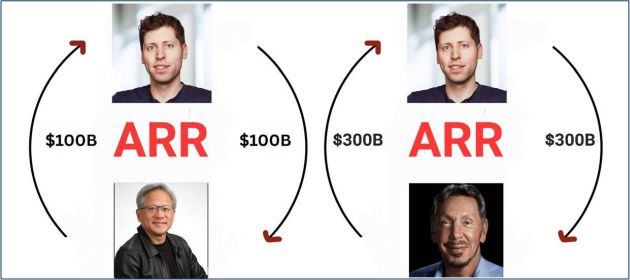

AI Didn’t Invent Circular Deals

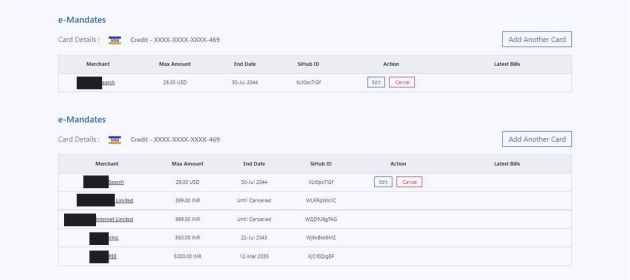

I concluded my blog post entitled ROI For Customer ≠ ROI For Investor with a promise to write a follow-on post on startup investments that are not made in cash. This is that follow on post. Noncash investments have been practice du jour in many industries for decades. During the dotcom era, it was customary for startups to pay for marketing, … Read more