In Killing The Six Deadly CX Killers, I attributed six key reasons for poor customer experience (CX) and what brands could do to get rid of them, thus enhancing their CX.

In this post, I’ll cover the seventh deadly CX killer: Poor communications.

I have a Visa credit card issued by a Top 5 private sector bank in India that has the habit of confusing share price for market cap. I have both a Primary and an Add On card. Both credit cards have the same card number, expiry date, CVV and registered mobile phone number but different cardholder name and PIN.

(For the uninitiated, all instore credit – and debit – card transactions in India require a PIN to be entered in the POS terminal).

Recently, these two credit cards expired. A month before their expiry date, I received the new credit cards. They also match the old cards vis-à-vis common and different details.

The masked details of the OLD and NEW cards are shown in Exhibit 1.

| PRIMARY CARD | ADDON CARD | |

| OLD CARD | ||

| Cardholder Name | John Doe | Jane Doe |

| Card Number | 1234 5678 9012 3456 | 1234 5678 9012 3456 |

| Expiry Date | 01/19 | 01/19 |

| CVV | 123 | 123 |

| NEW CARD | ||

| Cardholder Name | John Doe | Jane Doe |

| Card Number | 1234 5678 9012 3456 | 1234 5678 9012 3456 |

| Expiry Date | 07/23 | 07/23 |

| CVV | 456 | 456 |

EXHIBIT 1

As you can see, the new cards had the same card numbers as the old cards whereas they had different expiry dates and CVVs compared to the old cards.

In other words, some details had changed and others had remained unchanged between the OLD and NEW cards.

But, since I had physically received two new cards, it was sensible to consider them as NEW.

This was reinforced by a line in the welcome letter accompanying the cards asking me to update the new card details in all standing instructions.

If you’re wondering why I’m belaboring what should be very obvious, read on.

Since PIN is required for instore use of credit cards in India, my next step was to set up the PIN for the two NEW cards.

This is when things became confusing and the need to belabor obvious things began.

Primary Card

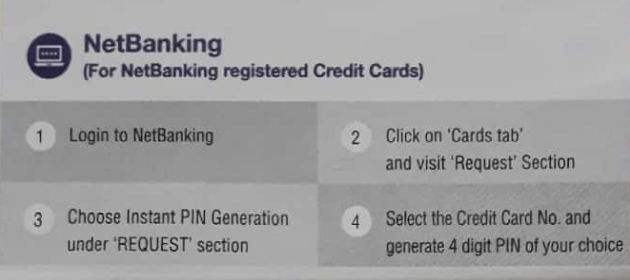

The flyer that came along with the welcome letter caveated that I could set a new PIN via NetBanking provided the card was registered on NetBanking (see EXHIBIT 2 below).

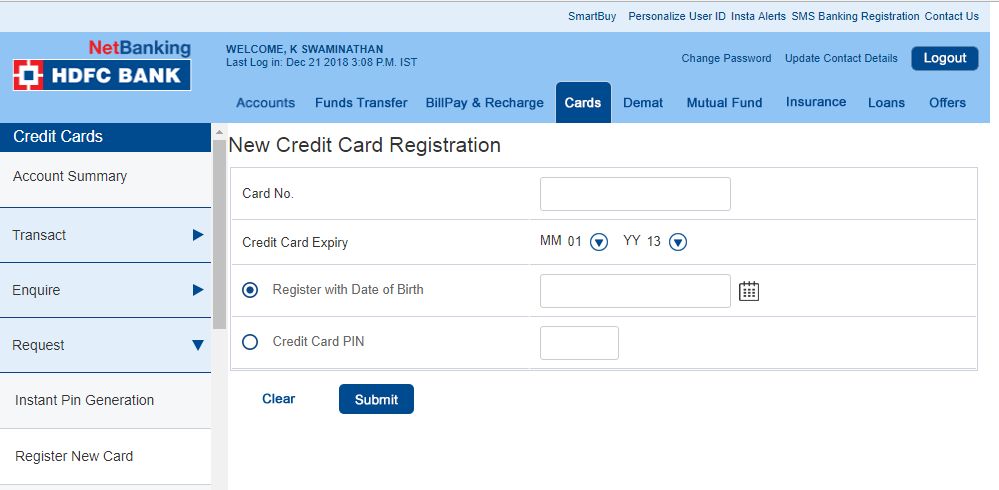

So I decided to register my NEW card on NetBanking. I clicked the “Register New Credit Card” option under the CARDS tab.

I then entered the new card number and expiry date. When I hit SUBMIT, I got a message to the effect that the card was already registered.

Duh.

How can my NEW card be registered when I hadn’t registered it? (If the bank had kindly done that on my behalf, it should have said so in the welcome kit. It should’ve also removed the qualification about the PIN setting procedure being applicable only to NetBanking registered credit cards.)

This message made sense only for the OLD card.

So, is my card NEW or OLD?

That’s why I was belaboring what should have been obvious.

You may be wondering why I didn’t blindly follow the instructions given on the flyer to generate PIN on NetBanking. That was because I knew that step involved Mobile OTP, which had been failing regularly. My concern was, if by chance my action applied on the OLD card and the Mobile OTP step failed, even my OLD card would stop working, while my NEW card was still not registered. In other words, I didn’t want to take the risk of losing access to both OLD and NEW cards.

Add On Card

The welcome letter stated, “For Addon Card, you will be receiving only Physical PIN Mailer at your registered address”. I didn’t get the paper mailer by snail mail – which is what I presumed “Physical” meant – for over 10 days.

I started wondering if I needed to generate the PIN for it on NetBanking.

But I knew I couldn’t blindly repeat the steps I followed for the Primary card because the Add On card has the same number and expiry date as the Primary card and there was no way to distinguish between the two on the NetBanking portal. I then stumbled on a message on the portal that I should be using the ATM PIN option.

Now, I never ever use a credit card at an ATM, so I was reluctant to follow this instruction at first. But I chalked this down to yet another example of poor language and went ahead. I got a message that I needed to request for paper PIN mailer. In other words, it wouldn’t come by itself. This wasn’t mentioned anywhere in the welcome kit.

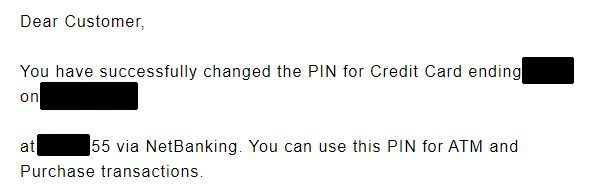

I finally went ahead with the instant PIN generation option for the Primary Card and received the following email:

More confusion ensued: I have four cards ending in the said number and I haven’t changed the PIN for any of them, so the email made no sense. I was worried if my worst fears had come true – the bank had changed my OLD card’s PIN instead of settting it as the PIN for my NEW card.

As you can see, I went through a very painful experience.

Part of it was owing to technical issues – three attempts and nearly an hour to get the Mobile OTP.

But bulk of the friction was caused by sloppy language across the welcome letter, website and email.

I wasn’t hot about digital alternatives to Paper PIN Mailer many years ago – any day, a paper PIN mailer beat the digital experience at the time – as my comments on the 2013 Finextra blog post entitled Are PIN Mailers still the best way to distribute PINs? would show.

After my recent experience, I remain skeptical about the digital alternatives even in 2019.

I’m not suggesting a return to paper PIN mailers but there’s a lot this bank needs to do to improve the CX of its digital alternative.

That will be the subject of a follow-on post. Watch this space!