In Interoperability – The Sole Loser In UPI, we saw why interoperability has been compromised in UPI.

In this post, we’ll explore ways to revive this noble goal.

Some people advocate education campaigns to increase awareness of VPA and thereby revive interoperability.

For reasons described in Interoperability – The Sole Loser In UPI, Google Pay, Walmart PhonePe and other fintech UPI apps need to maintain their Winner Takes All / Last Man Standing status, so it will not be in their interest to spread awareness of VPA. Ergo, I doubt if they will bother to run education campaigns to promote interoperability.

But this can be done by mandating the following alternative approach:

It worked fairly well when we used it to spread awareness of FPS, the equivalent of UPI in UK in 2008-9.

But I’m a bit skeptical if education alone will suffice.

That’s because Indians are in general quite blasé about branding and terminology.

After so many years of using Aadhaar, many Indians still misspell it…

Aadhaar is arguably the Word of the Year in India but I'm amazed at how often it's misspelled as Aadhar.

— Ketharaman Swaminathan (@s_ketharaman) December 9, 2017

The general attitude is “as long as you understand what I’m saying, how does it matter?”

In general, this is a wrong attitude. While you may understand what they’re trying to say, you may also understand a few things that they’re not trying to say e.g. they’re sloppy, lack attention to details, can’t be trusted, etc.

When CEOs of financial services companies demonstrate this attitude in public, it could hurt their companies.

When finance people mix up Stock and Flow, you gotta wonder if your money is in safe hands with them. https://t.co/s0bb4GMSQY

— Ketharaman Swaminathan (@s_ketharaman) June 10, 2020

When money is at stake, this attitude could backfire spectacularly.

Let’s see what this attitude could lead to in the case of UPI.

The two terms involved in a UPI payment are VPA aka UPI ID and UPI Password aka UPI PIN. To promote interoperability, UPI ID should be shared freely. Whereas, to ensure security, UPI PIN should never be disclosed to anyone.

UPI ID is a complex string like johndoe@okicici-ICIC0002390-000502054296-UPI whereas UPI PIN is a simple 4-digit number e.g. 1234 (like ATM pin number).

When I ask someone for their UPI ID before initiating a UPI Payment to them, some people could interpret it correctly as VPA whereas some others who have a casual attitude towards terminology might confuse it for UPI PIN.

Also, given the relative ease of sharing 1234 versus johndoe@okicici-ICIC0002390-000502054296-UPI, which one do you think people will tend to share more often?

I thought so too.

In both cases, if people give away their UPI PIN, they could be defrauded. (For the uninitiated, the way UPI works, it’s possible for a scam artist to empty out a person’s bank account if they know their UPI PIN. Sadly, a lot of people still think (wrongly) they need to give out their UPI PIN to receive money.)

As it is, there are many scams in UPI.

This guy uses UPI to transfer INR 6L to a fraudster. Since UPI imposes a transfer limit of INR 1L, it means he got fooled 6 times by the same fraud. He surely takes the old adage "a fool and his money are soon parted" to new heights. pic.twitter.com/UnFDq1e5zI

— GTM360 (@GTM360) December 3, 2019

I fear that, in an attempt to drive interoperability in UPI, education about VPA might cause more scams.

Seems like NPCI also believes that it’s silly to “ban and fine” leading UPI apps, as some pundits have proposed and I dismissed as harebrained in Interoperability – The Sole Loser In UPI.

The scheme operator has thought of a different strategy to rein in the leading UPI apps. It recently capped UPI market share at 30% (Source).

While the move seeks to undo Winner Takes All in UPI, it will have an unintended consequence on interoperability and / or UPI volumes.

According to the SOP released by NPCI, UPI apps like Walmart PhonePe and Google Pay that have higher than 30% market share will need to bump off customers. (Technically, since the 30% cap is by transaction volume and not user count, PSPs don’t actually need to shed customers but decline some of their transactions. But the end effect is the same: customers will find their transactions getting bumped off.)

Bumped off customers will have to install another UPI app.

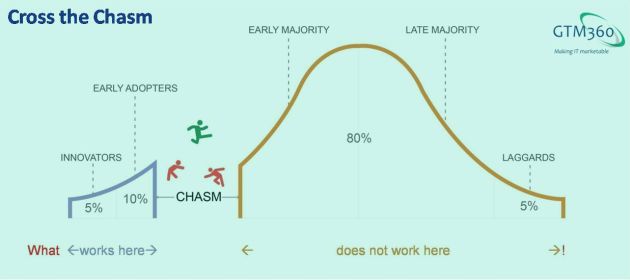

Let’s say another UPI app XYZ comes out of the blue and aggressively acquires all of them. People will then ask “Do you have Phone Pe / Google Pay / PayTM / XYZ?” and enter mobile phone number to initiate the payment. Interoperability will remain dead.

But, given #ZeroMDR, I seriously doubt if any other PSP will be in a big rush to get into UPI. (As we’ve seen, even existing PSPs like banks have curtailed their exposure to UPI by de-acquiring merchants they’d formerly enabled for UPI payments ever since #ZeroMDR reg came into effect last year.)

So, in all probability, it will be down to these bumped off customers to install one of the other 48+ UPI apps. In this case, the odds of both sender and receiver having the same UPI app will be very low. So it will not be possible to send money by entering the receiver’s mobile phone number. The sender will need the receiver’s VPA.

Even if we optimistically assume that the receiver knows it and gives it to the sender, there’s every chance that the sender finds its too painful to enter johndoe@okicici-ICIC0002390-000502054296-UPI in the virtual keyboard of his smartphone. It will not be possible to proceed with UPI payment. Sender will go back to cash.

Sadly, the attempt to revive interoperability of UPI will have ended up killing UPI itself.

DISCLAIMER: This post is speculative and is the result of my connecting of the dots that I’ve seen in the public domain. It does not purport to provide any inside track into the thought processes, business plans or financials of banks or fintechs around UPI, except if noted otherwise. This post is also not legal or investment advice.