A few years ago, I had guided my retainer customers in the digital payments space on how to address imminent threats from identity theft and cyberfraud. More in In #CashlessIndia – Why Putting Cart Before Horse Will Work.

Cue to the present day.

The media is full of reports on frauds in UPI payments. As a result, the aforementioned concerns have come to the limelight.

No amount of security can prevent payment fraud when flawed app design meets gullible user. #UPIfraud pic.twitter.com/OdE4tgU7z1

— Ketharaman Swaminathan (@s_ketharaman) March 14, 2017

Pursuant to this spate of frauds, people are wondering if digital payments has any future amid threats from data breach, identity theft, and cyberfraud (collectively “fraud”). Take this question on Quora for example:

What is the future of digital payments in India amid continuous threat on data theft issues?

At various times in the history of business, people have asked similar questions about other products and services. For example:

- What is the future of computers amid threat of loss of jobs?

- What is the future of Concorde amid threat of noise pollution?

“Loss of jobs” and “noise pollution” are called second order effects.

Computerization has caused loss of jobs, still computers have flourished.

Concorde massively cut down the flying time from London to New York City from 5.5 hours to 3.5 hours. Even today, the Concorde’s Atlantic Crossing time has not been bested. Still Concorde shut down because it wasn’t able to overcome concerns around the noise pollution caused by its sonic boom.

None for same time, but here's one that's perhaps even beter: Concorde used to arrive in JFK before takeoff time in LHR:)

— Ketharaman Swaminathan (@s_ketharaman) October 12, 2019

Both Computers and Concorde are exhibits of innovation and progress. One overcame its second order effects and flourished. The other did not.

Why this disconnect?

Regulation and customer education are among the reasons advanced in public discourse.

But I believe the chief cause of the disconnect is Marketing.

Many products solve one old problem but introduce three new problems aka second order effects. But they’re still successful.

That’s because they leverage two consumer behavior attributes:

- Short attention span

- Overthinking is uncool

As Twitter user @sarthakgh pointed out in the context of the recent GameStop fracas, “second order thinking doesn’t make for good memes”. Wall Street Bets subredditors piled into the mall videogame company’s stocks and pushed up its price from $40 to nearly $500 in a span of one week in January. By doing so, they thought they were bankrupting greedy Wall Street hedge funds who had gone short on the stock. Little did they realize that they were actually hurting themselves a/k/a the common man whose hard-earned money was invested in the very same hedge funds via pension funds and endowments.

second order thinking doesn’t make for good memes. and we don’t really know about the LP base of affected funds. yet.

— Sar Haribhakti (@sarthakgh) January 28, 2021

Successful products don’t fight short attention span or try to educate their users to drive change in their behavior. Instead, they turn short attention span to their advantage.

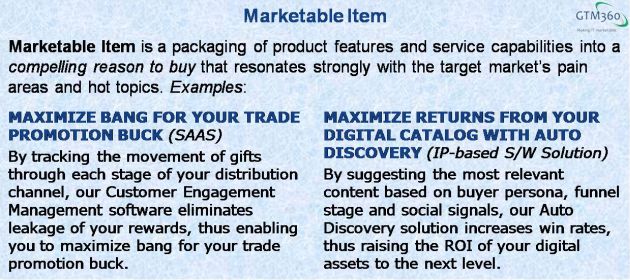

Marketable Items can help in that pursuit. They amplify the solution to the one problem that your product solves. Your product may not introduce any new problems but, even if it does, your customer is likely to miss its second order effect because of the same two reasons mentioned above.

Since Marketable Items help you raise the appeal of your product, you can count on short attention span of the C Suite. If the CEO namedrops a new technology, you can count on people at the operating level glossing over the details because overthinking about the new problems introduced by the said technology can be a bad career move.

You can find the definition of Marketable Item and a couple of examples in the following exhibit.

This strategy has never failed to work in IT.

Here are three examples.

Windows

When IBM launched the PC in the early 1980s, customers loved the product and gradually started replacing their minicomputers with PCs. But, over time, they became anxious about becoming too dependent on the IBM platform.

Microsoft entered the scene and pitched DOS, and later, Windows, as a way to solve the vendor dependence problem. By letting its programs run across all brands of so-called Wintel PCs, Microsoft gave customers a sense of assurance that they were not locked in to the IBMs or Compaqs or Dells of the world.

Microsoft entered the scene and pitched DOS, and later, Windows, as a way to solve the vendor dependence problem. By letting its programs run across all brands of so-called Wintel PCs, Microsoft gave customers a sense of assurance that they were not locked in to the IBMs or Compaqs or Dells of the world.

With this strategy, accompanied by some clever agreements Bill Gates forged with OEMs with the help of his mother, Microsoft was able to spread MSDOS – and, later, Windows – far and wide and become one of the largest tech companies in the world.

It took a while for customers to realize that they were now locked in to Microsoft. But it was too late by then.

Dependence on Microsoft is still so strong that very few of its customers have moved away from its MSDOS + Windows desktop OS platform despite getting free-of-cost alternatives like Linux.

Despite the onslaught from Linux, Ubuntu & other free open source alternatives for years, Windows still has 85% marketshare of Desktop Operating System. Go Microsoft! pic.twitter.com/gwZcnUdC7V

— Ketharaman Swaminathan (@s_ketharaman) February 14, 2019

Fast forward to modern times.

Kubernetes

According to Gartner analysts quoted by The Register, Kubernetes solves one problem and introduces three new problems.

By hyping up its solution to the data portability problem, Kubernetes has managed to shift the spotlight away from the new problems it is creating. So far, its strategy seems to be working.

While it’s still early days, there are enough precedents to suggest that Kubernetes may be able to pull another Microsoft by continuing with this strategy.

Dashboard

Dashboard solved one old problem, namely, high cost of data access. And introduced three new problems:

- Low shelf life

- Death by filters

- Mistrust of data

See Dashboards are Dead for more details.

Given its successful run, Dashboard has overcome its second order effects and is poised to become another Windows or Kubernetes rather than Concorde.

Although the data scientists quoted in the above article predict that Dashboard will be replaced soon by Notebook, the shiny new thing in data distribution.

I see similar dynamics at play in the case of Digital Payments.

I’ve helmed the digital payments LOB at Oracle. I’ve continued to work on the space subsequently. As a result of my background, I have a vested interest in the topic. But I’ll set all that aside for the moment and refrain from waxing eloquent about how digital payments is a great innovation and that no one can’t stop the march of progress, blah blah blah.

Instead, I’ll take a look at the subject from a neutral perspective.

Digital payments has a penetration rate of around 20% in India. Prima facie, it has a huge headroom for growth and enjoys a very bright outlook.

But, on the other hand, it has triggered serious concerns around fraud, as noted at the beginning of this post.

Whether Digital Payments will overcome their fraud-related second order effects and go on to achieve their full potential really depends on Marketing, as was the case with the success of Computers and failure of Concorde.

I recommend the following approach to banks and regulator:

- Do not screw up the UX of UPI apps by mandating extra steps to mitigate fraud

- Reimburse victims of fraud once and make them undergo mandatory training on how to use digital payment apps securely

- Refuse further reimbursements if they fall for fraud again. (Repeat victims may still have the right to approach law enforcement if they get defrauded again).

I believe that this approach will make consumers take responsibility for their use of digital payments apps, cull out serial suckers from the digital payments ecosystem, and lay a strong foundation to drive further growth of digital payments despite fraud.

Solution to control APP/Zelle/UPI fraud in UK/USA/India is not to add more steps in the app & screw up UX. Instead, banks should reimburse victims once, train them how to use the app securely & refuse reimbursements if they fall for fraud again. https://t.co/01JQ32YN8u

— Ketharaman Swaminathan (@s_ketharaman) April 6, 2020

Quora Reference: https://qr.ae/pNOf48.

UPDATE DATED 22 DECEMBER 2022:

In the above post, we have used the term “fraud” from the pov of victim / perpetrator / law enforcement. As far as the digital payment ecosystem is concerned, what we’re talking about is actually scam not fraud. The difference between the two is explained in the following exhibit (H/T Zelle – the A2A / UPI of USA):

tl;dr: Scam is Authorized Payment. Fraud is Unauthorized Payment. Needless to say, banks will need to reimburse all incidents of Fraud. It’s only in the case of Scam that we proposed that banks restrict their reimbursement to the first incident.