It has become a favorite pastime for a lot of people to predict the disruption of B2B sales. (Ditto banks, telcos, et al.)

Take the author of this LinkedIn post entitled Enterprise Sales Has Been Disrupted – Why Sales Pros Should Care for instance.

Like disruption talk in many other areas, this is a sureshot way to gain likes and followers on social networks – and lose revenues and profits in business.

In this post, we’ll debunk this disruption notion by taking two examples from B2B technology.

- Product A: Ticket size $995

- Service B: Ticket size $25000

Let’s get into it.

Product A: Ticket Size $995

Back in the day, Prospects would find this product via Yellow Pages. Today, they discover it on Google Search.

Then, prospects would call the Vendor’s Sales Rep after reading its Yellow Page listing. Now, they visit the Vendor’s website to gather more information by themselves without involving the Sales Rep.

Let’s look at the subsequent steps in the purchase journey.

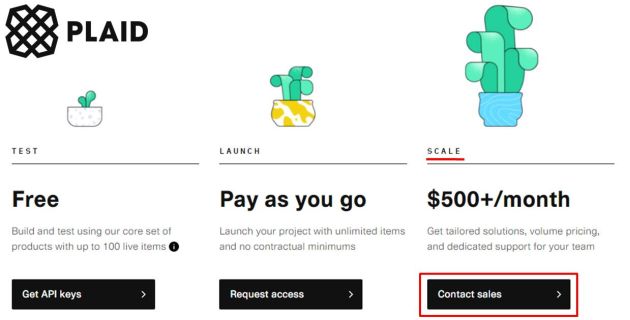

Then, prospects got a quote from Sales. Now, some prospects still expect sales to send them a quote. But many others are happy to look up pricing plans on the vendor’s website by themselves in the so-called “self-service” mode. But they might run into the growing practice of SAAS vendors not disclosing prices online and, instead, asking prospects to “Contact Sales” for a quote.

I can think of various reasons why vendors withhold pricing information from their websites:

- Product may involve integration with the prospects’ existing IT landscape, so it’s necessary for the vendor to know more about a given prospect’s situation before committing a fixed price

- Product may be complicated so vendor doesn’t want prospects to get confused with too much information on the website

- Premium pricing will need justification in the form of differentiators but the vendor does not want to open up all its cards on its website where they will be also visible to its competitors

- The vendor follows “continuous monetization” strategy and terms like “user” become too nuanced to explain on a website. As described by Software Pricing Partners, “continuous monetization is a pricing optimization technique in which B2B software companies continually optimize all aspects of how they license, package and price their products”. The technique is fueled by realtime usage data measured at the level of individual customers or even users within that customer. This reminds me of the half a dozen types of users for SAP S/4HANA Cloud, where the vendor can change the user type from one month to another based on the differing use of the cloud ERP by the same user between those months – and bill different rates accordingly.

- This is sales’ way of preserving its relevance in the face of dire predictions of massive loss of B2B sales jobs.

Whatever be the reason, the end result is the same: Even a prospect who is cool about self-service will need to contact sales for a quote.

Lest anybody think that it’s only the old and traditional companies who resort to this approach, even the new age startup Plaid uses the “Contact sales” button on its pricing page.

Once they get the quote, some prospects might place the order on the vendor’s website whereas others might prefer to talk to Sales before signing on the dotted line. There again, not all vendors accept orders on their websites. When I was evaluating graphic designers for my book cover on a popular freelancing website, I was surprised to find out that almost all of them wanted me to contact them before I placed the order. And that was for a ticket size of $25.

As we can see, technology has impacted steps in the early stages of the purchase journey but, when it comes to later stages, it plays a very limited role.

Inbound Marketing via Google Ads etc. tends to be quite effective for lead generation but sales reps – at least inside sales reps aka SDRs, if not field sales reps – are required for converting the lead to a deal.

Service B: Ticket Size $25000

Then and now, Prospects involve sales reps of shortlisted companies quite early in the purchase journey.

Then and now, cold call and cold email remains vendors’ top source of leads followed closely by referrals.

Contrary to what was predicted a few years ago, Inbound Marketing has not been such a big source of leads – neither in quality nor quantity. Anyone who has sold to enterprises would know that decision makers rarely do online research and reach out to vendors. As a result, most inbound leads are logged by interns in the prospect organization. No offence to hardworking interns but they lack influencing / championing / decision-making powers, so quality of inbound leads sucks. One of our customers has been carrying out high octane inbound marketing campaign for over two years. They averred that they haven’t booked a single order from a inbound lead during this period.

Then, cold calling and cold emailing around features and benefits were effective. Now, they’re not. But that does not mean that cold calls and cold emails have themselves stopped working. It just means that they need to be done differently. When it’s done by using ASPOs and other modern techniques, outbound marketing still contributes 80-90% of leads. See Use ASPO To Boost Cold Call Success Rates and Creating ASPO To Bolster Cold Call Success Rates for ways to make outbound marketing effective in the present day.

We must hasten to add that, for reasons highlighted in Don’t Let Your Competitors’ Inbound Marketing Steal Leads From Your Cold Calls, vendors shouldn’t abandon inbound marketing.

The best practice for leadgen is an integrated marketing campaign, where traditional outbound marketing tactics like cold calls and cold emails are supplemented by inbound marketing tactics like SEM, SMM, etc.

Then and now, to close a deal from a qualified lead, it requires somebody to case the joint, map power centers, cultivate relationships, elicit requirements, submit proposals, and conduct negotiations. That somebody is the sales rep.

The author of the aforementioned article quotes HBR statistics saying cold call does not work 90.9% of the time.

That sounds about right. But it also means that cold call does work 9.1% of the time.

Let’s compare that with the conversion rate of Google Ads, arguably the most effective inbound marketing tactic ever. The click thru’ rate (CTR) of a typical Google PPC ad is around 5%. Which means that, out of 100 people who see a Google Ad, five visit the advertiser’s website. Per anecdata, around 20% of website visitors perform a conversion event like a form fill. Therefore, the end-to-end conversion rate for Google Ads is around 1% (being 0.05*0.2).

Cold call: 9.1%. Google Ads: 1%.

Even ignoring the anecdata around the inferior quality of inbound leads, it’s amply clear that outbound marketing outperforms inbound marketing by ~10X.

Had this guy been familiar with these facts and figures, I’m betting that he wouldn’t have made a fool of himself in public by dunking on cold call.

There’s no doubt that technology has impacted B2B selling. In a recent study, we used a quantitative model to estimate that Internet Has Changed B2B Buying By 45 Percent.

There’s no doubt that technology has impacted B2B selling. In a recent study, we used a quantitative model to estimate that Internet Has Changed B2B Buying By 45 Percent.

As we saw in that blog post, bulk of that change has happened in the early stages of the buying process.

Sales reps are still actively involved in the later stages of the purchase journey. Sure, they use Zoom, Google Hangout, Microsoft Teams, Salesforce, and other digital selling tools.

But that’s nothing new: Sales reps have always used calculators, spreadsheets, Powerpoint (and Harvard Presentation Graphics before that) and other digital selling tools even in the past.

That means digital selling is aiding – not disrupting – B2B sales.

Bottomline: The use of technology has increased in B2B selling but digital selling tools are still used by human sales reps. That’s unlikely to change until digital twins, metaverse, and other futuristic digital technologies go mainstream. Ergo, for the forseeable future, all talk of disruption of B2B sales by technology is trash talk.