At the conclusion of my post entitled How RBI Emandate Can Become Consumer Savior, I had outlined two alternative operating models for the new RBI Emandate.

For the uninitiated, Emandate, a new regulation that came into effect in India from 1 October 2021, changes how banks process recurring payments and auto debits (“Standing Instructions”) set up with credit card and debit card. More at RBI Emandate: Revenue Killer Or Consumer Interest Savior?.

My alternatives addressed the widespread critique of the current form of the regulation from consumers, merchants, and banks. Either model would have substantially reduced the compliance burden for all stakeholders while providing adequate consumer protection.

I was hopeful that, by adopting one of them, the regulator would bring about a change in the perception of Emandate from “revenue killer” to “savior of consumer interest”.

"CoFT is an overkill. Customers cannot be treated as hapless babes. There is a fine line between assertive regulation and permit raj".

Excellent op-ed in today's @EconomicTimes re. regulatory overreach in payments including #Emandate. pic.twitter.com/9BD9fAnI2Y— Ketharaman Swaminathan (@s_ketharaman) January 3, 2022

Alas, my optimism was misplaced. The regulator did nothing to assuage the concerns expressed by various stakeholders over its new directive.

In turn, merchants have rebuffed RBI Emandate. As I feared they would.

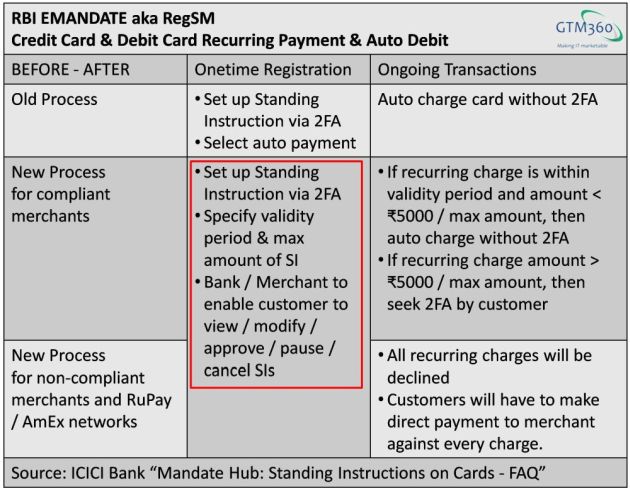

Emandate requires merchants to change how they register and initiate standing instructions based on credit card and debit card. The new process is marked in RED in the following exhibit.

In the early days, very few merchants were compliant with Emandate. Which was not shocking.

But the situation did not change much even in the next four months. Given below is my firsthand exposure to the responses of different merchants during this period.

- Stopped accepting Indian credit cards altogether, even for one-off payments e.g. Heroku.

What the hell, @heroku ! You are abandoning tens of thousands of developers and your entire paying customer base in India(except enterprise big money of course) because you can’t be bothered to give an alternate payment option. @RBI damn you too. Never trusting @salesforce again! pic.twitter.com/nwfzwJAFLV

— Nalin Narayan 🧨 (@nalinnarayan) December 16, 2021

- Discontinued monthly payment plans and moved to onetime payments for longer durations e.g. Adobe.

- Discontinued card-based recurring payments and started offering UPI AUTOPAY instead e.g. Economic Times for its ET Prime subscription product, Netflix India for its OTT subscription.

- Discontinued even UPI AUTOPAY after offering it for a brief period e.g. ET Prime.

But you did support UPI Autopay when I checked on Jan 11. Curious to know why you pulled the plug on it later?

— Ketharaman Swaminathan (@s_ketharaman) February 15, 2022

- Charged credit card on file without my even having to enter CVV or any other credit card details e.g. Amazon USA.

One-off USD payment against one-off bill & recurring bills: Yes, with many bank credit cards, some even without OTP.

Recurring Payment: No, not USD, not even INR, not with any bank credit card. #Emandate— Ketharaman Swaminathan (@s_ketharaman) December 29, 2021

- Stopped card-based recurring payments and told customers to visit their websites to manually renew their subscriptions with credit card e.g. Go Daddy for domain renewal. My experience with that has been very weird.

This is getting surreal.

I've 2 domain registrar a/cs.

One 1 a/c, renewal failed on 2 Oct, then succeeded in mid-Nov & today – w/o OTP on either occasion.

On 2nd a/c, renewal failed today.

Thing is, I used same Credit Card on both a/cs.— Ketharaman Swaminathan (@s_ketharaman) December 31, 2021

Four months after Emandate came into force, I have not come across a single merchant in India or abroad who supports card-based recurring payments according to the new process dictated by the directive.

In short, merchants have given the middle finger to RBI Emandate.

I don’t think the situation is about to change much in the forseeable future.

According to a recent article in Economic Times, many Indian merchants and most overseas merchants have declined to modify their systems to comply with RBI Emandate. Many OTT platforms, cloud storage websites and subscription-based services have said that the investment required to comply with RBI’s directive does not have a business case.

Recurring payments fail as platforms ignore RBI rules. Majority international merchants are not going to hop on to the e-mandate solutions because they feel that the investment and changes they have to make to their systems post the RBI diktat is far too burdensome. India is a small market and it doesn’t make sense for them to fine-tune and integrate their platforms to suit just one market.

The only way for customers to continue using their subscription services is to manually make recurring payments on their websites every month.

Merchants’ response resonates well with the surmise I’d made when I saw negligible adoption of Emandate in the early days:

I’m guessing that their cost of complying with the new regulation exceeds the loss of revenues from monthly subscriptions.

This is a tight slap on the face of regulators in a molehill market trying to make mountain regulations. Will they learn a lesson from this fiasco? I won’t hold my breath.

PS: As banking industry regulator, RBI has no jurisdiction over OTT platforms, cloud storage websites and subscription-based services. Therefore these merchants do not have to comply with any RBI directives. To that extent, talk of merchants having to comply with RBI Emandate are a bit loose. Strictly speaking, they reference changes that merchants need to make in their systems so that they are able to generate payment messages that can be processed by banks in a compliant manner.

PPS: In case the above mentioned Economic Times article is paywalled, given below is the print version.