After being postponed by six months, RBI Emandate has finally come into effect from 1 October 2021. Applicable to recurring payments and auto debits, the new regulation has caused massive chaos for media companies, SaaS vendors and other businesses whose revenue model is anchored on automatically charging a credit card or debit card on file every month on the back of a onetime mandate issued by consumers and customers.

In this post, we’ll unpack this regulation and speculate on whether the disruption we’re witnessing now is just a case of teething troubles that accompany any new regulatory diktat or the portent of troubling times.

RegSM (Regulation Subscription Management), as I’d termed this anticipated regulation in Will Regulation Eliminate Subscription Trap? (Part 3), was originally intended to protect consumers from falling victims to subscription trap set by unscrupulous news, OTT and other Subscription Economy companies on their websites and app.

India’s central bank-cum-banking regulator Reserve Bank of India stipulated new rules for e-mandates used in subscriptions. According to the draft rules issued by RBI for what I’ll call Subscription Management, the bank whose credit card (“Issuer Bank”) you used to sign up for a subscription must ping you 24 hours before each recurring payment is due. If you don’t wish to continue with the subscription, you can opt-out of the payment and your credit card will not be charged.

RegSM originally applied only to recurring payments for subscriptions and was supposed to work on the basis of opt-out, which meant that if the payment was kosher, the consumer had to do nothing, and the payment would go through successfully.

However, the regulation, as it has come into force eventually, seems to have gone way beyond its original remit.

I keep crying Don’t Throw The Baby Out With The Bathwater hoarse regularly but this is not the first time we’re witnessing regulatory overreach.

Emandate is now applicable not only to recurring payments (e.g. subscriptions for news websites, OTTs, and SaaS providers) but also to auto debits (e.g. bill payments for insurance premium, electricity, gas and other utilities). (It does not apply to EMIs for loan repayments, though.)

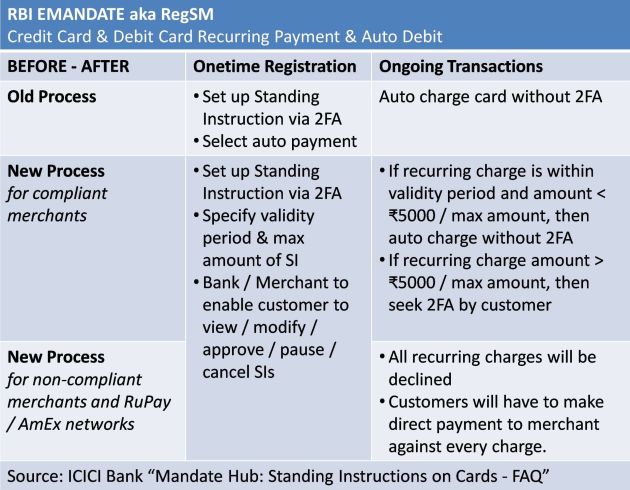

Every credit card and debit card based mandate for recurring payment and auto debit (“Standing Instruction”) will now need to be re-initiated by the merchant in accordance with the new rules, and processed by the issuer bank differently from before. You can find the BEFORE-AFTER changes in the below exhibit (courtesy: ICICI Bank).

Emandate will require enhancements in bank systems in order to inspect the incoming standing instruction from merchants, check for compliance with the new rules, send out advance debit notifications via SMS to customers, parse their responses (if any), and process – or decline – payments accordingly.

I’ve received alerts from two of my three primary banks that they’re ready with the changes. I haven’t heard anything from the third. According to media reports, State Bank of India, the largest bank in India – and the only Fortune Global 500 bank out of India – has not yet gone live with the changes.

Emandate will also require enhancements in merchants’ systems for registering and initiating standing instructions. The aforementioned FAQ has the following Q&A on the topic of merchant readiness:

Are the merchants and bank ready to meet the new conditions?

The new conditions prescribed by the guideline ‘Processing of e-mandates on cards for recurring transactions’ require a cohesive effort by all stakeholders involved in payment processing. A common industry-wide platform has been developed, and ICICI Bank has completed its internal development and integration. We are working jointly with merchants to make it live for customers at the earliest.

Going by my personal experience and media reports in the days immediately following the enforcement date of Emandate, not too many merchants are compliant with Emandate. As you’ll soon see, that’s a bit of an understatement.

First, my personal experience:

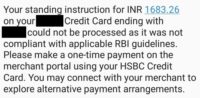

My domain renewals, which have gone through smoothly hundreds of times during the past 10+ years, starting bombing from 2 October. I got an SMS from the card issuer bank (sans the merchant name) saying it had declined my standing instruction from an unnamed merchant because it did not comply with the new RBI Emandate (see exhibit on the right). As advised by my bank, I tried to make a one-time manual payment directly on the merchant’s website. That too failed. The error message on my domain registrar’s website was no different from the plain vanilla error message it shows when a payment fails for technical and other mundane reasons (like timeout). I found no evidence that the company was aware of the tectonic shifts that had come into effect from the previous day in the way it was supposed to register and initiate autodebits for Indian customers. I re-tried the payment with PayPal. It went through successfully. I was initially wondering how that was possible since the same credit card on file with the merchant bombed. I then recalled that Emandate does not apply to standing instructions initiated by RBI-regulated entities like Payment Service Providers like PayPal and Banks. All my bill payments went through fine on HDFC Bank’s PayZapp app as well.

My domain renewals, which have gone through smoothly hundreds of times during the past 10+ years, starting bombing from 2 October. I got an SMS from the card issuer bank (sans the merchant name) saying it had declined my standing instruction from an unnamed merchant because it did not comply with the new RBI Emandate (see exhibit on the right). As advised by my bank, I tried to make a one-time manual payment directly on the merchant’s website. That too failed. The error message on my domain registrar’s website was no different from the plain vanilla error message it shows when a payment fails for technical and other mundane reasons (like timeout). I found no evidence that the company was aware of the tectonic shifts that had come into effect from the previous day in the way it was supposed to register and initiate autodebits for Indian customers. I re-tried the payment with PayPal. It went through successfully. I was initially wondering how that was possible since the same credit card on file with the merchant bombed. I then recalled that Emandate does not apply to standing instructions initiated by RBI-regulated entities like Payment Service Providers like PayPal and Banks. All my bill payments went through fine on HDFC Bank’s PayZapp app as well.- I didn’t see any change in the standing instruction functionality of other foreign merchants like Go Daddy, Hostgator, Netflix. They showed no signs of having taken any measures to comply with the new rules. With two exceptions: I did receive emails from Quora and LinkedIn acknowledging the new rules and saying they’re working with banks to resume standing instructions for my payments for ads on their platforms.

- I didn’t see any change in the standing instruction functionality of a couple of Indian merchants that I checked (e.g. Economic Times). But I did notice that every one of them had discontinued its monthly payment plans and had moved to onetime payments for longer durations (quarterly, half yearly, yearly and two yearly), thus sidestepping the provisions of Emandate altogether.

- As a personal best practice, I never set up auto debits for bill payments, so I don’t have any firsthand experience of defaulting on insurance premium, electricity, gas, phone or broadband bill payments.

Next, the media reports. According to New norms put auto debits in no man’s land in the Economic Times:

- Amazon has discontinued free trials for its Prime subscription service in India, citing “friction in the auto payments process.”

- Apple is advising its subscribers to top up its closed loop wallet Apple ID to ensure smooth payments.

- Google is asking customers of its cloud services to add a new primary payment method “that’s compliant with RBI.” Others such as YouTube and Facebook have put out similar instructions as well.

Banks are pointing to merchants. Merchants are pointing to banks. We’re in a no man’s land, indeed!

In How Merchants Will Thwart Subscription Dodgers (Part 4), I predicted that merchants will abandon Subscription Economy and go back to Upfront Payment Economy to thwart Subscription Dodgers. It now looks like some of them have done this for all subscribers. I’m guessing that their cost of complying with the new regulation exceeds the loss of revenues from monthly subscriptions.

As a result, perfectly legitimate payments have been getting declined since the beginning of October.

This is obviously causing a lot of hardship for consumers. It has also led to a sharp fall in the revenues of subscription economy companies. According to the aforesaid ET article, “the most hated organisation in founder circles right now is RBI“.

Kudos to @ICICIBank_Care for providing a comprehensive guide on the new RBI Emandate but why does it say "RBI Complaint" when it obviously means "RBI Compliant"?

Freudian slip?:)https://t.co/mazS7enzYn .#RegSM #RegEmandate pic.twitter.com/ACtTopUGN4— Ketharaman Swaminathan (@s_ketharaman) October 22, 2021

I’m sure Emandate has eliminated a few subscription traps but it seems to have caused the failure of many more kosher payments. Its negative impact has far outweighed its positive contribution.

Not to blame any single party for the mess but, as of now, Emandate is a revenue killer.

But it doesn’t have to be that way. In a follow-on post, we’ll see how to steer Emandate to its original goal of being a savior of consumer interests.

Stay tuned!