According to @sweatystartup, shipment volumes at a certain Amazon Distribution Center (“said DC”) are down from 75,000 to 50,000 packages a shift.

Friend works at an Amazon distribution center.

Volume down from 75,000 packages a shift to 50,000 or less.

Hiring freeze began last week.

Managers walking around mid shift offering optional vacation time (basically send you home).

A lot of employees standing around.

— Nick Huber (@sweatystartup) May 21, 2022

Assuming that order value per package has not increased dramatically, this presages a 33% drop in Amazon’s sales.

Based on personal experience and anecdata, let me speculate on a few likely reasons for this spectacular fall in the ecommerce giant’s revenues.

#1. LOOMING RECESSION

All those predictions of an impending recession are true.

"Economists predicted 10 out of the last 3 recessions".

BUT

"Economists averted 7 out of 10 recessions by giving early warning".

— GTM360 (@GTM360) April 29, 2020

Coupled with unprecedented inflation (above 8%), maybe there’s a sharp fall in purchase of discretionary products and services.

@DizzleTheRizzle: Sales for everything is down across the board forget junk or not. I sell name brand on amazon and YTD sales are down 21% stuff that always sells is not selling. The consumer discretionary sales are falling fast.

To help the uninitiated to fully comprehend the last sentence in the above tweet, let me reproduce the definition of discretionary v. nondiscretionary goods from my blog post entitled Just Because You Can Show Digital Ads Doesn’t Mean You Should:

- Discretionary goods: These are products and services that are considered non-essential by consumers but purchased if they have enough surplus income. Examples of discretionary goods include luxury car, overseas vacation, foreign education of children, etc.

- Non-discretionary goods: These are products and services that are considered essential by consumers. Examples of non-discretionary goods include food, clothing, shelter, and so on.

#2. SHOPIFY STORES

While I’ve not been able to find an alternative for Amazon, others may have:

@Adam_Is_Pneuma: I stopped ordering from Amazon a while ago. Too many resellers and counterfeit products.

Maybe consumers increasingly view Shopify Stores as a viable substitute for Amazon?

@michaelsecom: Serves Amazon right for cutting affiliate commissions dramatically. E-commerce entrepreneurs are pumping ad $$ to sell on their own sites powered by Shopify, BigCommerce, or WordPress instead.

#3. RETURN OF BRICK-AND-MORTAR SHOPPING

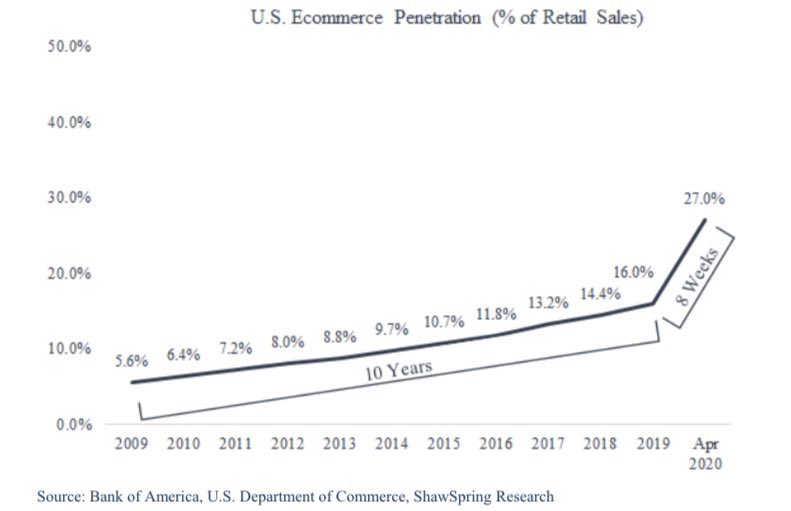

Amidst lockdowns, ecommerce shot up to 27% of total US retail sales at the height of the pandemic in April 2020.

Many disruptionistas predicted that would be the “new normal”.

But that’s not to be.

As the pandemic has waned, people have started going back to brick-and-mortar stores. Testimony: Ecommerce is now only 13.2% of US retail sales (Source). Interestingly, this is not only lower than the pre-pandemic peak of 16% in 2019 but is also below the figure prevailing a year earlier, when WalMart acquired Flipkart (14 percent).

When there’s such a massive fall in the sales of the overall ecommerce category, a dip in the sales of the category leader Amazon shouldn’t come as a surprise.

Of course, as Amazon expands its physical store network, it should be able to capture some of the gain from this trend but, as of now, Amazon’s sales from brick-and-mortar stores are probably a rounding error on its $470 billion revenues.

#4. TRAVEL

When I checked recently, the air fare for a certain sector was 75% higher than what I’ve regularly paid in the past.

A customer told me that a room in his go-to hotel in Mumbai cost 2X of its usual rate. What’s more, he couldn’t walk into the buffet breakfast but needed to book a prior appointment – something that’s unprecedented for both of us in our decades of travels across dozens of countries.

Per media reports and anecdata, airfares and hotel bookings are above 2019 levels.

@Jeff_is_trying: Bullwhip from being stuck inside and spending money on cheap goods to spending money on all the travelling people have been missing out. Airfares and hotel bookings are above 2019 demand.

It seems like people are traveling like crazy.

When they won’t be at home to collect the packages, it stands to reason that people won’t place orders on Amazon.

In this situation, the drop in Amazon’s shipping volumes is only a seasonal blip.

#5. ONLY THIS DC

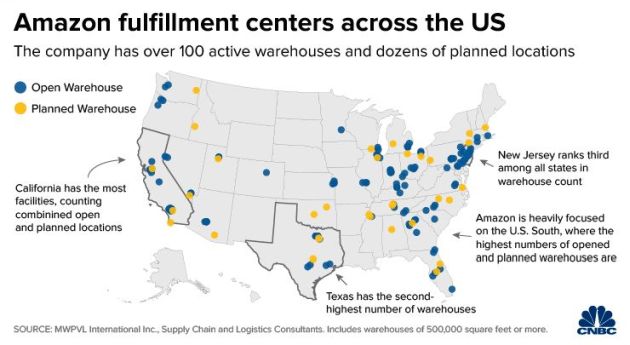

Amazon has 110 active Distribution Centers in USA.

Maybe Amazon diverted shipments from the said DC to one of its 109 other distribution centers across the United States, in which case volumes are only down in this particular DC. For all we know, there may be an increase in shipping volumes from 50,000 to 75,000 packages / shift in some other Amazon DC.

If so, the variance in shipping data from the said Amazon DC is not predictive of Amazon’s overall sales.

While the aforementioned reasons are logically plausible, we’ll know whether they’re factually correct only if Amazon announces a sales decline in its next quarterly results.

Amazon, stuck with too much warehouse capacity now that the surge in pandemic-era shopping has faded, is looking to sublet at least 10 million square feet of space https://t.co/0G6yLRnzgc

— Bloomberg (@business) May 22, 2022

Given that Amazon is one of my cult loyalty brands, I’m happy to be proven wrong.