economic Times in its edition dated 19 November 2021.

The title “Unfamiliarity Breeds Contempt” captures my thoughts perfectly. Kudos to the copy editors at ET for coming up with it.

In case the ET Prime article referenced above is paywalled, see following exhibit.

One more thing:

According to media reports, RBI, India’s central bank cum banking regulator, wants the government to summarily ban all cryptocurrencies, including Bitcoin.

The author of the first op-ed above tells the government to “Listen to RBI” on this matter.

I disagree.

Indian regulators ban automobiles and then take pride in preventing road accidents e.g. After disallowing banks from creating MBS, CDO, CDS, and other structured financial products, regulators patted themselves on the back for escaping from GFC.

Indian regulators also regularly throw the baby out with the bathwater. I can think of at least two examples of this behavior in the last 10-odd years:

- Two Factor Authentication: Introduced 10+ years ago, the RBI mandate for 2FA for online payments caused tremendous friction and resulted in massive failed payments. Many people who used to pay with credit card went back to cash. The pendulum then swung to the other extreme with UPI. UPI apps are always logged in and enable payments to be made with a four digit static PIN. While the lack of need to log in and suffer through the mobile OTP dance for each and every payment enhance the User Experience, the same features also diminish security. That’s a problem in a method of payment that is irrevocable, provides zero fraud protection and touches the bank account directly. Testimony: Spate of UPI frauds reported nearly everyday.

No amount of security can prevent payment fraud when flawed app design meets gullible user. #UPIfraud pic.twitter.com/OdE4tgU7z1

— Ketharaman Swaminathan (@s_ketharaman) March 14, 2017

- Emandate: The new RBI Emandate for recurring payments and auto debits based on credit card and debit card is a cure that’s worse than the problem.

While regulators have done a good job of keeping the lights on, the nation’s progress will be stunted if the government lets regulators dictate policy on matters related to state-of-the-art technologies and new generation business models.

Ergo I support the government’s reported moves to reject the regulator’s call for a ban on cryptocurrencies.

GoI: Regulate crypto, don't ban it.

RBI: Regulation can't be enforced, so ban Crypto.I agree with both: Crypto should neither be banned nor regulated. Instead it should be left to market forces & caveat emptor.

— Ketharaman Swaminathan (@s_ketharaman) November 15, 2021