This blog post features ten more contradictions / ironies / disconnects aka #GoFigure.

1.

There are tons of free credit cards with rewards, deferred payment, fraud protection, etc. Debit card offers none of these benefits but every one of them has fees attached to it.

Still there are 10X more debit cards than credit cards in India, a market that’s supposed to be very cost-conscious.

I know credit card is a privilege whereas everybody with a bank account is entitled to a debit card but my nuanced point is that, banks are required to issue an ATM card free of cost but every bank I know – including public sector banks – issues a debit card at a charge when I’ve asked for an ATM card and somehow their customers move on, as though there’s nothing to see here.

2.

Regulators urge fintechs to go ye forth and democratize lending in order to boost financial inclusion.

The same regulators blame BNPL fintechs for irresponsible lending and pushing the vulnerable sections of society into debt trap.

(We’ve seen the same contradiction with virtually every form of non-traditional credit product in the past, including payday loan and online P2P lending. All of them were initially hailed as panacea for the acute problem of low credit penetration but were later reviled as predatory lending products.)

3.

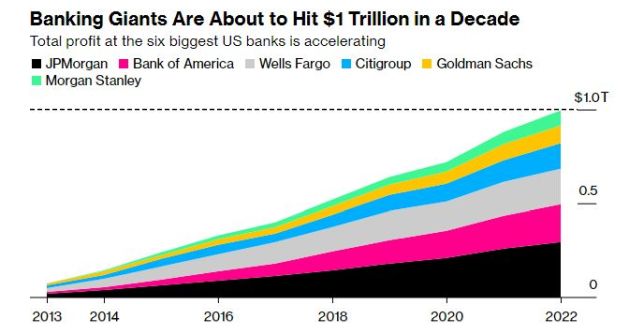

Top 6 US banks earn one trillion dollars in profits in the last 10 years. Top 6 US fintechs don’t earn anywhere near one trillion dollars even in revenues, let alone profits.

Still some finsurgents tell banks to learn how to run their business from fintechs.

4.

Sequoia Capital and Index Ventures took down embarrassing references to their very worst investments: FTX, once championed by Sequoia, and Fast, backed by Index.

Blockchain Immutability for others. Delete command for us.

5.

After the implosion of FTX, a centralized exchange, Crypto Maxis shilled Uniswap and other decentralized crypto exchanges.

But traders are just taking their business to other *centralized* exchanges.

6.

When you had $46 trillion GDP, you couldn’t protect yourself from getting looted by a bunch of ragtag traders.

But, when you have $3.5 trillion GDP, you’ll reclaim your losses from a superpower.

7.

Tesla, Intel, et al planning to pull out manufacturing from China due to Covid lockdown in Shanghai, Shenzhen, etc.

FDI in China jumped 26%.

Exhibit A: Supply Chain diversification is wishful thinking – fashionable to talk about but hard to implement.

8.

Either you see ads or you buy a subscription, right?

Nope. Even a paid subscription has ads.

9.

People: We hate ads.

Also people: 18% of American households used a free, ad-supported TV (FAST) service in 2021, which was up 125% from the corresponding figure (8%) in 2020.

10.

ZOOM:

Revenue up 5X. Operating Margin percentage up 7X.

Stock down 4.5X from peak.

Exhibit A: Stock price is driven way more by liquidity, FOMO / BAAP, sentiment and other extrinsic factors than intrinsic factors like revenue and profit.

In fact, Renaissance Technologies has become the world’s fourth largest hedge fund by betting on the thesis that stock prices form a number series – just like other physical variables – and are completely detached from fundamentals.