If you sell to a business, you’re B2B.

If you sell to a consumer, you’re B2C.

That much is clear.

According to the popular narrative, if you sell to a business, which sells to a consumer, you’re B2B2C.

That’s not correct.

The true B2B2C is when

Your company sells a product / service to a business, gaining customers and / or data from that business that you get to keep and use. And where, most importantly, that group of customers becomes untethered from the middle B – at some point, they recognize that YOU (the first B!) are the product they use.

– “On B2B2C Business Models” by Alex Rampbell @a16z

The key to being a B2B2C is the ability of the first Business to eventually own the Consumer of the second Business as though it were its own Consumer.

Alex Rampbell gives Affirm-Casper as an example of a true B2B2C.

Let’s unpack this example.

Casper is a D2C mattress brand that sells fairly expensive mattresses directly to consumers.

The Average Jane Consumer may not have ready cash to buy such expensive mattresses. Casper might lose the sale if it does not offer credit.

But credit is a different business from mattress and involves complex and unpleasant activities like underwriting, chasing up for repayments.

What does Casper do?

It partners with a pureplay (BNPL) credit brand like Affirm and offers credit at the POS to make the sale happen.

Being a pureplay consumer brand, Casper will not want to get its hands dirty in collection of the loan. Therefore, at some point, Casper will connect Affirm and Jane to each other. At this stage, Affirm will acquire the Consumer of Casper as its own Consumer. During the process of servicing of the loan, Affirms obtains Jane’s PII and other information and Jane learns about Affirm. This sets up a direct relationship between Jane and Affirm.

In parallel, Affirm acquires another client, say, Away, a leading luggage D2C company.

During the course of Affirm’s continous engagement with Jane, Jane could learn about Away. This enables Affirm to deliver a new consumer to Away.

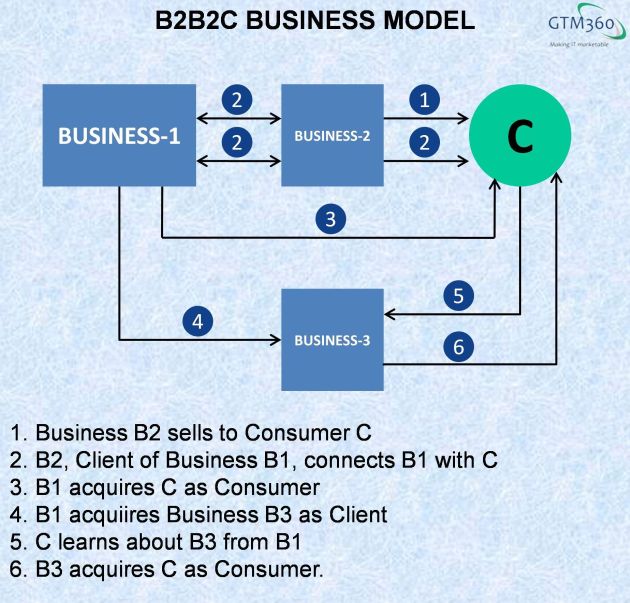

This model is illustrated in the following exhibit.

Affirm-Casper is a canonical example of a business model that fulfills the above definition of B2B2C, where

B1 = Affirm

B2 = Casper

B3 = Away

C = Average Jane Consumer.

Some experts use the term Embedded Finance in the above context since the financial product (credit in the case of Affirm) is not sold directly to the consumer by its “manufacturer” (Affirm) but is embedded into the workflow of purchase of a non-financial product (mattress in the case of Casper).

Just to be clear, the lender in question can alternately sell its loan product directly to the consumer without going through the non-finance company, in which case it would function as a normal B2C business.

Let’s compare this with another example from the article: Hilton-Expedia.

Jane books a hotel room at a Hilton property on Expedia’s website. This is not B2B2C since the product that Jane is buying from Expedia is owned by Hilton, and Expedia does not acquire Jane via Hilton (actually Jane is already a consumer of the B2C business Expedia). Expedia is only the distributor of the product “manufactured” by Hilton. So, while this is a classical example of indirect distribution, it’s not B2B2C.

In a true B2B2C business model, you have a product, which you sell to another business, which adds a different product of its own to your product and sells the bundle to its consumers, who then become your consumer, and, from there, consumer of your other clients.