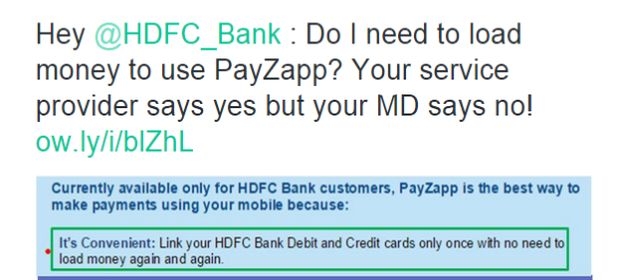

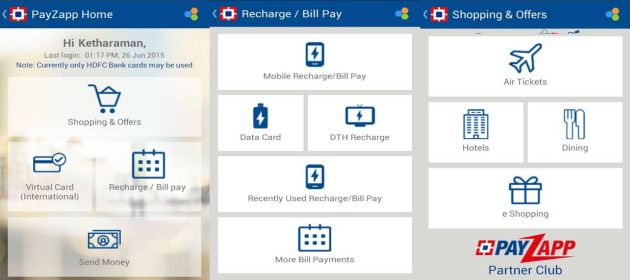

Empowering Frontline Is Still Key To Customer Delight

Those of you that have read the all time classic business book In Search of Excellence might recall the anecdote of the automobile company that rushes a part by helicopter to a customer whose car has broken down in the middle of a desolate highway. Needless to say, the company wins the customer’s loyalty for … Read more