Uber didn’t invent targeted offers but the “world’s largest taxi company” sets itself apart from other brands by the innovative ways with which it uses the new marketing tactic to deepen customer engagement, as I’d highlighted in Mastering Targeted Offers – The Uber Way.

Uber didn’t invent targeted offers but the “world’s largest taxi company” sets itself apart from other brands by the innovative ways with which it uses the new marketing tactic to deepen customer engagement, as I’d highlighted in Mastering Targeted Offers – The Uber Way.

I recently saw Uber’s mastery of another “next gen” marketing tactic, namely, Abandoner Remarketing.

For the uninitiated, abandoners are those who visit a website (or fire up a mobile app), click around but leave without making a purchase; and the act of following up with them and persuading them to convert (i.e. make a purchase) is called abandoner remarketing.

I abandoned all my bookings during a week in the recent past when I suspected surge pricing. I say “suspected” because, as I highlighted in Uber Creates Loyalty To The Deal But Not For The Brand, the fare estimate displayed by the Uber app no longer mentions whether it’s subject to surge pricing or not.

At least 50% of the B2C – and 90% of B2B brands – I come across regularly don’t provide any evidence of even tracking conversions, let alone employ remarketing techniques to win back their abandoners. Most of the others that do take abandonments seriously use Retargeted Ads to remarket to people who fail to convert.

But not Uber.

The world’s largest rideshare company uses a combination of cross-sells and special deals – herewith termed “targeted offers” for the sake of convenience – to remarket to its abandoners.

During the week week following my spate of abandonments, I got the following Targeted Offers from Uber:

Whenever I fired up Uber, the app placed the highlight on the uberPOOL icon. For the uninitiated, this is the “car pool” product recently introduced by Uber. An uberPOOL ride typically costs 40-60% of uberGO, which is Uber India’s entry level private cab product. Sensing that I’d abandoned surge rides the previous weeks, Uber perhaps thought that I was price sensitive and tried to propose a cheaper offering

Whenever I fired up Uber, the app placed the highlight on the uberPOOL icon. For the uninitiated, this is the “car pool” product recently introduced by Uber. An uberPOOL ride typically costs 40-60% of uberGO, which is Uber India’s entry level private cab product. Sensing that I’d abandoned surge rides the previous weeks, Uber perhaps thought that I was price sensitive and tried to propose a cheaper offering- I got an email from Uber summarizing the number of uberGO rides I’d taken the previous month along with the fare I’d paid. The email also simulated my savings had I chosen uberPOOL instead of uberGO. This was obviously yet another attempt to draw my attention to a lower-priced uberPOOL alternative

- For the first time ever, I started seeing cabs with wait times exceeding three minutes. On one occasion, Uber showed me two options with varying wait times and fares: 3 minutes @ INR 75 and 12 minutes @ INR 60. In this, I see an attempt by Uber to make my preferred product cheaper if I was willing to live with a slight delay in getting picked up

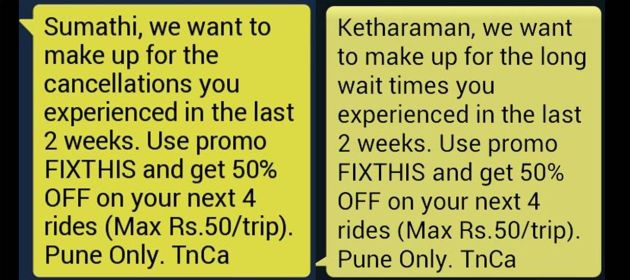

- My wife got a targeted offer of 50% off “to make up for the cancellations you experienced in the last 2 weeks”

- My daughter also got the same offer

- I got 50% off but for a different reason: “to make up for the long wait times you experienced in the last 2 weeks”.

Uber’s targeted offers were personalized and based entirely on my actions of the previous week. Contrary to what some people may think, I didn’t find them creepy at all. In fact, I thought Uber’s responses were very smart and reflected a strong intent on the part of the company to deepen its engagement with me.

Now let’s examine the relevance / accuracy of these targeted offers.

To me, a taxi is a private mode of transport. When I think of Uber – or its chief rival Ola for that matter – I’m not thinking of sharing a ride with a stranger. Therefore, I won’t order an uberPOOL (or Ola Share) at any price – even if keep ditching uberGO only because of surge price. So, Uber wasted its first two targeted offers on me.

But I don’t fault the company for making them: It’s only by proposing and testing my response to its cross-sell offers that Uber can learn my preferences and make better offers going forward; besides, the offer for uberPOOL may have worked on many others who don’t mind a compromise on privacy in return for a lower price.

From the way the app kept switching between the two fare-wait time options every few seconds in TO #3 above, I felt that Uber was running an A/B test on me. But two can play the A/B testing game. I never intended to take a cab for that journey and fired up the app only to test Uber’s response to my previous week’s abandonments.

My wife did experience one cancellation during the previous week. So TO # 4 was totally relevant.

My wife did experience one cancellation during the previous week. So TO # 4 was totally relevant.

My daughter had booked an Uber the previous week. While the cab came in two minutes, the app displayed a wait time of 154 minutes. So TO # 5 was well-grounded in data (though not in reality!)

I abandoned my bookings because I suspected surge pricing or was A/B testing Uber. So the trigger for the last targeted offer – long wait times – was wrong.

But I’m not complaining. 50% off is 50% off – I’ll take it regardless of its rationale. When I convert on it, I’m expecting that Uber’s algorithm will tag me as a big sucker for its targeted offers and keep making more of them going forward. Mission accomplished!

Oh wait, just as I was about to publish this post, I got an offer from Uber for 50% off on my next 10 rides. This is the mother of all targeted offers I’ve gotten from Uber so far.

Looks like Uber’s algorithm has already fulfilled my expectation!