Every month, when I pay my credit card bills, I sigh to myself “if only there was a way to pay this bill with another credit card and earn rewards…”.

Others are more vocal with their wish. See Why can’t I pay my credit card bill with another credit card?.

As a credit cardholder, I know that my credit card “bill” is merely a statement of all the bills that I’ve already paid with my credit card during the previous month. To that extent, it’s silly for me to think of a credit card statement as a bill.

As an industry insider who has a ringside view into how credit card works, I know that it’s impossible to pay one credit card bill with another credit card – and why.

I know that my wish is delusional but that hasn’t stopped me from having it month after month for years – maybe because credit card payment is the single largest payment made by me and I’m guessing most people during the month.

Given that I’ve been using credit card for 33 years, I’ve gone through this delusion 396 times so far (being 33*12). I’m sure I’ll continue to go through it for the rest of my life. Going by regular Q&As on social networks on this topic, I’m not alone.

Enter CRED.

A product that will give me rewards for paying my credit card bill.

Finally, somebody is telling me that I’ve not been so delusional for the past 30+ years after all.

For that alone, I rate CRED as a truly innovative product. It resolves a longstanding, even if irrational, customer pain area. Full marks to CRED for that.

For the sake of completeness, CRED also does a few other things like multiple card management, bill pay and exposure of hidden charges.

(In the interest of full disclosure, I abandoned CRED midway through the onboarding journey. Click here and here to know why. But that’s only me. At the last count, nearly 6 million prime and superprime credit card customers in India have joined CRED.)

Seven Indian startups recently became unicorns on the back of their latest funding rounds. (For the uninitiated, unicorn is a company with a valuation of one billion dollars in the private market).

CRED is one of them.

CRED is also arguably the unicorn that has attracted the most buzz – mostly of the negative type – amongst them.

IMO, the negativity around CRED is misguided and driven at least partly by a lack of understanding of CRED’s business model.

Founded by serial entrepreneur Kunal Shah, CRED recently hit a valuation of $2.2 billion, a bulk of which was achieved in the last three months.

Given my background in financial services IT in general and credit card management software in particular, and my company’s work around marketing of customer engagement management technology, I’ve been tracking CRED ever since it was launched in 2018. As soon as I heard about CRED, I spotted a striking resemblance between the fintech and a bunch of companies – think Cardlytics in the USA – that enable brands to make targeted offers off of credit card transaction data.

Credit cardholders are used to receiving inserts in their statements carrying offers for consumer goods (think electric shaver, mixer grinders, flat screen TVs). Typically, the same inserts are stuffed into every credit cardholder’s envelopes. In other words, they’re “spam”.

Platforms like Cardlytics offer brands a way to eschew spam and create targeted offers off of credit card transaction data, such as the one shown in the following exhibit.

Targeted Ad Based On Credit Card Transaction Data

I put several hotel rooms on my credit card one month. The next month, I get a “30% OFF” coupon from AirBnB for staying at one of its properties the next time. Source: Your Personal Data Is Not Sold, Just Used.

As marketing professionals know, ads that are relevant and timely – aka targeted – enjoy a higher conversion rate compared to mass-media ads where every Tom, Dick and Harry is bombarded with the same message.

CRED was – and still is – positioned around rewards but I’m predicting that it will eventually get into ad tech à la Cardlytics.

Called TransPromos, "ads" like these are fairly common abroad. Leading tech provider, Cardlytics, claims 2000 bank customers in USA. CRED is a carbon copy. Matter of time before such "ads" are seen in India, too. https://t.co/r7lzFYISnY; https://t.co/8cSh1qdIq7

— Ketharaman Swaminathan (@s_ketharaman) May 25, 2020

In the early days of CRED, I was puzzled by CRED’s valuation in comparison with the market cap of Cardlytics, the market leader in this space.

CRED's business model is a carbon copy of Cardlytics'. After operating in the much larger credit card & more lucrative digital ad market of USA for years, @cardlytics has a market cap of $350M. Whereas CRED already has a valuation of $400M. Hmmm. https://t.co/8Y7W3fDg0e

— Ketharaman Swaminathan (@s_ketharaman) April 23, 2019

In January this year, I learned that Cardlytics’s market cap had shot up 8X to nearly $3.2 billion. Compared to that, CRED’s valuation had merely doubled to $800 million by that time. Accordingly, I felt that CRED was undervalued.

When everyone and his dog was ranting against the meteoric rise in CRED’s valuation, mine was the lonely voice in the wilderness.

Not any longer.

CRED’s valuation recently jumped by 3X to $2.2 billion.

Is there anyone here who could help explain what CRED’s business model is? How are/will they make money? Are they going to sell credit card users data? What’s the end game? @kunalb11

— Aryaman S (@areyaman) February 7, 2021

CRED’s restricted offering around rewards raises a few interesting questions.

Let me try and address them based on my speculation of the company’s endgame – targeted ads.

#1. How does apps like CRED earn money by just helping us to pay our Credit Card bills?

CRED will make money eventually by running targeted ads off of credit card transaction data it collects. This has worked well for Cardlytics and a bunch of other companies in the US. There’s no reason why the same revenue model shouldn’t work for CRED.

#2. How can CRED be more valuable than Citi India?

#2. How can CRED be more valuable than Citi India?

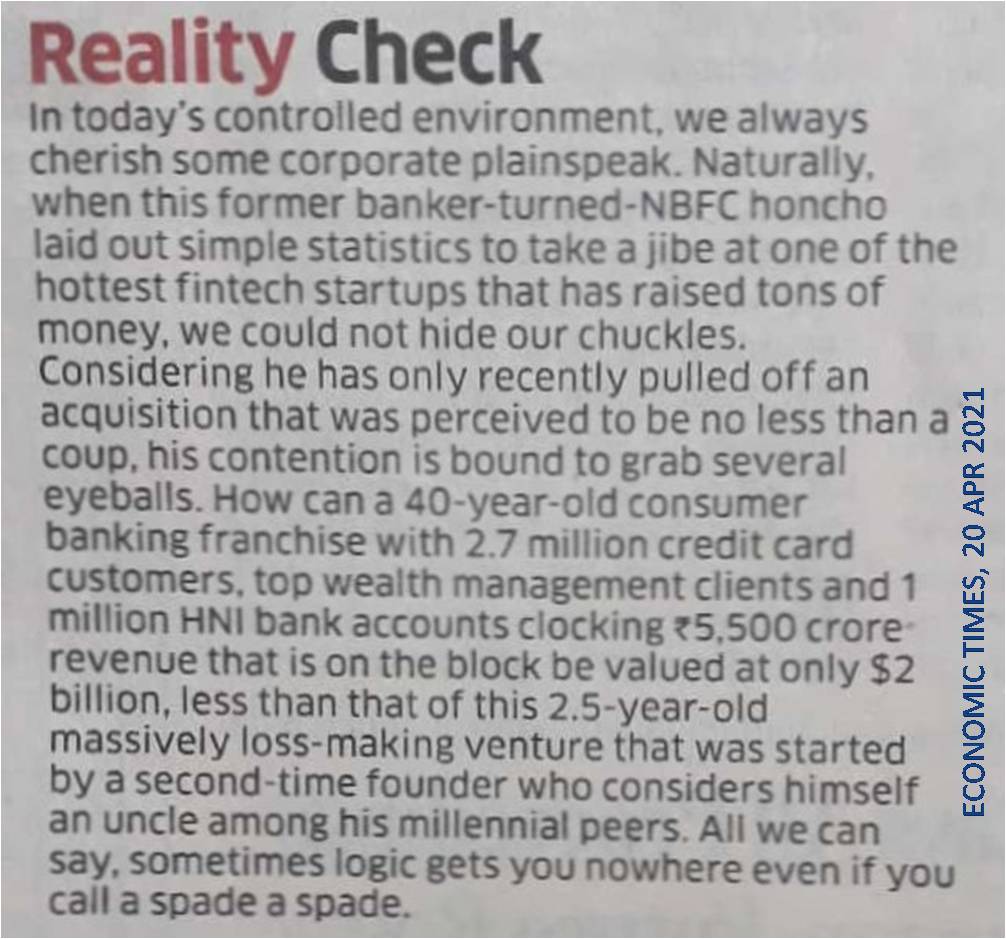

A banker-turned-NBFC honcho recently wondered how a 40 year old consumer banking franchise with 2.7 million credit card customers, top wealth management clients and 1 million HNI bank accounts clocking INR 5500 crores (US$ 733 million) revenue be valued at $2 billion, less than that of this 2.5 year old massively loss making venture? (He was evidently referring to Citi’s India portfolio and CRED.)

The answer is very simple:

Nobody is willing to pay more for Citi than what somebody is willing to pay for CRED.

If you see a CREST ad on your Facebook Timeline, it does not mean that Facebook Inc. has sold your personal info to P&G Inc.

Likewise, if and when CRED club members start seeing ads – which they don’t today – it will not necessarily mean that CRED is selling their data to advertisers.

What it will mean is that CRED is selling ads to brands. CRED does not have to sell its members’ credit card transaction data to run these ads.

In fact, CRED would be a fool to sell its transaction data. Notwithstanding the popular meme “data is the new oil”, the true value lies in running ads off of data. Data itself is worth peanuts, as people who tried to sell it found out.

Data is the new oil only for those who run targeted ads on top of it. For the guy from whom the data originates and to whom it belongs, data is not even worth peanuts. https://t.co/1QAFDdGZPK via @WIRED @GregoryJBarber . #Datum #Doc.ai #Wibson

— Ketharaman Swaminathan (@s_ketharaman) January 22, 2019

#4. What do you think of CRED’s recent “Indira Nagar ka Goonda” ad featuring Rahul Dravid?

All my life, I’ve been hearing backstories of famous companies out of the Manhattans and Menlo Parks and Shoreditches of the world. Quite frankly, they have become very tiresome. CRED’s ad fills me with the hope that, one day, we’ll hear backstories from the Andheris and Adyars and Kalyaninagars of India. (For the uninitiated, Indira Nagar is a famous neighborhood of Bangalore, as are the other three named ones in Mumbai, Chennai and Pune respectively.)

#5. Will folks with 750+ credit score sell their data for freebies?

Sure why not.

$100 billion companies indulge in nickel-and-diming.

Uber fines Rider even when Driver cancels. Few Riders jump thru' the hoops required to claim the measly refund, so Uber pockets the money. Why is the poster child of startups, creator of new gig economy & $80B company resorting to nickel-and-diming like any roadside $100B bank?

— Ketharaman Swaminathan (@s_ketharaman) June 18, 2019

Billionaires put $100+ million purchases on credit card to get freebies.

Even Billionaires Love Freebies

Hong Kong billionaire Liu Yiqian won the auction for a famous painting and put the ~$175 million tab on his American Express credit card. He earned enough reward points from this transaction to get unlimited number of free first class tickets from him and family from anywhere to anywhere in the world by any airline for their entire life. On a side note, this is testimony that people may use credit card even when they have cash. Source: Billionaire earns first-class travel for life by putting Modigliani nude on Amex.

Even if there’s a strong overlap between the “750+ credit score” and “disinterest in freebies” cohorts, the point is moot.

Rewards is probably only the initial hook of CRED. The real value to CRED customers will come from the targeted offers they will eventually receive from brands.

As you can see from the example of a targeted ad given earlier in this post, these will typically be ads from brands attempting to drive brand switching. They will offer mouthwatering discounts of 30-40% on 4-6 figure purchases, which could add up to a good sum even for the affluent. To be clear, these discounts will be funded by the brands, not CRED.

(I came across a guy who bought a Samsung Galaxy smartphone at CROMA and got a 10% cashback by paying with HDFC Bank credit card. Because he spotted the credit on his credit card, he thought it was paid by HDFC Bank. That’s almost never the case. The discount is almost always borne by CROMA and / or Samsung. The credit card company collects the rebate from the retailer / brand and merely passes it on to the credit cardholder.)

When people hear that their friends, relatives and neighbors have gotten 5-figure savings per year, I’m sure most of them will shed their current reluctance to share their credit card transaction data with third parties, and sign up for CRED in droves.

After all, in order to keep up with the Joneses in a deal-sensitive culture like India, people will need to keep with the deals scored by the Joneses!