On the one hand, there are 48 Payments Services Providers offering UPI payments in India. Which is a lot.

On the other hand, many people say there are very few UPI players and claim that there’s a huge concentration risk in UPI. This FUD narrative has scaled new heights after RBI recently cracked down on PayTM Payments Bank.

Which of these two takes is true?

The answer to that question lies in whether you’re looking at the number of players in total or the number of players having sizeable market share.

Going by the former criteria, there are many UPI players. Going by the latter criteria, there are not nearly enough UPI players. (H/T Frances Neagley, a character in Jack Reacher Season 2, for the phrase “not nearly enough”, which is obviously a twist on her last name.)

As an aside, there’s a similar disconnect in Android app stores: There are more than a dozen Android app stores but Google Play Store has over 90% share of the market.

In this post, we’ll see how we got here.

Why’re there so many UPI players?

As the fastest growing large economy, India is a big market for many products and services, including digital payments.

As the fastest growing large economy, India is a big market for many products and services, including digital payments.

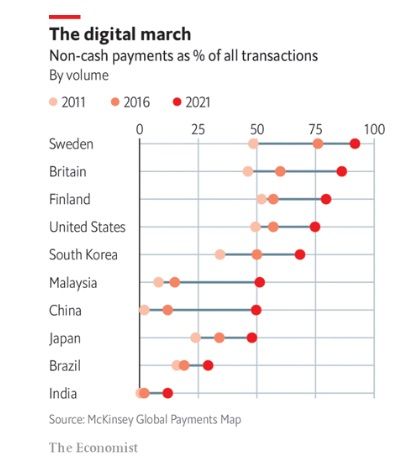

Cash has always been king in the Indian retail market. According to McKinsey, cash still accounts for 80% of retail payments made in India (see exhibit on the right). This means that digital payments has a very low penetration. Another way of putting it is that digital payments has a huge headroom for growth.

Whenever this happens in any market, we have what’s known as a “goldrush”. We’ve witnessed this in ecommerce, rideshare, and food delivery before. We’re seeing it in digital payments now.

Goldrush markets breed a landgrab behavior where multiple players emerge in a mad rush to grab the market. With the plentiful availability of venture capital during the ZIRP (Zero Interest Rate Phenomenon) era, the number of PSPs offering UPI payments went up exponentially.

Ergo we have so many UPI players. (NOTE: Some of these players support only UPI. Others support card payments as well. But, in the context of this post, we’ll simply call them UPI Players or UPI Apps.)

Why’re there so few UPI players?

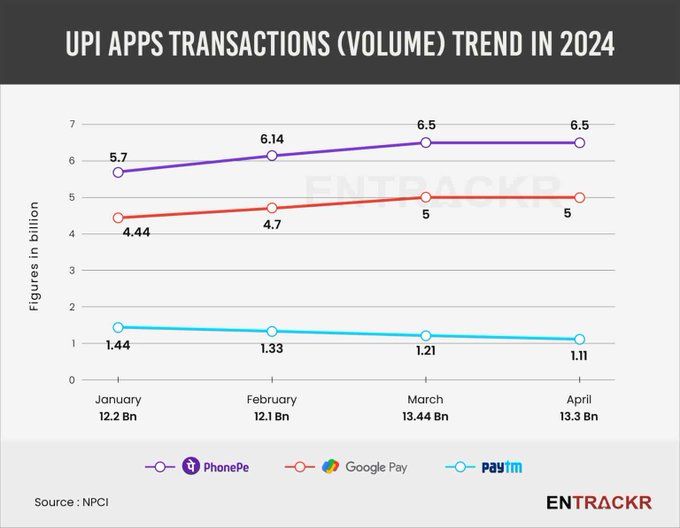

Walmart PhonePe and Google Pay drive 85% of volume and TPV (Total Payments Value) of UPI. This has created the popular narrative that UPI is a duopoly and that India’s A2A RTP method of payment has a high concentration risk.

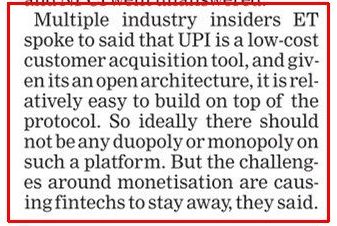

The UPI systems architecture allows multiple players to offer UPI apps. If there are only two large players in the field today, it’s entirely due to Reg ZeroMDR.

Let me explain.

At its inception, like all payment methods, UPI had a nonzero MDR. If I recall right, it was 0.6%, which was in line with debit card MDR of 0.6-0.8%. However, Reg ZeroMDR came into effect on 1 January 2020 and zeroed MDR of UPI. (For the uninitiated, MDR or Merchant Discount Rate is the fees paid by merchant to accept digital payments. Originally coined by the credit card industry, the term has been adopted by PSPs providing other methods of payments. Click here for more.)

At its inception, like all payment methods, UPI had a nonzero MDR. If I recall right, it was 0.6%, which was in line with debit card MDR of 0.6-0.8%. However, Reg ZeroMDR came into effect on 1 January 2020 and zeroed MDR of UPI. (For the uninitiated, MDR or Merchant Discount Rate is the fees paid by merchant to accept digital payments. Originally coined by the credit card industry, the term has been adopted by PSPs providing other methods of payments. Click here for more.)

Zero MDR means that banks and PSPs get no income for their UPI offering. This has decimated the business case of UPI for many PSPs and banks. Since it was politically incorrect for them to withdraw from UPI network, they soft pedaled their UPI offerings, as I highlighted in Banks Have Not Lost The UPI Plot. On the other hand, flush with venture capital, nonbank fintechs had a field day chasing the UPI market since it offered huge scope to pump up valuation via vanity metrics like number of transactions and Total Payments Value (TPV).

As it happens in virtually all startup industries, VC eventually drives Winner Takes All outcome, whereby many companies in the industry shut down, some function as zombies, and the market is dominated by one or two players (aka “last man standing”), who deliver multibagger returns. Winner Takes All happened earlier in ecommerce (Amazon and Flipkart), rideshare (Uber and Ola), and food delivery (Swiggy and Zomato), and it’s happening in UPI now.

Winner Takes All is a VC thing whereas monopoly / duopoly is a market thing – but good luck explaining the distinction to Joe Six Pack / Jane Six Pack (respectively man or woman in the street) (although I have tried).

Regulators are meant to prevent / break up monopoly / duopoly but UPI is a classic case where the regulator’s ZeroMDR policy has ironically created a duopoly of two American apps (Walmart PhonePe and Google Pay).

What now?

According to ET Prime article titled Paytm, PhonePe, Google Pay vs. cash: India’s long journey to a digital economy, despite so many digital payment apps being around, cash and cheque still dominate the payments market; cash in circulation remains at an all-time high; and, as noted earlier, cash is still king.

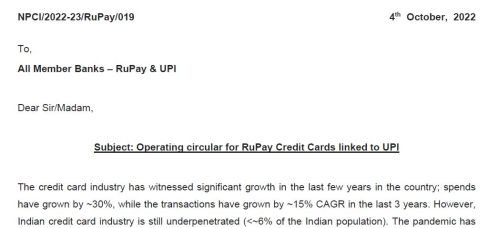

Credit card issuance, transaction volumes and payments values have also doubled in the recent past. Banks in India issued 40 million credit cards from circa 1975, when credit card entered the Indian market, to 2019 or so. In the next four years through to end of 2023, they issued another 40 million credit cards. So the 40 year old credit card industry doubled in size in just four years, a stupendous feat that was acknowledged by UPI scheme operator NPCI in its following circular.

This is a sign that UPI is replacing cash (and debit card) rather than credit card.

At the peak of Michael Schumacher’s career, there was a famous statement made to express his absolute dominance of Formula One racing. Lately, they’re using that line for Lewis Hamilton.

Lewis Hamilton has replaced Michael Schumacher in one of my all time favorite quotes: "Michael Schumacher is so successful that the only exciting part of the race is the one that happens behind him." pic.twitter.com/vGDP47vLgV

— Ketharaman Swaminathan (@s_ketharaman) July 24, 2019

This statement can be easily paraphrased for method of payments in India. No prizes for guessing which of cash, UPI or credit card takes the place of Michael Schumacher / Lewis Hamilton!

What next?

Three years ago, NPCI dictated that no PSP should have more than 30% market share of UPI processing volumes. This was like trying to ban network effects. Needless to say, it didn’t happen.

Three years ago, NPCI dictated that no PSP should have more than 30% market share of UPI processing volumes. This was like trying to ban network effects. Needless to say, it didn’t happen.

After the recent RBI crackdown on PayTM Payments Bank, which was the third-ranking UPI app by volumes, PayTM users have predominantly switched to PhonePe and Google Pay. Sinecure bureaucrats are learning another lesson on how markets operate: When a #3 product disappears, consumers move to #1 and #2 products, not #4 through #48. Click here for more details.

What was always an impractical rule sounds even more harebrained with the exit of PayTM. For whatever it’s worth, NPCI has set another deadine to comply with it: End of this calendar year. This time, it is nudging new UPI players to incentivise users to to snap the American duopoly in UPI (Source: Economic Times).

I forgot to mention that one of the 48 UPI apps is BHIM, which is owned by NPCI.

I’m not sure why NPCI is pushing third party UPI apps to forge ahead instead of prodding its own app to capture greater market share! If I were to take a wild guess, it’s because third party apps might be VC-backed and flush with funds whereas NPCI may not have the budget to offer cashbacks and other incentives to promote BHIM.