Since companies comprise individuals, many people believe that companies and individuals will behave in an identical manner under the same situation.

I disagree. There’s a big disconnect in the behavior of individuals versus companies.

I can think of at least three reasons for this disconnect:

- Fiduciary responsibility

- Market cap

- Emotion

#1. FIDUCIARY RESPONSIBILITY

Let me take the following following Quora question:

Why card companies wont care about a Rs. 2000 or $20 fraud transaction and will just refund me instead? It’s illegal, so why wont they help me find out who did it?

I’ll use my following answer to illustrate this point.

Your quandary is understandable.As an Individual, Fraud is Illegal, should be nipped in the bud, should not be allowed to propagate, fraudster should be punished to the full extent of the law, blah blah blah.

However, for a Company, every operating action is subject to Cost-Benefit analysis. The company would need to investigate the fraud before it can tell you who committed it and bring them to justice. In all likelihood, the Cost of investigating the $20 Fraud would far exceed the Benefit of doing so. So the fiduciarily responsible course of action for a Credit Card Company would be to reverse the transaction and refund you, which is what your credit card company has done in your instance.

But, from this, it would be a mistake to believe that a Credit Card Company does not care about the fraud.

Most of them do.

When I published my op-ed article entitled Controlling Credit Card Fraud Through Predictive Analytics, around 20 midsized-to-large banks in USA and a couple of them in Asia Pacific used Predictive Analytics to ferret out fraud. I’m sure those numbers have grown manifold by now.

To an individual, it might seem that the Credit Card Company has ignored the $20 fraud. But, behind the scenes, there’s a very good chance that each fraud incident is added to the training dataset of the company’s Fraud Detection & Prevention software. This will significantly improve the cost-benefit calculus of its detection and prevention of these frauds in future. Furthermore, in jurisdictions where this is mandatory, credit card companies also file fraud reports to the regulator.

The term fraud referenced in the above context includes both

- Third Party Fraud where a Credit Card is used in an unauthorized manner by a bad actor; and

- First Party Fraud where the real Cardholder uses his or her Credit Card and still files a fraud complaint, claiming that somebody else used it.

Credit Card Companies tend to come down quite harshly on both types of fraud.

Can’t say I blame them since fraud hits their bottomline directly and, as we all know, that’s one thing banks protect fiercely.

Finserv has consistently been the most profitable sector in FORTUNE 500 for several years. Now the industry has started outperforming the broader market on one more metric: Return to Shareholders (32% vs 22%) – via @McKinsey https://t.co/7j90k4PkaI

— Ketharaman Swaminathan (@s_ketharaman) April 26, 2018

#2. MARKET CAP

Companies have equity and market cap / valuation. They can sell their equity to raise cash and sustain losses for a long, long time. This is one of the guiding principles of Venture Capital Investment Model that I highlighted in Teardown Of The VC Investment Model.

Despite cash burn, Investors make record-breaking returns, Consumers get big discounts, Founders generate great wealth & Employees earn fat salaries.

Further proof that Cash Burn strategy works in VC model.

He who can understand that raises funds; he who can't fails.

— Ketharaman Swaminathan (@s_ketharaman) December 22, 2017

In sharp contrast, individuals don’t have equity and market cap / valuation, and will go bankrupt if they consistently spend more than they earn.

In case you’re looking at homes and other assets owned by individuals and thinking of treating them as equity, here’s a PSA: While such assets are monetizable, there’s a subtle, but huge, difference between how corporate equity and personal equity are monetized.

A company can sell part of its equity to raise funds. It does not have to pay back the money to investors. While investors do expect dividends and / or capital gain in return for their investments, a company is under no contractual obligation to deliver either.

That’s not the case with an individual. While the average John Doe or Jane Doe can raise cash against their personal assets, it’s in the form of loans that must be paid back. Even Home Equity Line of Credit (HELOC), which is positioned as a way to unlock the growing market value of a home, is still a loan and must be paid back.

AFAIK, there’s no financial instrument that lets an individual sell a part of their home – or any other personal asset – and raise money that they don’t have to pay back. On the other hand, there are many products that allow companies to do exactly that.

#3. EMOTION

Individuals have emotions and do tend to show them at their workplaces. But such emotions are nuanced compared to raw emotions displayed by the same individuals in their private lives. More in Role Of Emotion In B2B Sales.

As a result, even if a company behaves emotionally to a certain extent because its employees have emotions, its behavior is different from that of its employees.

The aforementioned reasons are by no means exhaustive. I’m sure many of you can think of more reasons to explain the difference in behavior of individuals and companies. Please share in the comments below.

At the risk of contradicting the above, I’ve recently started seeing convergence in the behavior of individuals and companies in a few areas.

At the risk of contradicting the above, I’ve recently started seeing convergence in the behavior of individuals and companies in a few areas.

Take the average consumer’s attitude towards security deposits for Internet and mobile connections. For the uninitiated, people like me who signed up for these services soon after they were launched 20+ years ago had to pay security deposits for the basic connection and for VAS like International Roaming.

Of late, I’m noticing that many of them don’t bother to get back their security deposits when they cancel a broadband or mobile phone service.

Like the aforementioned Credit Card Company, these individuals have presumably decided that the cost of following up with the ISP, TELCO / MNO for the security deposit far exceeds the value of the deposit, so why bother. (That said, a shout out to Vodafone – a few years ago, I was pleasantly surprised to receive the proverbial cheque in the mail for refund of security deposit that I never remember I’d paid!)

Does this create a moral hazard?

Does this create a moral hazard?

You bet it does. But it’s not the only one.

I can readily think of many other moral hazards in modern times:

- Bailouts to banks during the Great Financial Crisis

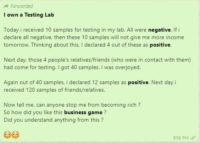

- Contact tracing rules creating commercial motivation for Covid-19 testing labs to veer towards excessive False Positive results (see exhibit on the right).

But somehow life goes on!

UPDATE DATED 11 APRIL 2022:

BitClout is attempting to change the following observation about the status quo that I made in the original post:

AFAIK, there’s no financial instrument that lets an individual sell a part of their home – or any other personal asset – and raise money that they don’t have to pay back.

The new crypto startup mints a token whose value is based on the reputation of an individual. Individuals can sell the token and thereby raise money without being obligated to pay anything back. That’s exactly like a company share.

BitClout:

* Resolves chronic pain: If companies can have valuation, why can't individuals?

* Cowboy: Uses profiles of 15K celebrities without their permission

* Roach Motel Dark Pattern: You can get in but you can't get out.I see a bright future ahead for this startup.

— Ketharaman Swaminathan (@s_ketharaman) May 21, 2021

UPDATE DATED 23 MAY 2023:

BitClout, the Web3 company that came up with a mechanism to give valuation to individuals, is still around although nobody talks about it these days.

Now it’s time for giving valuation to horses! Enter new startup Commonwealth. Here’s Matt Levine in the Money Stuff newsletter dated 22 May 2023:

Buy a share in a racehorse for as little as $50 … earn a cut of its winnings. You don’t need to know a single thing about horse racing. If you’re willing to put in $50 and risk losing it, you’re in with an experience that’s unlike any other out there. It would be fun to run an activist campaign, do a hostile takeover of a horse and change his training regimen or let him retire.

If Commonwealth takes off, the term “horsetrading” will acquire a totally new meaning!

UPDATE DATED 12 JUNE 2025:

In the original post, I’d made the following observation about the status quo:

AFAIK, there’s no financial instrument that lets an individual sell a part of their home – or any other personal asset – and raise money that they don’t have to pay back.

I thought of revisiting it after reading the following passage in Matt Levine’s Money Stuff newsletter dated 11 June 2025:

I wrote last week about two classic financial ideas that people keep reinventing: “People should be able to sell stock in themselves”, and “people should be able to sell stock in their houses.” Over the years, many companies have been formed to address the first idea, and at least a few have been formed to address the second.

Referencing his Money Stuff column dated 25 February 2020, Matt Levine wrote:

What if people could sell stock in themselves? Instead of borrowing money and pay back a fixed amount, why not take an advance in exchange for a fixed percentage of your future income? In the case of Lambda School, participants pay no tuition upfront but pledge to remunerate 17% of their incomes for 24 months after landing a job that pays more than $50,000 a year. Of course, if no one ends up getting jobs, investors will eventually stop buying the Lambda ISAs, but that would all happen a long ways down the road. (emphasis mine).

Notice that students of Lambda School are legally obligated to pay 17% of their incomes. So this is not quite the same as shares of a company, which don’t guarantee any share of its profits aka dividends to shareholders.

On 3 June 2025, Matt Levine had written about a new startup called Horizon , which enables shares in home equity.

Transform Dormant Home Equity into Bitcoin. Alternative to HELOC for monetizing home equity that does not involve any monthly payments. Ideal for people who believe that BTC will rise faster than home prices.

I didn’t fully get the part about Bitcoin but, assuming there’s no major gotcha there, this product does come close to company shares.

Based on this, let me update my original observation:

Company-like share is still not a thing for individuals but it has started happening for home equity.

UPDATE DATED 30 JUNE 2025:

The above observation is reinforced by the following passage in the section titled Fernando Tatis of Matt Levine’s Money Stuff newsletter dated 26 June 2025:

As a dorm-room question, “what if you could sell stock in yourself” is terrific. But of course you can’t. You’re not a corporation; you don’t have stock. You could trivially form a corporation, but the point is that the earning power is with you, not any corporation you form, and the investor wants your earnings. Forming a corporation, selling 10%, and then signing your baseball contract in your own name doesn’t work.

Not sure why the corporation workaround doesn’t work but let me not flog the dead horse any more.