After I published Shattering The Myth Of Lack Of Space, a couple of readers who are familiar with the locales covered in the post reached out to me with several interesting questions. One of them is Rajeev Jog, my fellow alum from IIT Bombay. The other would like to remain anonymous.

I’ve already responded to them via email. Since I thought our convo would be of interest to everyone, I’m posting a lightly edited version of our Q & A below.

Q1: Canary Wharf is only one part of London, most of the rest is about as high rise (or less!) than Mumbai

A: Canary Wharf is pretty much the only CBD left in London nowadays. While many new office buildings have cropped up in and around Tower of London and Shoreditch neighborhoods in the last few years, they do happen to be highrises.

Q2: I don’t know the exact numbers but very tall buildings cost more to build than merely tall buildings (on a per square feet basis).

Yes, I’ve heard that too but funding is not such a big constraint in India nowadays. The same Real Estate PE funds that finance the highrise buildings in USA, Dubai, Singapore, etc. are also active in India. Blackstone, the US PE firm that is the largest owner of real estate in the world, is also the largest owner of (Commercial) Real Estate in India and owns, among others, the iconic Express Towers office building in Nariman Point, Mumbai.

Q3: I don’t have the numbers to back this up but I think the amount of available PUBLIC open space in either NYC or London is far more than Mumbai.

A: Having visited Central Park in NYC and Regents Park (and many other parks) in London, I see where you’re coming from. But have you considered Borivali National Park aka Sanjay Gandhi National Park in your calculations? Because, until recently, I didn’t.

People don’t normally look up maps of the city in which they have grown up. Accordingly, I had never seen Mumbai’s map.

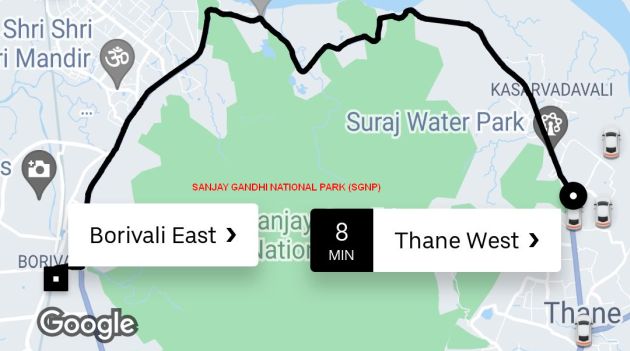

That changed recently when I took a Uber between Thane and Borivali. (For the uninitiated, Thane is an Eastern suburb and Borivali is a Western suburb of Mumbai.) The app displayed the following route:

As you can see, it’s very round about.

I noticed that Sanjay Gandhi National Park comes on the as the crow flies route between Thane and Borivali. Being a wildlife preserve, automobiles are not permitted to drive through SGNP. Ergo the road needs to go around the park and is very circuitous.

Back in the day, Greater Mumbai ended at Borivali, so much of SGNP was situated outside the city limits. Whereas we now talk of Metropolitan Mumbai, which stretches up to Vasai on West and Thane / Panvel on the East, so SGNP is entirely within Mumbai.

While I’ve not been to Sanjay Gandhi National Park, I reckon from a glance at the Google Maps exhibit on the right that the open space provided by the park should amount to 20-25% of the land mass of Metropolitan Mumbai. From my visits to New York City and London, that might be comparable with – if not greater than – the open space provided by Central Park etc. and Regents Part etc. to those two cities respectively.

On a side note, I sometimes feel that so much open space is a luxury and keep craving for a road cutting through Sanjay Gandhi National Park. Today, you need to drive 20 kms on Ghodbunder Road to get from Thane to Borivali. If my dream road became reality, it would cut down the distance between the two areas to seven kms. This will not only save a lot of time but also slash the fuel consumption and the ensuing pollution. The new road will certainly cause pollution inside the wildlife preserve but that would be more than offset by the reduced pollution on the current Ghodbunder Road route.

Lest this sound too farfetched, there was indeed a plan in the early 80s to build a road through SGNP between Mulund (adjacent to Thane) and Goregaon (adjacent to Borivali). When I recently went for a meeting in a building situated at the end of Dindoshi Road in Goregaon East, all I saw of the proposed Goregaon Mulund Link Road was the 40 year-old sign announcing the imminent start of its construction:). I’m guessing the woke brigade killed this road construction project.

Q4: My latest blog post has your favorite topics Bombay, Manhattan, Civil Engineering and Conspiracy Theory. Keen to know your thoughts?

(I asked this question to the anonymous friend, who is a Civil Engineer from my alma mater IIT Bombay and a long time resident of Manhattan. The reference to the conspiracy theory was a nod to my speculation about the origin of the myth of lack of space in my original post.)

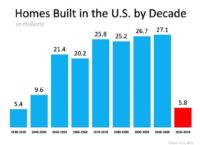

A: Probably no conspiracy theory involved. In Housing Inventory March 7th Update: Inventory Down 1.4% Week-over-week; New Record Low; Possible Bottom, the author of one of the top residential real estate blogs in USA is saying it’s pretty much an issue of strong demand and shortage of supply (caused by pandemic disruptions to supply chains). Even as the disruptions have eased, property developers are in no rush to build / complete new homes because that will increase supply and drive the prices down. House prices went up by 20% last year, why spoil the party?🙂.

A: Probably no conspiracy theory involved. In Housing Inventory March 7th Update: Inventory Down 1.4% Week-over-week; New Record Low; Possible Bottom, the author of one of the top residential real estate blogs in USA is saying it’s pretty much an issue of strong demand and shortage of supply (caused by pandemic disruptions to supply chains). Even as the disruptions have eased, property developers are in no rush to build / complete new homes because that will increase supply and drive the prices down. House prices went up by 20% last year, why spoil the party?🙂.

Q5: Why spoil the party?

“Spoil the party” is a fascinating notion of Supplier Behavior.

Back in 2009, I wrote a blog post about how competition in a free market capitalism will keep prices in check but not necessarily in a band that consumers would perceive as “reasonable”. In other words, even when there’s heavy competition, suppliers won’t spoil the party by cutting prices in a race to the bottom. That post was in the context of exorbitant data charges levied by Mobile Network Operators.

Since then, Reliance Jio has spoiled the party by launching its mobile Internet service at 10X lower price than competition.

On the other hand, no existing or new player has upended prices in the Residential Real Estate – or even Commercial Real Estate – industry. Even when thousands of apartments lie unsold, I have not come across a single builder who has spoiled the party by cutting prices too deeply. The protagonist in Salman Rushdie’s recent novel entitled The Golden House is a real estate magnate who tried doing just that. Of course it’s a work of fiction but the said magnate receives death threats and is forced to flee his home city overnight and seek exile in NYC. You can find my review of this book here.

Then there are other examples where nobody has spoiled the party despite huge competition.

Credit Card MDR. Merchant Discount Rate (MDR), or the fees charged by banks to let merchants accept credit card, has hovered in the 2-3% band during the entire 60 year existence of credit card industry. This is despite the fact that there are hundreds of acquirer banks and perpetual complaints from thousands of merchants that credit card fees are exorbitant. Many senior bankers I’ve asked insist that individual banks do have a wide latitude in setting MDR, so the 2-3% band is not because of price fixing by Visa / MasterCard duopoly, as is commonly alleged. Also credit card APR, in which Visa and MasterCard play no role, has hovered in the 24-36% p.a range during the period when interest rates have fallen from 15% to nearly 0%. Interestingly, even Jeff Bezos of the “your margin is my opportunity” fame hasn’t spoiled this party – Amazon credit cards have pretty much the same MDR and APR as other credit cards in the market.

I've been waiting for years for a fintech to build an alternative payment – or even credit card – with 2X Rewards and 0.5X MDR of Visa / MasterCard credit card.https://t.co/IHXWQIwcnv

— Ketharaman Swaminathan (@s_ketharaman) March 8, 2022

Overdraft Protection Fee. This is the fee levied by banks on customers who overdraw their checking accounts. Most US banks seem to charge $35 per overdraft (Source: The Financial Brand) despite the fact that (a) the fee is set by individual banks, and there are 4500 of them in USA (b) there’s constant outrage by consumer advocates that this fee is a big ripoff. See Overdraft Protection – Another Hot Opportunity For BPOs? for more details of ODP.

Overdraft Protection Fee. This is the fee levied by banks on customers who overdraw their checking accounts. Most US banks seem to charge $35 per overdraft (Source: The Financial Brand) despite the fact that (a) the fee is set by individual banks, and there are 4500 of them in USA (b) there’s constant outrage by consumer advocates that this fee is a big ripoff. See Overdraft Protection – Another Hot Opportunity For BPOs? for more details of ODP.

I’ve not come across any research or anecdata that deep dive into the conditions under which a market player will spoil the party versus won’t spoil the party. If readers are aware of any, please share in the comments below. Thanks in advance.