In Credit Card Best Practices – Part 1, I argued that whether credit card is boon or bane is shaped by whether you use it or let yourself get used by it. I then outlined five best practices for using credit card in a way that it serves the cardholder’s interest.

In this second part, I will describe five more best practices towards the same pursuit.

#6. Avoid credit card debt

When I got my first credit card 30+ years ago, my family, friends and coworkers exhorted me never to revolve my outstandings from one month to another i.e. always to pay off my full balance every month. To follow that advice, it meant that I had to have enough money in my bank account when the payment fell due.

When you spend with credit card, you commit to the expense on Day 1, come to grips with it when you get the credit card statement on Day 45, and face the final day of reckoning on Day 60 when you need to pay the bill. (Which is unlike cash, cheque, debit card or A2A / UPI, where all three events occur simultaneously on Day 1.)

This is a long gap. If you lose track, you might spend the money on something else. If that happens, you may not have enough money in your bank account to pay your credit card bill in full on the deadline. This means you’ll be forced to make a partial payment – or, gasp, minimum payment – which sets you up to fall into a debt trap.

Credit card debt is full of gotchas and can prove to be a slippery slope.

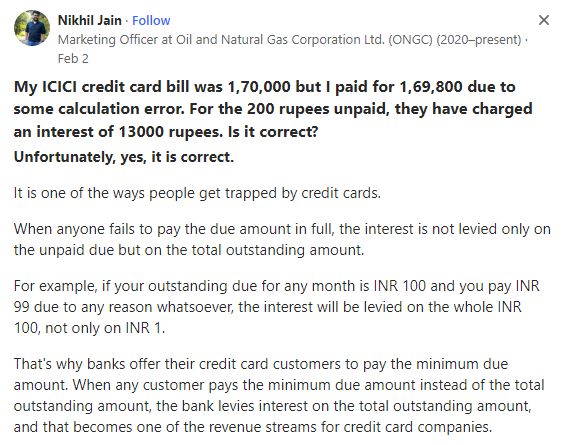

For example, the average credit cardholder does not realize that banks levy interest on the entire outstanding amount in the case of partial payment. This creates a massive debt trap. See the following exhibit of a Q&A from Quora to understand the gravity of this situation:

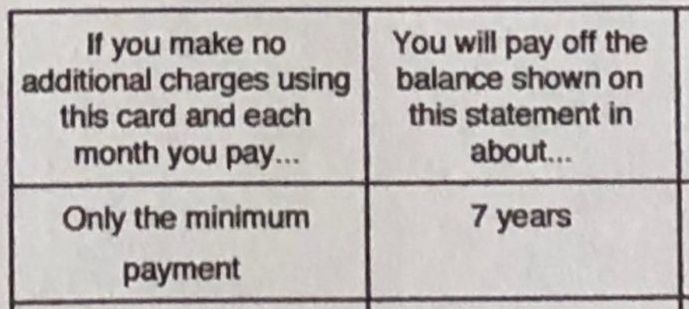

As banks warn you, it will take years to clear your debts if you make only the minimum payment.

Therefore, you should avoid falling into credit card debt trap.

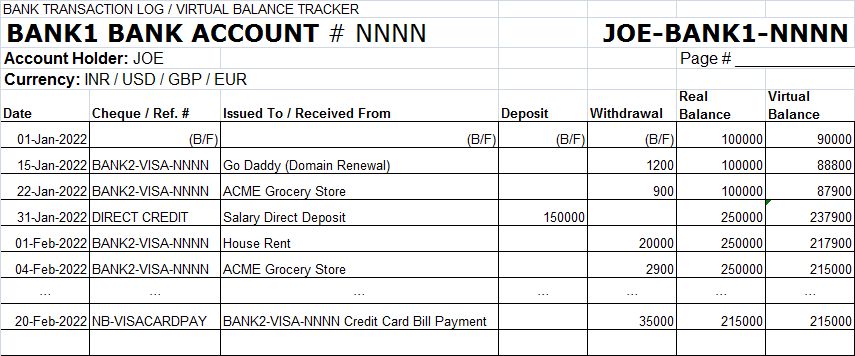

Towards this endeavor, I created what I call a Bank Transaction Log, which is illustrated in the following exhibit:

(Click here to download this template as Excel file (XLSX, 11 KB) for your use.)

As soon as I swipe / dip / tap my credit card, I make an entry in the BTL and deduct the charge from the real bank balance and arrive at the virtual bank balance. I track the virtual balance closely and ensure that it never falls below a preset floor (above zero). This way, I will always have enough money in my bank account to pay the credit card bill on its due date. That’s how I escape the dreaded debt trap.

I started tracking virtual balances right from the time I got my first credit card in the late 80s. At the time, while office computers and spreadsheets were fairly common, home computers were rare, and smartphones and Internet were non-existent. As a result, my tracker was paper-based.

Now there are many Personal Finance Management (PFM) websites and Mobile Money Management Apps (MoMMA) that support virtual balance tracking / “Safe to Spend” feature. I don’t use any of them since I’m not comfortable about handing over my online banking credentials to third parties.

But I continue to use my paper tracker to this day. And I’m happy that it has served its purpose – not once in 30+ years of using my credit cards have I ever busted my bank balance and committed the deadly sin of revolving my credit card outstandings.

The collateral benefit of my tracker is to spot scammy charges. I tally entries on my credit card statement with those in my tracker. I flesh out mismatched entries as potential scam charges and report them to the credit card company.

The collateral benefit of my tracker is to spot scammy charges. I tally entries on my credit card statement with those in my tracker. I flesh out mismatched entries as potential scam charges and report them to the credit card company.

BillGuard is one app I know that uses crowdsourced technology to detect and report scammy charges on a credit card statement.

Given below are explanations of BTL entries:

- Joe is the name of the credit cardholder.

- Joe’s Visa credit card is denoted as BANK2-VISA-NNNN, where BANK2 = Bank that has issued this Visa credit card to Joe and NNNN are the last four digits of this credit card.

- Joe has a bank account NNNN at BANK1 Bank i.e. JOE-BANK1-NNNN, from which he pays his credit card bill. Note that BANK1 and BANK2 need not be the same bank.

- As an when Joe uses his credit card, he makes an entry on this BTL e.g. On 22 Jan 2022, Joe bought groceries worth 900 from a grocery store called Acme Grocery Store. He immediately deducts the Virtual Balance by like amount, while leaving the Real Balance unchanged (since the money has not left his bank account).

- On 31 Jan 2022, Joe receives his salary of 150000 by direct deposit to this bank account. This will lead to like increase in both Real Balance and Virtual Balance.

- Joe pays his credit card bill on 20 Feb 2022 by way of Visa Card Pay feature on the Internet Banking of BANK1, denoted as NB-VISACARDPAY. This transaction leads a deduction of like amount of the Real Balance (since money leaves his bank account) but no change in Virtual Balance (since Joe has already deducted all the charges in his credit card statement as on the date he incurred them).

#7. Track SMS Alerts

In some jurisdictions like India, by law banks must send an SMS alert whenever a credit card is swiped / dipped / tapped. In others, it’s possible to get them for a nominal fee e.g. £5 / month from my bank in UK.

Track these alerts closely. If you notice any suspicious charges, don’t panic. Credit card is a cash substitute, so it’s meant to be as easy to use as cash, so unauthorized use may happen occasionally.

Contact your credit card company immediately and raise a dispute / chargeback. According to credit card network rules, credit card is a revocable method of payment, so the bank must reverse the charge.

(Unlike payments made with UPI India, FPS UK and Zelle USA – banks will not reverse them since they’re irrevocable A2A methods of payment.)

In some countries like USA, the bank will reverse the charge immediately, follow up with merchant in the background, come back and redebit your account if it can prove you made the transaction.

In others like India, which use 2FA for credit card payments, the bank will pushback on the credit cardholder, saying “only you know PIN / OTP, so you only must have made the payment”. But don’t accept this argument because stolen credit card information can always be used to make purchases outside India without PIN / OTP. Keep pushing back. According to credit card rules set by Visa and MasterCard for the whole world, in the event of a dispute, it’s the bank’s responsibility to prove that you made the transaction, not yours to prove that you didn’t.

This is a standard feature of credit cards. Amex is able to tout it as a USP b/c banks have kept it under wraps in India. pic.twitter.com/RxEFAoU81j

— Ketharaman Swaminathan (@s_ketharaman) March 23, 2017

On a side note, if you pay for something with a credit card and the product does not work as advertised, you can still claim a refund from your credit card company on the grounds of “deficiency in service”.

#8. Fight surcharge

Some unscrupulous merchants tack on an extra charge if you pay them with credit card. Called surcharge, it negates the monetary benefits of almost all credit cards. Therefore, never pay surcharge.

In many instances, you can avoid the surcharge by routing the credit card payment through an intermediate PSP. For example, if I pay my electric bill on the utility company’s website with a credit card, I face surcharge. However, if I use my go-to PSP PayZapp to pay the same bill with the same credit card on file, there’s no surcharge. In addition, I earn cashback for using the PSP’s app. This is one of those cases where middleman lowers cost. #GoFigure.

If such an intermediate PSP is not available to skirt surcharge (and earn cashbacks!), try the tips given in How To Fight Surcharge And Take #CashlessIndia To Next Level to pushback against surcharge.

#9. Have 2-3 credit cards

Have two or three credit cards. They can serve as backup in case of technical and other reasons due to which first card might get declined. After RBI Emandate came into effect on 1 October 2022, I discovered that one of my three credit cards still supports international recurring payments, so I didn’t have a problem when the other two stopped working for this usage scenario.

Multiple credit cards can also serve as additional source of funds in the case of, say, medical emergencies.

(In USA, it’s not abnormal for people to have 10-15 credit cards.)

A credit card is a Line of Credit from your bank. Indulge yourselves, but responsibly. As someone said, “What’s the point of having f**k you money if you never say f**k you?”

#10. Use cash advance strategically

Most credit cards allow you to withdraw cash from ATMs.

Cash advances are treated as loans and attract hefty fees and exorbitant interest charges. Avoid them except when you can find a strong business case for using this facility strategically. Like I could many years ago.

The tax year end was fast approaching. I wanted to open a Public Provident Fund account (India’s equivalent of pension) to save income tax. I didn’t have the spare cash. I took a cash advance on my credit card and used that money to fund the PPF account opening. I paid the outstanding in full the next month. Of course, I incurred exorbitant interest charges. But the amount of tax I saved was 5X the amount of interest I paid. I don’t think I’ve ever achieved such a high ROI on any other “investment” in my life.

Then there are legends about Silicon Valley unicorns whose founders raised seed capital by maxing out their 15 credit cards!

It might seem like a lot of effort to follow 10 best practices to make effective use of credit card. But, if my experience is anything to go by, you will internalize most of them within a month or two of using credit cards.

Until then, simply follow best practice #6. That alone will make sure that you are better off using a credit card compared to any other method of payment.