On the one hand, there are people who think credit card is one of the greatest inventions of mankind.

On the other hand, there are people who think credit card is a weapon of mass financial destruction.

Maximalists put as many of their spends on credit card as possible.

Haters shun credit card like the plague.

I’ve rarely come across a product or service that’s as polarizing as credit card.

As regular readers of this blog and my social media posts may have sensed, I’m a Credit Card Maxi. Ever since I got my first credit card in the late 1980s, it has been my go-to method of payment.

Credit card allows a random guy to pick up stuff from a store shelf and leave the store without paying for it even though the retailer doesn’t know this guy from Adam. Accordingly, it engenders trust and enables commerce like no other tool.

For the cardholder, credit card showers compelling value in the form of:

- Float from deferred payment

- Rewards

- Fraud protection

- Redressal against fraud

- Credit history

Ergo, I consider credit card to be one of the greatest products of all times. (Cash comes close but is inconvenient to carry and entails the risk of theft especially in dodgy neighborhoods.)

But I know that there are people who make purchases on credit card, revolve their outstandings from one month to another, get hit by exorbitant – but legally permitted – interest rates (aka APR), and fall into a debt trap. Not surprisingly, they dunk on credit cards.

What gives?

I think a person’s perspective on credit card is shaped by how they use it.

Maxis use credit card whereas Haters get used by credit card.

Transactors: People who pay their credit card bills in full every month.

Revolvers: People who carry forward their credit card outstandings from one month to another. https://t.co/LEgyinK4qV . #CapitalOne #SecuredCreditCard— Ketharaman Swaminathan (@s_ketharaman) November 1, 2019

Over time, I have devised a few best practices for using credit card to my advantage. I will share them in this and a follow-on post. Let’s get on with it. (DISCLAIMER: Nothing in this blog post is financial or legal advice.)

#1. Put everything on credit card

Put all your spends on credit card so that you can maximize your rewards earnings. In addition, you will get the other benefits of credit card mentioned earlier.

Put all your spends on credit card so that you can maximize your rewards earnings. In addition, you will get the other benefits of credit card mentioned earlier.

A big ticket expense that can be moved to credit card is house rent. While landlords can’t / won’t accept credit card, there are many third party startups who will accept a credit card payment from the tenant and transfer the amount to the landlord via bank transfer e.g. CRED, MagicBricks, NoBroker, RedGirraffe, et al. But beware of 1-2% surcharge slapped by many of these startups for this service. When I last checked, the Surcharge v. Rewards math sucked on my existing credit cards. But there are other credit cards on which the calculus could be favorable.

You don’t have the right CC to milk this @amuldotexe . Even with ~500 charge on 33k rent I pay , I get 2-3 % as points which make up for the charge if not spare me a 100-200 . And I get to fill my high yearly spend limit easily n then get free renewal n other perks with it .

— tarun.meth (@harMaal10) February 20, 2022

The landlord will lose the security provided by Post Dated Cheque but will be saved the trouble of having to go to the bank to deposit the PDC every month.

#2. Don’t use credit card online

As far as possible, don’t use your credit card for online payments, especially in a two factor authentication regime like India. 2FA might appear safe at first blush but it creates tremendous friction and introduces a high risk of payment failure. If a payment fails, it’s quite painful to get the transaction reversed.

But still follow best practice #1 while shopping online as follows: Select Pay on Delivery as the mode of payment while checking out on the ecommerce website. When your consignment reaches your doorstep, pay for it with a credit card.

This also has another advantage, namely, you can be sure of receiving your stuff without having to chase the delivery agent. More at Why COD Still Rules Ecommerce In India.

You have no clue: It has nothing to do with City / Bharat.

Smart people select COD / POD, delivery agent chases them.

Dumb people drink Kool-Aid of digital payments and they chase delivery agent. https://t.co/r3Y2F9b0AR— Ketharaman Swaminathan (@s_ketharaman) April 4, 2022

#3. Never miss a due date

You already get 15-45 day credit with a credit card. Don’t push your luck. Pay your bill 7-10 days before the deadline. This way, even if the payment fails, you will still have enough time to re-initiate another payment before the deadline lapses. To ensure that you don’t miss the due date, set up a calendar reminder on your phone or PC.

#4. Insist on paper statement

Depending on the bank and / or jurisdiction, eStatements for credit card can be very convenient or extremely painful.

If it’s convenient, you might ignore the eStatement, as WSJ points out:

Paying your bills with a swipe can be simple. But the convenience of technology could also make you passive about your finances.

If it’s painful – I’m looking at passphrases and passwords required to open the eStatement – you might not open the damn thing in the first place. If you get past that stage, you could miss double debits and fake / hidden charges.

eStatement for credit card, bank account, etc. is a terrible Dark Pattern. PDF makes it easy to miss fake / hidden charges & hard to mark them for further action if you manage to notice them. It's even worse if the PDF is password protected.

— Ketharaman Swaminathan (@s_ketharaman) September 26, 2019

So, insist on paper statements. At least you will open it. If there’s something glaring, it will catch your eyes. You’ll easily be able to spot hidden charges and scammy entries (like the subscription you signed up for and forgot to cancel).

From their side, banks will promote eStatements for various reasons:

- Go Green

- eStatement is cheaper than paper statement

But, according to my pet conspiracy theory, the real reason is that bankers know that people don’t open eStatements or read them as thoroughly as paper statements. Accordingly, when they’re pushed eStatements, cardholders will miss the due date for payment, incur late payment fees, and miss dodgy charges, all of which are sources of mouth-watering revenues for credit card companies.

"US cardholders received over $14.3bn in deceptive & unwanted credit card & debit card charges. 1 in 3 American cardholders receives at least 1 grey charge of $215 each year." ~ BillGuard & Aite Group "Grey Charges" report, via https://t.co/kPBPkPgzD9

— Ketharaman Swaminathan (@s_ketharaman) November 24, 2019

So you should be ready for pushback from your bank when you insist on paper statements. In addition, you might even come under pressure from your greenwashed friends and family members for chopping trees.

But don’t budge. From personal experience, it’s worth fighting the good fight for paper statements.

In the worst case, if you have no choice but to live with eStatements, take a print out as soon as you open the eStatement, so that it becomes easier to process it. If you don’t have access to a printer, I recommend these ProTips:

- Visit smallpdf.com and unlock your eStatement so that you can open it in future without entering a passphrase / password.

- Download and install Adobe Acrobat Reader DC software. It’s free. It helps you highlight, annotate and save your changes to a PDF document. You can use it to mark suspicious charges on your eStatement.

#5. Redeem reward points

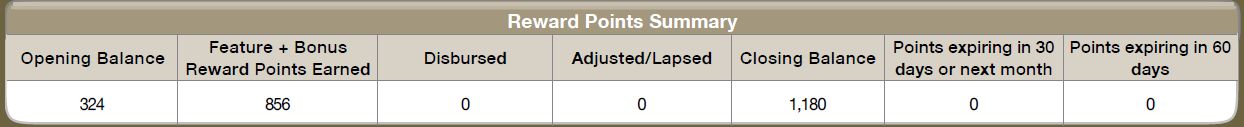

As you know, you get reward points for using your credit card. Make sure to redeem your rewards.

Most reward points lapse if they’re not redeemed in one or two years. Most statements will show a summary of reward points earned, redeemed and about to lapse. Have a quick glance at this section so that you’re on top of your redemptions and never let your rewards lapse.

After you place your redemption order for gift, you might have to chase up with the bank / courier to actually get your gift. More at Bank Insources Credit Card Reward Redemption Theft.

I will cover a few more best practices of credit card use in a follow-on post.

Stay tuned!