I first heard the meme “Banks privatize profits and socialize losses” soon after some banks were bailed out during the Great Financial Crisis of 2007-8 in USA.

The narrative was, when banks do well, they distribute their profits to their employees and shareholders whereas when they do badly, they palm off their losses to taxpayers who rescue them via state-funded bailouts.

I’m no stranger to banks failing. I still remember the day I held the London Times in my hand with the front page splashed with the news of failure of Northern Trust Bank while I was standing just outside that bank’s headquarters in Canary Wharf! The sight of a bank failing in front of my own eyes will surely go down as one of the most surreal experiences in my life!! (I’d left London by then but my office was situated in the same building as Lehman Brothers – imagine how surreal that would have been had I still been there on that fateful day in September 2008!!!)

That said, I didn’t learn about the dynamics of bank failures and bailouts until much later. The learnings scaled new heights after Terraform, Voyager and FTX failed last year and Silicon Valley Bank and Signature Bank went bust earlier this year.

Based on these lessons, I’m prompted to call BS on the popular narrative that banks privatize profits socialize losses.

#1. TARP was not a grant

The US federal government created the Troubled Assets Relief Program to rescue troubled banks during GFC. Many people think TARP was a grant i.e. free.

The US federal government created the Troubled Assets Relief Program to rescue troubled banks during GFC. Many people think TARP was a grant i.e. free.

That’s not true. TARP was effectively a loan structured as a preferred equity purchase by the Fed from banks, who bought them back a few years later. Taxpayers actually made a profit on the transaction.

#2. Central bank is lender of last resort

When they learn that TARP was not a grant, many people ask why only Wall Street should get such loans and why the government should not give similar loans to bail out troubled companies in automobile, retail and other Main Street industries.

The most obvious answer to this question is that, only banks cause systemic risk to an economy. Any number of GMs and K-Marts can go bust but failures in Main Streeet do not have a contagion effect.

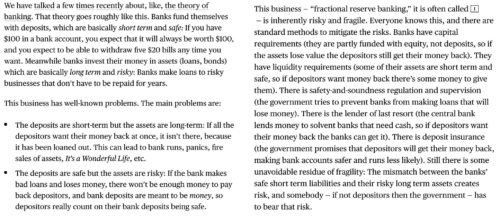

But, if we probe beneath the surface, the populist question betrays ignorance of how fractional reserve banking works and why that makes banking different from any other industry.

Banks take deposits from the public and make loans to individuals and companies. Deposits are repayable on demand whereas loans have a fairly long tenor.

In other words, banks borrow short and lend long. This makes banking inherently risky and fragile.

The model works because it is backed by the promise that the central bank will be the lender of last resort to banks if they face liquidity issues triggered by a mismatch in asset and liability duration.

No other industry operates with such a foundational risk. Therefore, no other industry is backed by such a foundational promise.

That is why only banks get loans from the government.

(That said, a part of TARP was also extended to the automobile industry when it went through troubled times. I don’t know how that happened but it did.)

There are a few other factors that ensure the stability of the banking industry like deposit insurance and capital adequacy rules. More in the Money Stuff newsletter dated 20 April 2023 by Matt Levine.

#3. DIF is backed by banks

When the Federal Deposit Insurance Corporation takes over a troubled bank, it sells the bank’s assets and pays insured depositors (and other creditors). If the funds realized from the sale don’t suffice, FDIC accesses funds from its so-called Deposit Insurance Fund to make insured depositors whole.

When the Federal Deposit Insurance Corporation takes over a troubled bank, it sells the bank’s assets and pays insured depositors (and other creditors). If the funds realized from the sale don’t suffice, FDIC accesses funds from its so-called Deposit Insurance Fund to make insured depositors whole.

DIF is fully backed by banks. Contrary to what the Average Joe thinks, the fund does not receive any contributions from the government or the taxpayer.

So, whether DIF took a $2B or $20B hit while rescuing a failed bank should not concern the man on the street. All that matters to him is that he did not take any beating in the process.

On a related note, FDIC also made uninsured depositors whole when Washington Mutual, Silicon Valley Bank and Signature Bank failed. In what’s probably the only case of not all depositors being made whole since FDIC was created on the back of the Great Depression of 1929, uninsured depositors of IndyMac lost $2.6B.

#4. FDIC is fully funded by banks

Banks not only fund the Deposit Insurance Fund but bear all costs of FDIC. As a result, while FDIC is a US federal government agency, it does not receive any money from the government / taxpayer.

As Warren Buffet highlights in the Bloomberg article entitled Buffett Says More Bank Failures Are Likely But Depositors Are Safe:

The public has the impression the FDIC is the US government. But the costs of the FDIC, including the cost of their employees and everything, are borne by the banks.

It’s understood that, being a government agency, FDIC bestows confidence upon the fractional reserve banking system. It also suggests that the government will print dollar bills to prevent / resolve a full-blown systemic banking crisis. However, in actual practice, “banks have never cost the federal government a dime”, as Buffet reminds Bloomberg.

Is First Republic Bank an exception or has Warren Buffet's prediction aged well? pic.twitter.com/BDKaHvQe5a

— Ketharaman Swaminathan (@s_ketharaman) April 26, 2023

#5. Banks pay premium even on uninsured deposits

When VCs and startup founders demanded that uninsured depositors in Silicon Valley Bank must be made whole, Business Insider chided them thusly:

As Silicon Valley Bank went down the tubes, it wasn’t surprising that the loudest mouths in Techworld started demanding that the federal government cover everyone’s losses. When capitalism goes kersplat, even the most libertarian Peter Thiel adherents turn into New Dealers. Sure, they like to mock colleges as “woke madrassas” and condemn student-loan forgiveness as a moral hazard. But when it’s their money on the line, they’re all for privatizing the profits and socializing the losses. It’s a robber-baron classic.

The woke madrassa completely misses a basic fact of deposit insurance: Banks pay premium to Deposit Insurance Fund on their entire deposit base, comprising insured and uninsured accounts (H/T @patio11).

A bank pays assessments on its total liabilities, not just insured deposits (Source: FDIC)

Therefore there’s nothing hypocritical about the Silicon Valley satraps’ demand for protection of funds above $250,000 – they’re only asking what’s paid for.

Far from socializing losses, banks actually helped the taxpayer profit off of their bank bailout packages.

Then there’s the “subsidy from Capitalism to the taxpayer”:

We also want the deposit insurance fund to be adequately capitalized to avoid taxpayers needing to backstop it. This relies on charging large depositors insurance premiums and then… not insuring them. That is a subsidy from Capitalism, Inc. to the taxpayer mediated through the banking system in times of crisis. “No bailouts with taxpayer money!” is an appealing slogan for many politicians. I could go either way on it, but I cannot remember any bills proposed to refund insurance premiums charged for uninsured deposits. – Deposit Insurance Maximization As A Service by Patrick McKenzie (@patio11).

The real meme, therefore, is “banks socialize both profits and losses”.

While on the topic, the public tends to forget that shareholders of the banks taken over by FDIC got completely wiped out.

So the real target of the ire against bank bailout – Joe and Jane Public shareholders – did not get bailed out. (I don’t know the fate of suppliers of these banks. If readers have some insights, please share in the comments below.)

While the US regional banking crisis was brewing in March, there was another meme going around in India that USA should outsource regulation of its banking industry to RBI.

Let me take this opportunity to call BS on that as well.

The traditional business of the banking industry is lending. (That’s why the media often uses the terms banks and lenders interchangeably.) Let’s see how that’s faring in India.

There are just 80 million credit cards in the hands of 35 million unique people in a population of 1.4 billion. Lending to SMEs is also extremely underpenetrated.

On the other hand, credit card has a penetration of 300% in USA and there are plenty of sources of capital for SMEs in USA.

Net net, in the core business of lending, India in 2023 resembles USA in circa 1950s.

This presents a huge headroom for banking in India to grow on the back of the soup-and-nuts lending business. That’s not the case in USA, where traditional sources of growth are exhausted long ago and banks must necessarily venture into newer and risky businesses like startup funding and structured financial products to drive growth. (This is really a reflection of the difference between emerging and advanced market dynamics that we see in many industries apart from banking / lending.)

Accordingly, RBI can take a conservative approach to banking, airdrop tried-and-tested foreign regulations (e.g. Basel-III) to ensure prudent lending in India, restrict the Indian banking industry to its traditional lending lanes, and even come up with business-killing regulations from time to time (e.g. Regulation Emandate) – and the Indian banking industry will still enjoy high growth with relatively low risk. Needless to say, that kind of regulatory framework will kill banking in USA.

Coming to the related matter of ensuring stability of banks, let’s see how RBI has fared here.

@pvsubramanyam: Our banks are safe. No, not because RBI is monitoring them well. It is just that PSU banks are guaranteed by the President of India. If that ‘guarantee’ is withdrawn, there will be a run on many of them.

This guy may be overly alarmist but it’s no secret that many public sector banks have unhealthy balance sheets and are probably kept afloat only because they’re owned by the government and therefore enjoy sovereign guarantee. (For the uninitiated, 70% of banks in India are state-owned.)

To really appreciate RBI’s track record on ensuring stability of Indian banks, we need to study lenders that don’t enjoy sovereign guarantee: RBI couldn’t stop scores of them from failing e.g. YES Bank, PMC Bank, and IL&FS, to cite just one example each of a Private Sector Bank, Cooperative Bank and Non Banking Finance Company respectively. Let’s see what happened to their customers when these lenders failed:

- Depositors of YES Bank could not access their funds for weeks even though RBI managed to rescue the bank with the support of State Bank of India and other healthy banks

- The fate of depositors in PMC Bank is still hanging in balance many years after the bank failed

- Creditors of IL&FS lost money with no hope for recovery.

Contrast this with US regulators who were able to restore full account access to insured and uninsured depositors of Silicon Valley Bank and Signature Bank over a weekend.

No, siree, USA should not outsource regulation of its banking industry to RBI.

If anything, RBI can learn a lesson from US regulators on how to establish and operate the equivalent of DIF under its deposit insurance subsidiary Deposit Insurance and Credit Guarantee Corporation. Going by the long delays suffered by depositors of failed Indian banks to recover their money, it’d appear that DICGC does not have a prefunded facility that it can access immediately.