According to the popular narrative, new age companies leverage data in virtually every facet of their business (as against traditional companies that run on intuition).

To a large extent, this belief is right.

Many digital natives owe their spectacular rise in the last decade or two to their prowess with data and analytics. A big part of Amazon’s success has been attributed to its recommendation engine, which involves massive amount of number crunching.

But my recent encounters with new-age companies has upended this narrative. I’m now wondering if data bungles are caused by technology issues rather than by attitude problems as hitherto believed.

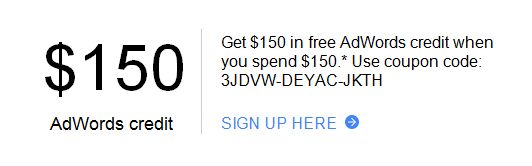

#1. GOOGLE

I got an offer for $150 AdWords credit from Google.

I clicked the SIGN UP HERE button and entered the given coupon code on the following page. I got an error message saying this offer is only valid for new AdWords customers.

I have no problem with offers that are not available to existing customers.

But I do get annoyed that Google, which knows fully well that I’m an existing AdWords customer for 10+ years, made this offer to me in the first place.

Configuring a targeted offer engine to exclude existing customers is not rocket science – it’s not even AI! I know this much on the back of my company’s experience of working together with the leading provider of a Customer Engagement Management platform.

#2. AMAZON

I kept getting telephone calls and emails from Amazon to join its Amazon Business program.

Thing is, I signed up for Amazon Business over a year ago!

I initially thought the email was a phishing attempt by a fraudster.

But, a few days later, I got the same message via LinkedIn InMail.

So it’s not a fraudster but another example of bungling of data by a new age company.

#3. OLA

I’ve been using Ola Rentals for years. For the uninitiated, this product lets riders rent cabs for full day packages within the city.

I bailed out of an Ola Rentals booking one day last month. The next day, I went ahead with the booking.

I got the following note from India’s largest cab aggregator two days later.

While Ola recognized that I abandoned a rental booking on a particular day, it missed the following data points:

- I made a rental booking the next day, so I couldn’t have been “unsure about booking a Rentals”

- I’ve used Ola Rentals several times in the past, so it was silly on the part of Ola to explain the basic features of this product to me.

The only sensible part of this communication was the 10% discount offer for an Ola Rentals booking. But, since I’d already completed the rental trip before I got the targeted offer, it was useless to me.

#4. PAYTM

I got a “long time no see” email from PayTM lamenting that I’d not used the app for a long time. It offered a cashback if I made a payment with the app in the next three days. It came one day after I’d made my largest ever PayTM payment!

#5. GOOGLE

A day after my Chrome browser got auto-updated, Google displayed the following screen.

I promptly clicked the blue button and took the “WHAT’S NEW” tour.

Despite that, Google showed me this screen nearly 20 times.

#6. QUORA

Quora informed me that one Angela Schultz had upvoted my answer to a certain question.

In the same email, Quora reported that my answer had received 0 upvotes!

I could go on and on with more examples but I’m sure you get my drift.

I have no inside track into why these new-age companies committed these data faux paus.

But, if I were to hazard a guess, I’d say it’s because they use many microservices to deliver the end-to-end process and these microservices are not synchronized with the same data.

Specifically,

- the microservice that selects customers to be targeted for a cashback offer (because they haven’t used the product for long enough time) was not refreshed by payment transaction history (PayTM example).

- the microservice that drives the upvote counter received different data from the one that drives the upvote notification email (Quora example).

This speaks to the good old no single source of truth problem, which has beset traditional companies for ages.

It also reminds of an experience I had with my bank in Germany in the early oughties.

The bank’s ATM would continue to display the same account balance even after I withdrew cash from it. To see the latest balance, I’d have to insert my debit card into a separate machine and print out the statement. The ATM machine reflected the latest balance only on the next day. Apparently, the bank’s core banking system in which account balances were computed sent out the updated information to the statement printing machine in realtime but to the ATM network only in batch (once a day at midnight).

While I was writing my previous 2 tweets, I got 6 identical emails from Jio, the TELCO which disrupted other TELCOs in India and drove the industry to doldrums. I've also got 2 SMSs in English & 3 SMSs in Marathi (local language) on the same topic. (1/n) pic.twitter.com/eoRXUFhXXY

— Ketharaman Swaminathan (@s_ketharaman) April 26, 2019

Thing is, I already topped up my account yesterday and Jio shouldn't have sent even a single alert. If this is the state of systems & CX in the TELCO that disrupted the other TELCOs, I won't hold my breath that TELECOM will make a dent on BANKING anytime soon. (2/2)

— Ketharaman Swaminathan (@s_ketharaman) April 26, 2019

The above incidents reek of legacy system issues that have plagued traditional companies – including the aforementioned bank in Germany – for ages.

It’s sad to see that even digital natives exhibit legacy-like tendencies in spite of using modern technologies like cloud and microservices.

Such disjoint behavior not only mars the Customer Experience but raise serious questions about the touted ability of digital natives to use data.

I hope the above incidents are one-off. Otherwise, they could presage the rapid loss of data chops by digital natives.

Data is the new oil only for those who run targeted ads on top of it. For the guy from whom the data originates and to whom it belongs, data is not even worth peanuts. https://t.co/1QAFDdGZPK via @WIRED @GregoryJBarber . #Datum #Doc.ai #Wibson

— S.Ketharaman (@s_ketharaman) January 22, 2019

How can digital natives get rid of the data problem and truly leverage data to improve their products?

While that could be the subject of a separate blog post – even a book! – here’s a sneak preview in the context of the Ola example above:

The company could have sought my feedback on why I bailed out of the rental booking the previous day, instead of conveniently assuming that I didn’t know about its rental product. In this specific case, it was because I was “just looking around” but I frequently abandon competitor’s Uber Hire bookings because the app does not display the package details – hours, kilometers, fare – upfront, and does not provide telephone support to answer tricky questions that inevitably crop up in most rental bookings.