WYSINWYG (to be pronounced “wisinwig”) means “What You See Is Not What You Get”.

We described four WYSINWYG terms in finance in Eight WYSINWYG Terms In Finance – Part 1:

- Nonprofit Company

- Winner Takes All

- Banking the Unbanked

- Too Big To Fail

We will cover four more finance WYSINWYGs in this second part.

#5. MARKET MANIPULATION / PUMP AND DUMP

Pump and Dump is not literally pump and dump.

When people buy a stock, they obviously buy it with the expectation that its price will increase. One day, depending on their cash needs, they will sell the shares at a higher price than the price at which they bought it, thereby making a profit. That’s the objective of trading and investing. While there’s buying that leads to pumping up of the price, and selling aka dumping, it’s not market manipulation or a pump and dump crime.

Pump and dump is when you purchase the stock with the sole intention of increasing its price in order to cash out of another position that yields a profit only if the stock price goes up.

Matt Levine provides a canonical example of pump and dump / market manipulation in his Money Stuff newsletter dated 15 November 2023:

Cole CapitalOne way to acquire a public company is, you put out a press release saying “I am making a public offer to buy all the shares of this company,” and that press release starts a complex process in which the company’s board feels compelled to negotiate a deal with you, or if they don’t then you follow through on the press release and launch a hostile tender offer for the shares. The press release is a key moment in the campaign, the point where you go public, but it is preceded by lots of preparation and followed by lots of tactical maneuvering. The acquisition of a public company is difficult and complex and typically requires many hours of work from hundreds of people to get everything done.The press release is easy, though? You can just type it? Business Wire seems to charge several hundred dollars for disseminating a press release, so it’s not free, but if you pay Business Wire’s fees it’ll be picked up pretty broadly and everyone will think that you are launching your effort to buy the company. And so if you want to pretend to acquire a public company, you can just do the press release and not all the other parts.Why would you want to pretend to acquire a public company? The standard reason is market manipulation:

- You buy some stock in the company at a low price.

- You put out a press release saying “Fake Capital Management LP is buying this company at a 90% premium.” (which is a false claim).

- People and/or algorithms read the press release and buy the stock to speculate on the takeover.

- You sell the stock at a high price.

Thank goodness for some clarity!

#6. INSIDER TRADING

Insider Trading is not literally trading by insiders.

Companies want their CEOs to have skin in the game, so they pay a substantial part of their compensation in stock. From time to time, CEOs need hard cash, so they will sell their stocks. While that’s trading by insider, it’s not an insider trading offence.

"You want your CEO to have skin in the game, so you'll pay him in stock. He'll need to sell his stock sometime. But insider trading is illegal. So you create the polite fiction that CEO has MNPI only sometimes & let him sell his stock at other times." ~ @matt_levine

— Ketharaman Swaminathan (@s_ketharaman) August 22, 2022

The bedrock of professional trading is to find out some information that’s not known to everyone and to take a position based on that. For example, according to an article titled Traders’ New Edge: Satellite Data in Fortune, hedge funds and many others in the investment community buy data on parking lots of more than 50 US retailers. Based on the number of parked vehicles, they predict the revenue of retailers ahead of quarterly results. This privileged information is not available to the common man. But trading on the basis of it is not insider trading.

It would be an insider trading crime only if the hedge funds obtained this so-called Material Non Public Information (MNPI) illegally e.g. by hacking into the retailer’s ERP system.

Insider trading is really about theft. Much as prosecutors and law enforcement officials puff up their chests whenever they nab somebody for insider trading and wax eloquent about protecting the common man’s interest blah blah blah, insider trading is not principally about fairness or level playing field.

@s_ketharaman: “Insider Trading is not about fairness but it is about theft. Whenever an insider trading case is announced, the prosecutors will make a speech about how financial markets have to be a level playing field, … but it is all nonsense.” ~ https://bloomberg.com/opinion/articles/2019-03-13/you-have-to-pay-the-right-person via @matt_levine

(At the risk of muddying up an already-complicated topic, Matt Levine says that there’s no separate insider trading crime in US Securities Law – it’s a type of securities fraud.)

#7. KNOW YOUR CUSTOMER

Let’s take the most common example of a cybercrime: Joe uses a digital payment to buy something from Jane, and does not get what he ordered.

Many people want the Payee Bank to be held liable for this Authorized Push Payment Scam e.g. Melvin Haskins, who left the following comment on my Finextra blog post entitled Why Is It So Hard To Catch Cybercriminals?:

I do not believe that anyone other than the Payee Bank has responsibility. They have allowed the person to open the account without carrying out KYC.

This flawed take is based on a sweeping interpretation of the term KYC.

KYC is not character certification. It’s merely the verification of identity and address of account holders basis artefacts like Drivers License and Passport submitted by the account holder.

Was a time when the verification was quite rigorous. Banks would contact the government agencies that issued the documents to verify their authenticity and sometimes even send somebody to the customer’s house / workplace to physically verify their address. I doubt if they do any of that now. According to an ex-banker, these days banks don’t need to do anything more than ensure that the artefacts are not obvious counterfeits. In some countries, banks subscribe to third party POI and POA verification services and have indemnity clauses to transfer the liability of incorrect verification, if any, to those agencies.

To that extent, the term KYC is an obfuscation.

To that extent, the term KYC is an obfuscation.

While “Partial KYC” done by neobanks and fintechs does not even verify ID and address fully, banks’ “Full KYC” was never supposed to vet customer’s character.

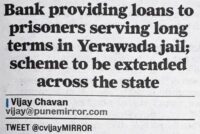

When banks open fully KYCd accounts even for convicted criminals, how can they decline accounts to alleged scammers (as long as their KYC documents are in order)? More at Fraud v Scam: Who Is Liable For Cybercrime.

#8. MAXIMUM RETAIL PRICE

India is the only trillion-dollar economy where Maximum Retail Price is a legal mandate. Marked on the product packaging, it’s the maximum price at which a product can be sold in retail.

MRP is applicable on packaged goods across multiple industries e.g. chips, hair oil, shaving cream, soap, toothpaste, and so on.

The “maximum” in “maximum retail price” conveys the impression of price control. Accordingly, many people believe that some statutory body has set the maximum price, presumably based on “cost plus fair margin”.

This is not true. MRP is decided by the manufacturer. No regulatory authority is involved in setting the figure (except for a handful of goods under price control like cardiac stent, Covid-19 drugs like Remdesivir, etc.). For all we know, manufacturers might set their MRP at 25% or 50% or 250% margin, it’s up to them. Likewise, no regulatory authority forces a consumer to buy something at a certain MRP, so consumers can feel free to reject something without giving any reasons.

Yo @Flipkart @flipkartsupport : Not only is your price (INR 155) above MRP (INR 65) but you also deface the MRP. Not sure if that counts as one or two offences. pic.twitter.com/VUZzRcH059

— Ketharaman Swaminathan (@s_ketharaman) April 15, 2019

It’s also not widely known that manufacturers can set different MRPs for the same product for different channels.

A Coca-Cola spokesperson said in an email revert that it is legislatively recognised and accepted that different maximum retail prices (MRPs) can be declared on different packages even if they contain identical products in the same quantity.

– Economic Times

So, the next time you see the same bottle of Bisleri mineral water sold at ₹30 in a supermarket and ₹100 at a multiplex, just grin and bear it (or don’t buy it).

While on the topic, MRP is not applicable on cab fares, food at restaurants and QSRs, unpackaged goods, and services including those provided by carpenters, electricians and other handymen, etc. These products and services might come with a rate card but the price printed there is “List Price” – and not MRP e.g. prices on a restaurant menu. While the providers of these products and services will not take too kindly to scalping of their wares by others, marking up items above their list prices is not illegal (not legal advice). On second thoughts, they might do the scalping themselves (I’m looking at Uber surge prices).

If you’ve come this far, you might have noticed that there’s a lot of hair splitting in finance, especially when it comes to terms related to nonkosher activities. That will be the subject of another post (Spoiler Alert: Hair splitting is increasing, not decreasing.)

DISCLAIMER: This post is not legal or financial advice.