In Part 1 of this blog post, I had given seven examples that showed that, just because you can do something doesn’t mean that you will.

In this Part 2, I will give eight more examples.

8.

Millennials do everything on a mobile phone. Therefore, they will refuse to visit bank branches.

Just because Millennials do a lot of things on a mobile phone doesn’t mean they will refuse to visit branches from time to time to do their banking.

As I warned my retainer customers in Will Millennials Bankrupt Neobanks?, many neobanks have gone bust because they fell for this mistaken notion.

"deposits held at seven of the leading neobanks total $1.68 billion, about 0.014% of all deposits held in US banks." ~ https://t.co/bYM4WUQz3u via @Forbes @rshevlin

— Ketharaman Swaminathan (@s_ketharaman) August 19, 2019

9.

You can use my credit card details to buy stuff for yourself. Therefore, you will do so.

Just because you can use my credit card details to buy something for yourselves doesn’t mean you will.

Normal people simply don’t do illegal stuff that often. That’s why credit card fraud is less than 0.01%. This misconception is the basis of regulatory mandate for two factor authentication, which introduced tremendous friction, increased risk of payment failures and proved to be a conversion killer for online businesses.

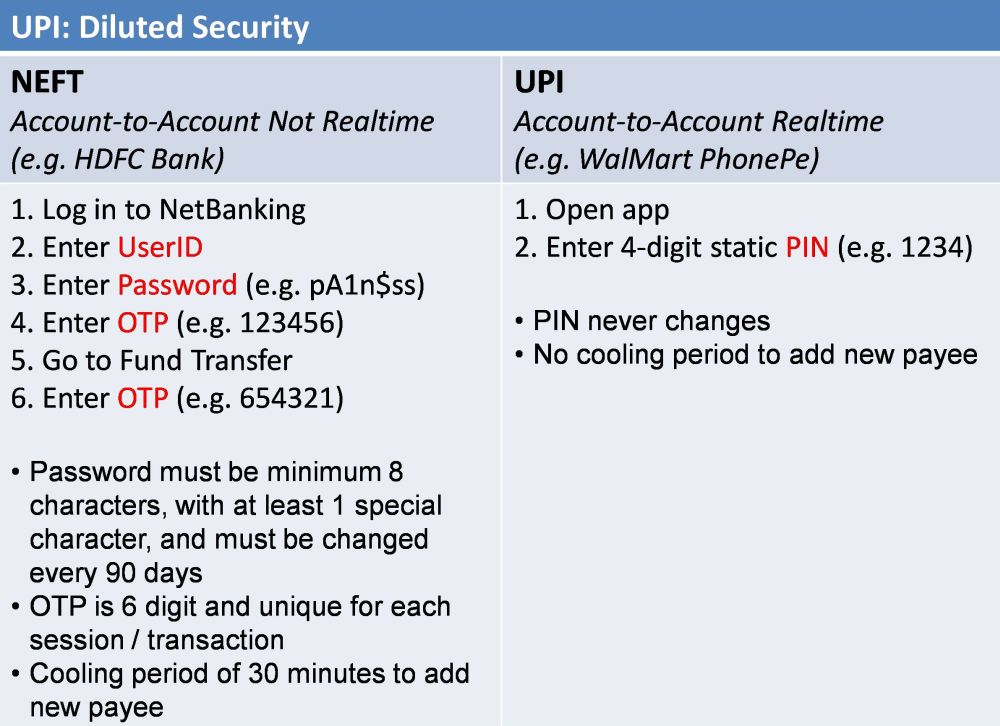

It has taken the regulator nearly 10 years to understand the reality and make course correction with UPI. See below exhibit for areas of dilution of security in UPI compared to other methods of payments.

10.

Every man on the street needs a loan. Therefore, lenders should give a loan to every man on the street.

Just because the man on the street needs a loan doesn’t mean a lender can give a loan to every Tom, Dick and Harry and expect to be in business.

Recovery is key when it comes to loans. LendingClub, OnDeck and many other online P2P lenders have learned this lesson the hard way.

"LendingClub, which went public in 2014 at a market cap higher than all but 13 US banks has since lost ~90% of its value." ~ https://t.co/gPavmqC0zR via @business .

Moral of Story: You can't build a business out of giving a loan to someone just because they need it.

— GTM360 (@GTM360) December 27, 2019

11.

A sales rep earns more commission on higher order value. Therefore, she will jack up the selling price.

Just because a sales rep earns more commission on a higher order value doesn’t mean he will push up the selling price just like that.

Anyone who has done selling even for one day will know that most sales people are likely to do exactly the opposite IRL. Reps are wary of losing the deal by hiking prices because that would leave them open to be undercut by competitors or lead to no decisions by customers with budgetary contraints.

12.

You’re a Preferred Customer for a bank. Therefore, the bank is your preferred bank.

Just because you’re a Preferred Customer for a bank doesn’t mean the bank is your preferred bank!

Yo HDFC Bank, please don't jump to conclusion. Just because I'm *your* Preferred Banking customer for 15 years does not mean you're *my* preferred bank! pic.twitter.com/mLJNOrNLtc

— Ketharaman Swaminathan (@s_ketharaman) November 1, 2019

You can read more about my experience of being a Preferred Banking customer of a leading private sector bank here.

13.

Somebody shows interest in your company. Therefore, they will buy your products or services.

Just because somebody shows interest in your company’s products or services (“prospect”) doesn’t mean they will buy from you (“customer”).

Any sales rep knows that a typical sales cycle goes through various stages, as shown in the exhibit on the right. Many prospects who start at the top of the funnel dropoff before they become customers at the bottom of the funnel. A vendor would be lucky to get one deal from 40 prospects, with the other 39 prospects falling out of the funnel because they buy from a competitor, don’t take a decision, and for a variety of other reasons.

In 2006, over 30 developed countries reportedly showed interest in UPI. Five years later, not a single one has implemented UPI.

Over 100 countries showed interest in UPI in 2016. 5 years later, not one has bought it.

Gentle reminder that interest is not action.

Purchase journey goes thru' Awareness-Interest-Desire-Action stages. 97.5% of people who show interest don't buy. #AIDA pic.twitter.com/Y2SKxBsi4W— Ketharaman Swaminathan (@s_ketharaman) October 19, 2021

14.

A startup can research the fate of its predecessors. Therefore, it will.

Just beause a startup can research the fate of its predecessors doesn’t mean it will.

Exhibit A: Banked, yet another fintech that’s trying to disrupt Visa and MasterCard despite scores of its predecessors giving up years earlier after reading the writing on the wall. Click here for more.

Dwolla, PayM, Pay By Bank… I've lost count of the # of startups that have tried to disrupt Visa & MasterCard in USA, UK in the last 10 years. Banked is proof that Just beause a startup can research the fate of its predecessors doesn't mean it will. https://t.co/3QZ6sh4ySG

— Ketharaman Swaminathan (@s_ketharaman) May 25, 2020

15.

Anyone can add or edit content on Wikipedia. Therefore, Wikipedia is junk.

Just because anyone can add or edit content on Wikipedia doesn’t mean it only has junk.

IRL, most people don’t take the trouble to register for Wikipedia and log on to it each time just to write garbage. (I know there are a lot of time rich folks out there but they have other places to go to that are more fun than Wikipedia!). Testimony: A recent study found that Wikipedia is just about as likely to have inaccuracies as any of the traditional encyclopedias.

Happy 20th Birthday Wikipedia. In theory, it can contain junk. In practice, it's quite accurate. Per common joke, it's just as well that Wikipedia works in practice, because it does not work in theory.

— GTM360 (@GTM360) February 2, 2021

Just because I can write another example doesn’t mean you’ll read another example:).

So let me stop right here!

PS: In case you are interested in reading more examples, you’ll find some in the comments below.