Zepto just became the first unicorn in the Quick Commerce space.

Zepto, an India-based grocery delivery company, secured a $200 million Series E at a $1.4 billion valuation in a deal led by Stepstone Group. – Axios Pro.

Compared to UDAAN and a couple of other startups that became unicorns in six months or so, Zepto has taken close to three years to achieve the distinction but point to note is that Zepto has become a unicorn during an 18 month funding winter, a period in which the Indian startup world did not mint a single company with a billion dollar valuation.

Apart from Zepto, the leading players in this industry, which is also known as 10 Minute Delivery and Rapid Delivery are BlinkIt, Dunzo, and Swiggy.

Based on my first hand experience with it over the last year and a half, I’ve been very optimistic about the prospects of this sector.

However, the space has met with a ton of skepticism in both social media and mainstream media, mostly stemming from the widespread belief that consumers don’t need grocery in 10 minutes. I never subscribed to the naysayers’ take. Not because I think that people need groceries in 10 minutes but because capitalism is about wants, not needs.

Was a time when people waited for two days for a cheque to clear and booked a taxi a day in advance of their scheduled trip. Naysayers who claimed that people don’t need instant payments or on-demand taxi at the time – yes, there were many of them – had egg on their face when UPI and Uber / Ola became blockbuster hits.

Likewise, the skeptics of quick commerce have been proved wrong by Zepto.

Since the time Thomas Watson Sr. predicted that there would be a market for at the most 70 IBM computers in the world to the time when Nokia’s then CEO predicted that iPhone wouldn’t sell more than a million units, even the best and the brightest have wrongly estimated market size by needs, totally missing the point that the core mission of marketing and advertising in a capitalism is to expand the market by driving wants and aspirations.

Having made this point many times – think India Inc Is Not In A Slowdown. India Inc Is The Slowdown – I can’t help but think of the repeated missouts of this basic fact of capitalism as a tragicomedy.

I started using Swiggy Instamart and Dunzo Daily around a year and a half ago (Zepto and BlinkIt didn’t serve my catchment at the time.) Going by my order history during this period, I’m jumping to the conclusion that quick commerce will upend the retail industry.

During the last 30 years or so, I’ve witnessed many formats in the industry, from khirana (India’s version of mom-and-pop stores) and organized / big box retail through to ecommerce and quick commerce. At every transition, pundits predicted the demise of khirana. But this humble mom-and-pop format never died – khirana still accounts for over 85% of retail sales in India.

But, for the first time during these three decades, I have this feeling that the status quo of the retail industry is about to change drastically (terms and conditions apply!).

I’ve posted many updates on social media over the last 18 months about my optimistic take on quick commerce. In fact, a good portion of this blog post has been ready for six months or so. I didn’t publish it earlier since I didn’t want to risk jinxing quick commerce by being too optimistic about it in its nascent stage. But, by creating its first unicorn, the industry has proved that that it has legs.

I’m gung-ho about quick commerce for three reasons:

1. HUGE WHITESPACE

When I moved in to my present neighborhood two decades ago, there were five khirana stores and one single outlet department store within five minutes walking distance of my house. All of them took orders on the phone and were happy to deliver even the proverbial single loaf of bread in 10-30 minutes.

Fast forward to the present day. Thanks to the combination of skyrocketing rents and pandemic lockdowns, three out of these five khiranas have shut down.

The only khirana store left in my building now grumbles about delivering one-off items and takes 1-2 hours to deliver the chunky orders that it accepts for home delivery. The aforementioned supermarket has switched to the beat system whereby it makes only two deliveries a day, so the average waiting period to receive my order is 6-8 hours.

Against this backdrop, quick commerce has a huge white space. Swiggy, Dunzo, et al literally deliver in 10 minutes quite regularly but even if they take 30-45 minutes or so, they can drive massive switch in shopping away from khirana stores (not to mention supermarkets and ecommerce websites). Going by the failure of the Flipkart Quick, my gut feeling is that quick commerce will work only as long as it delivers within 45 minutes.

@s_ketharaman: Flipkart Quick 90 minute delivery service flops as customers choose 10 minute delivery competitors – Economic Times.

On a side note, I was curious to know why my neighborhood khirana store drastically changed his home delivery policy, and asked its owner if the unending supply of “delivery boys” from Rajasthan that enabled free and rapid deliveries in the past had stopped. He told me it hadn’t but shared a different problem: Apparently, every boy who comes from a remote village in his home state to work in his store thinks he has mastered the grocery business in six months and quits to open his own store. Capital is no problem, since it’s possible even for a total n00b to get a loan of one crore rupees (around $125,000) from Marwari community lenders virtually overnight. If he succeeds, he continues with his own store. If he fails, he surrenders his store to his financier and heads back to his village. He does not rejoin the store he left as an employee since the social stigma of failure is so strong in his community that he can’t show his face to his previous cohort.

2. GREAT CX

In a brick-and-mortar store, if I see something I like, I pick it up from the shelf and drop it in my shopping cart. One and done.

On an ecommerce website, I’m deluged with endless variants from zillion sellers. As a result, I’ve found it to be a major PITA to shop for groceries on Amazon, Big Basket, JioMart, and other ecommerce websites.

I’m not alone. Even in USA, where ecommerce started 30 years ago and is well entrenched by now, e-grocery sales is less than 1% of total retail sales (as compared to 13.2% for ecommerce that spans all product categories), per data from US Census.

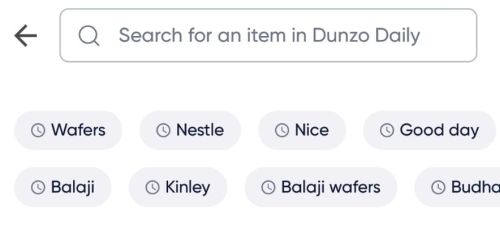

In contrast, quick commerce apps like Dunzo and Zepto have a limited assortment. When I do a search on quick commerce apps, I see only one result and it often exactly matches the item I want to order. Sometimes, I don’t even need to do a search: I see a “tag cloud” of items matching my needs below the search box. I just tap a tag and instantly get to see the item I wish to order.

In contrast, quick commerce apps like Dunzo and Zepto have a limited assortment. When I do a search on quick commerce apps, I see only one result and it often exactly matches the item I want to order. Sometimes, I don’t even need to do a search: I see a “tag cloud” of items matching my needs below the search box. I just tap a tag and instantly get to see the item I wish to order.

Accordingly, it’s very simple and quick to select products and add them to the shopping cart i.e. spearfish shopping.

Since delivery happens in 10-20 minutes, there’s no barrage of delivery status SMS messages and emails that’s practice du jour with ecommerce companies.

One and done. The quick commerce ordering and delivery experience is highly frictionless.

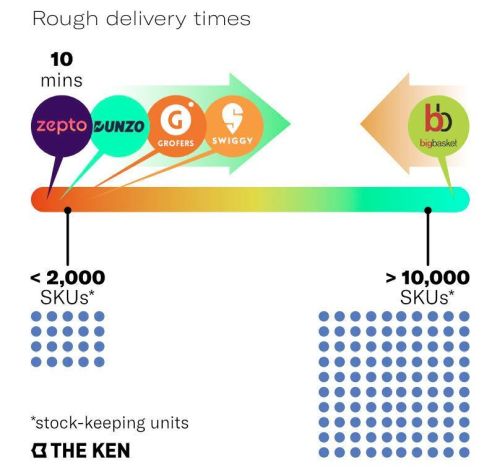

For the uninitiated, assortment in retail industry refers to the number of items or SKUs (Stock Keeping Units) stocked in a store. The number is typically 60,000 in a superstore (think Walmart SuperCenter or HyperCity), 30,000 in a supermarket (like Kaufhof Galeria or DMART), 10,000 in a khirana store, and 2,000 in a quick commerce app.

3. WORKS AS ADVERTISED

In my 18 months of shopping with them, Dunzo Daily and Swiggy Instamart

- had 80% or more of the items I wanted to buy, which is higher than the fill rate on ecommerce websites (60%) and supermarkets (70%).

- delivered 100% of my orders in less than 30 minutes. Contrary to the practice of some ecommerce companies who leave my package at the gate of my housing complex, quick commerce startups have delivered all my orders at my doorstep.

- delivered over 90% of my orders accurately (knock on wood!). In the one-odd orders they’d bungled, all I had to do was to click a picture of what they delivered and send it via chat. They instantly initiated the refund. This is a phenomenal accomplishment considering that I’ve faced shortshipments in around 20% of my ecommerce orders that were delivered after a few hours or next day (and which took months of follow up to get the refund).

This is a very impressive track record on fill-rate, ontime delivery, and accuracy.

I have placed more orders on Swiggy Instamart and Dunzo in the last 18 months than I have done on Amazon Fresh, BigBasket, and JioMart in the preceding 10+ years. Before lockdown, roughly one-third of these items each would have been purchased from khirana, supermarkets and ecommerce websites. I stopped going to supermarkets during lockdown and never went back after that for grocery shopping. I also stopped ordering groceries on ecommerce websites. In effect, all my purchases from quick commerce startups are items that I’d have otherwise bought from khirana stores.

That’s a big displacement from khirana stores and is the chief reason why I believe quick commerce poses an existential threat to the good old mom-and-pop store format.

That’s a big displacement from khirana stores and is the chief reason why I believe quick commerce poses an existential threat to the good old mom-and-pop store format.

Everyone has a fun story to narrate with a 10 minute grocery delivery. Here’s mine:

I was staying over at a relative’s place in Mumbai. Close to midnight, as I was about to turn in, I noticed that there was no mosquito repellent in the room. Nope, I didn’t embrarrass them at that late hour by asking them if they had any. I simply whipped out my phone and ordered a Good Knight Gold Flash mosquito repellent from Swiggy Instamart. I got it in 17 minutes.

Every time somebody does well, there will be detractors who envy their success and hide their sour grapes feeling behind contrived social or ethical smokescreens. Quick commerce is no exception.

Think scores of Wannabe Do Gooders who claim that 10 minute delivery is inhuman to the delivery agent. According to them, the tight delivery deadline forces delivery agents to drive too fast and cause accidents to themselves and others on the road.

I never bought this critique. For one, are these random guys willing to provide alternative employment to these delivery agents for whom their heart bleeds? Secondly, I wonder how it’s any business of randos to worry about issues that are right up the alley of other people who are better qualified to handle them.

@gtm360: Common men should celebrate the phenomenal achievement of quick commerce startups and leave traffic and issues like that to the drivers, traffic police, et al.

End of the day, “to make omelet, you need to break eggs”.

Armed with nonpublic information that only he has access to, the Founder CEO of Zepto gave a more politically correct rebuttal to this critique:

@aadit_palacha: 10 minute delivery is about short distances, not high speeds:). The average distance of a Zepto delivery is 1.8 km. To travel 1.8 km in 10 minutes, one can drive at 15 kmph. That’s why Zepto has 3.1x lower accidents on an average compared to a regular biker on the road.

End of the day, three things matter most in business:

- Is there a demand?

- Can someone fulfill the demand?

- Can he make money in the process?

Let’s see how quick commerce fares on these counts.

According to @aadit_palicha, Founder CEO of Zepto, the company is currently doing 2X more sales every month compared to the total sales in the whole of FY2022. Going by the exponential growth in the GMV (Gross Merchandise Value) of 10 minute grocery delivery startups, the answer to the first question is a resounding YES. Check.

Given that the industry works as advertised, the answer to the second question is also a YES. Check.

While quick commerce startups are still burning cash, this is a relatively new industry and we should not forget how long it took for ecommerce companies to turn profitable. As long as quick commerce startups are able to raise venture capital, they have money. By raising an up-round during a prolonged funding winter, Zepto has left no doubt about the answer to the third question. Check.