As the title of our website’s WHAT WE DO page proclaims, GTM360 helps growth-stage companies in technology-intensive industries to “cross the chasm” and break into the mainstream market.

In a recent MEDIUM article titled 25 Years Later, ‘Crossing the Chasm’ Has Withstood the Test of Time, author Tiffani Bova has a fireside chat with Geoffrey Moore, the author of “Crossing the Chasm”, the classic published nearly 25 years ago.

When asked how relevant the principles of chasm marketing are in today’s world, Moore quipped:

“With over a million books sold, and it being in its third edition, (I have) only made small updates to the book (including new company examples). However, the frameworks have remained consistent and continue to be completely applicable to today’s B2B businesses.”

I pondered about the “completely applicable” part of Moore’s reply and left a detailed comment below the article. A lightly-edited version of my comment and Moore’s response are reproduced below.

I’ve been in the B2B technology space for three decades and read “Crossing the Chasm” a decade ago. During this period, I’ve come across two major categories of enterprise software:

(A) New versions of good old transaction processing-cum-analytics software viz. ERP, CRM, CBS e.g. SAP, Salesforce and FLEXCUBE respectively

(B) Altogether new genres of software viz. Enterprise Chat, Social Media Management e.g. Slack and HootSuite respectively.

CATEGORY A

Purchase of Category A software continues to be quite centralized and the TALC persona of the buyer company asserts itself at some stage of the process. Therefore, I’ve no hesitation in agreeing that the key takeaways of chasm marketing continue to be relevant for this category.

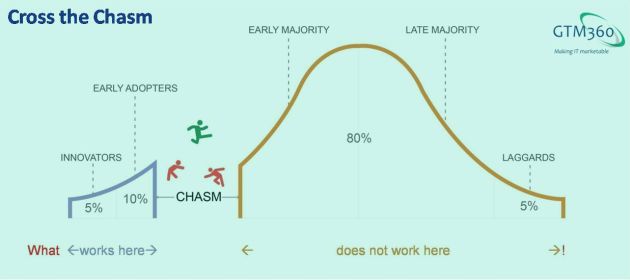

For the uninitiated, TALC refers to “Technology Adoption Lifecycle”. TALC spans five segments of the market with varying sizes, namely, Innovators (5%), Early Adopters (10%), Early Majority (40%), Late Majority (40%) and Laggards (5%). A given buyer company belongs to one of these segments and exhibits the traits of the correponding TALC persona.

CATEGORY B

Purchase of Category B software is quite decentralized.

Slack’s founder once said that his company initially targeted end users directly, created excitement, got individuals in sales, marketing, and other functions to sign up for the platform using their personal or corporate credit cards, and then used the critical mass of business users as a fait accompli to get the enterprise to purchase and roll out the platform across the whole company. This is now called the “land and expand” strategy.

The buyer company’s TALC persona does not seem to come to the fore in the buying process.

If we apply the notion of TALC to individual buyers, the same messaging resonated with all of them without any ostensible attempt to segment them into Innovator / Early Adopter or Early Majority cohorts.

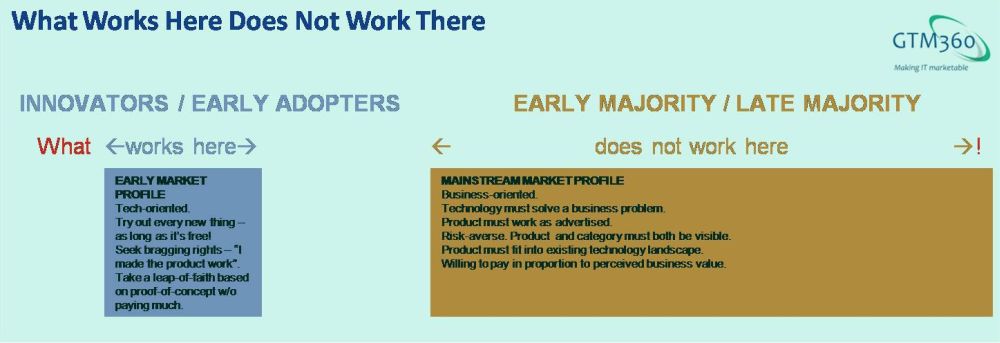

This vitiates the basic principle of chasm marketing, which is, “what works in Innovators and Early Adopters segments does not work in the mainstream market comprising Early Majority, Late Majority and Laggards”.

Chasm marketing proponents could counter this by positing that all customers of Slack were themselves Innovators / Early Adopters, that’s why the same messaging worked with all of them. While this is consistent with the “what works here does not work there” tenet of chasm marketing, it would amount to an admission that Slack hasn’t yet entered the mainstream market.

Slack is worth tens of billions of dollars. Many other companies in Category B are unicorns with $1B+ valuation in private markets. That makes them bigger than many conventional Category A companies. If Slack and the other Category B companies have managed to become so big despite addressing only Innovators / Early Adopters market, is the concept of mainstream even applicable to them? Do they even face a chasm??

In short, chasm marketing is certainly relevant for Category A software but I’m somewhat undecided about its applicability for Category B software.

As of now, bulk of the software industry’s revenues comes from Category A software (Source: McKinsey).

Ergo, “Crossing the Chasm” is still very much valid for the B2B technology market taken as a whole and will continue to be relevant for the forseeable future.

As if to prove this point, there’s no shortage of companies I come across virtually everyday that are facing the chasm and need a drastic change in their approach to cross over to the mainstream market.

To truly "cross the chasm", @pickrrapp needs to stop asking customers to specify dimension & weight of packages. pic.twitter.com/JA858OzgiL

— GTM360 (@GTM360) March 9, 2016

Not just companies – even entire technologies.

"No Compelling Reason". "Must Go Beyond Early Adopters". Well, looks like VR can use a dose of our Cross the Chasm Marketing! pic.twitter.com/K7TXFqybru

— GTM360 (@GTM360) April 4, 2017

In closing, let me post Geoffrey Moore’s response below:

GTM360 – Response from Geoffrey Moore

Crossing the chasm is at its core a B2B model focused on high-risk purchasing decisions that get reviewed by multiple constituencies within the enterprise before they are confirmed. For the bulk of the 20th century this was IT. In this century, consumer IT developed a very different path to market based on low-risk adoption decisions going viral – a very different model. We talk a bit about it in the appendix to the third edition of Crossing the Chasm. Nowadays we can see some blending of the two. In the freemium model, for example, you start with the consumer path but at some point look to close a B2C deal. In the SaaS model you often “land” with a given early adopting unit but seek to “expand” by crossing the chasm to pragmatic later adopters. In data-driven business models you would like to get the signal-collecting edge devices deployed for free (or as close to it as you can get) and then monetize the analytical and predictive value of the data streams via B2B contracts with interested parties. In each case, when you get to the big contract signed by the enterprise executive, you should see “chasm dynamics” prevail.

Geoff

In short, Moore suggests that, while chasm is not a thing in the “land” phase, it is indeed applicable in the “expand” phase of the “land and expand” GTM strategy followed by Category B software companies. Makes sense!