When you pay someone, you expect to get a receipt for the payment. Especially when that “someone” is a business.

Receipt – or “proof of receipt of payment” – must be issued by the Payee / Merchant so that you can use it to independently prove that the Payee / Merchant has received your money. A confirmation from an intermediary like a Payment Service Provider does not count as proof of receipt.

When you pay with a credit card, you get such a proof of receipt. It’s in the form of a receipt and chargeslip you get from the cashier if your payment was made at the Merchant’s brick-and-mortar store; or e-receipt you see on the Merchant’s website if your payment was made online. (Please note that the realtime SMS Alert, if any, that you get on your mobile phone soon after you make the credit card payment does not count as receipt. The alert is sent by your card issuing bank and the Payee is under no obligation to accept it as receipt of money).

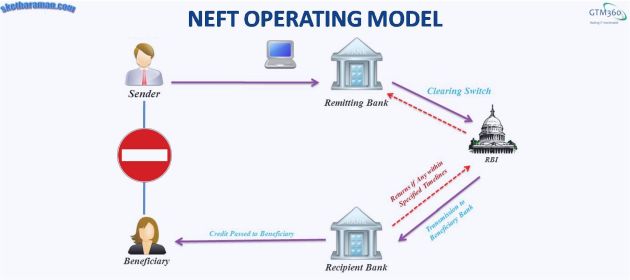

But when you pay via NEFT (India), you don’t get such a receipt. For the uninitiated, National Electronic Fund Transfer is an account-to-account, push-based digital payment method. Operated by Reserve Bank of India, NEFT can be used to transfer money from one bank account to another electronically. Click here to know more about NEFT.

From recent experience, this can become a serious problem for retail banking consumers.

My friend Rajesh had paid the fees for the last semester of his college in June 2017 via NEFT. Not having registered for the bank’s online banking, he initiated the transfer by filling a paper form at the branch near his house. The banker punched in a few details into his computer and told Rajesh the payment was done. When the banker didn’t offer any confirmation for the transaction, Rajesh insisted on getting something in writing. Good move, as we’ll soon see. In response, the banker scrawled a few details on a piece of paper by hand. Rajesh filed the paper away.

Life went on.

Cue to December 2017, when Rajesh’s course ended. His project defence was scheduled in the middle of February 2018. In the first week of February, Rajesh received an email from his college saying they hadn’t received his fees and wouldn’t let him take his viva voce. Rajesh hurriedly retrieved the paper he’d filed away seven months earlier, saw a certain reference number called UTR written on it and emailed it to his college. The accounts department issued a no-dues certificate and let Rajesh complete the project defence. Problem solved. At least for then.

Then came time for the Convocation in the middle of March 2018.

Rajesh received an urgent email from his college saying his last semester fees was outstanding. He once again quoted the UTR. But this time it didn’t work: The college insisted that they hadn’t received his payment and told Rajesh to follow up with his bank.

By then, Rajesh was already working in another city. Since it’d be a pain to go back to his hometown to follow up with his bank, he tried to find a remote solution.

This is what he found out on website of RBI, the NEFT scheme operator:

Q.20. Is there a way for the remitter to track a transaction in NEFT?

Ans: Yes, the remitter can track the NEFT transaction through the originating bank branch or its Customer Facilitation Centre (CFC) using the Unique Transaction Reference (UTR) number provided at the time of initiating the funds transfer. It is possible for the originating bank branch to keep track and be aware of the status of the NEFT transaction at all times.

He spent some time on Google and Quora and all his research pointed to UTR as the sole reference for an NEFT payment. Since quoting the UTR hadn’t persuaded the college, he had no choice but to take a day off from work and visit his bank.

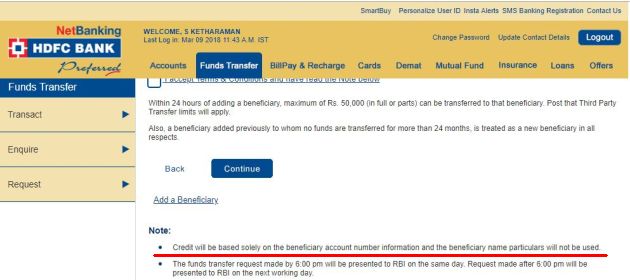

As soon as he met the banker, Rajesh was told that his payment had failed. When the banker pulled out the NEFT form from his file, Rajesh realized that he’d made a mistake while writing the college’s account number in the payment request form. Luckily for him, the money didn’t go to the wrong person. As my bank takes trouble to point out, “Credit will be based solely on the beneficiary account number information; the beneficiary’s name will not be used.” Since the (wrong) account number didn’t exist at the Beneficiary bank, Rajesh’s money got credited back to his account. While this happened back in June 2017, Rajesh didn’t have online access to his account and hadn’t bothered to look up the updated passbook, so he noticed the reversal entry only during his latest trip to the bank.

As soon as he met the banker, Rajesh was told that his payment had failed. When the banker pulled out the NEFT form from his file, Rajesh realized that he’d made a mistake while writing the college’s account number in the payment request form. Luckily for him, the money didn’t go to the wrong person. As my bank takes trouble to point out, “Credit will be based solely on the beneficiary account number information; the beneficiary’s name will not be used.” Since the (wrong) account number didn’t exist at the Beneficiary bank, Rajesh’s money got credited back to his account. While this happened back in June 2017, Rajesh didn’t have online access to his account and hadn’t bothered to look up the updated passbook, so he noticed the reversal entry only during his latest trip to the bank.

It appeared from this incident that UTR is only a proof of initiation of an NEFT payment. Since UTR didn’t get canceled even after the payment had failed, UTR didn’t seem to be a proof of receipt or even of completion of payment.

When Rajesh narrated this incident to me, I found this a bit strange. I wrote to the Relationship Management Head at my bank branch to double-check. I didn’t get any reply from her. I then raised the subject with an ex-Banker friend. He told me that large corporates send billions to one another without any proof of receipt. While he didn’t say it explicity, it was apparent from his body language that “retail consumers shouldn’t worry too much about lack of receipt for the measly amounts they transfer.”

Still not convinced, I tried to recall how another A2A EFT like FPS handles receipts. I reached out to my ex-colleague Chetan Ghadge who was involved very closely in implementing FPS for a Top 5 UK bank. He reminded me how the Beneficiary Bank is required to acknowledge receipt of each individual payment to the Payer Bank within 15 seconds. If the Payer Bank does not get an ACK within this period, it resends the same payment marking it as a duplicate. It repeats this procedure for three times and, if at the end of the third attempt, it still does not receive an ACK from the Beneficiary Bank, the Payer Bank cancels the payment instruction and informs the Payor accordingly.

In short, while it handles interbank messaging faster than the batch-based NEFT, FPS also doesn’t seem to provide a proof of receipt to the consumer. This was confirmed when I read the following statement on the FPS website: “Once the payment has been made, a confirmation message will always be sent between banks. Each sending bank will decide how this confirmation will be made available to its own customer.”

The operating model of NEFT (and FPS) doesn’t seem to have any provision to issue a proof of receipt.

Maybe it’s only me but I find it ironical that for all the chatter they generate between the sending bank and receiving bank, these payment schemes don’t think it necessary to support communications between the Payer and the Payee, the two most important entities in a payment transaction.

I mentioned earlier that lack of proof of receipt could be a problem for retail banking consumers. You must be wondering why I chose to qualify the customer segment.

That’s because corporate banking customers tend to employ dedicated people and / or technologies to reconcile payments on a regular basis and are therefore able to spot discrepancies quickly. So, lack of proof of receipt is not such a big problem for corporate banking customers.

Ergo, what my ex-Banker friend said about corporate banking customers was right.

However, his attempt to use corporate customers to obfuscate the retail consumer scenario was cheeky. But I won’t blame him. When the Average Joe or Jane consumer hears that megacorporations use NEFT to make high value payments without proof of receipt, they start seeing a halo around NEFT and forget about proof of receipt for their low value payments. If customers forget basic principles so easily and convince themselves so readily, why should a banker disregard the old sales advice, “Once you’ve sold, shut up”?

Like customers of all products, payers and payees have certain responsibilities when they use a certain payment product. However, mistakes happen.

In the above incident, my friend Rajesh wrote the wrong beneficiary account number in his NEFT transfer form; he didn’t notice the reversal entry until much later. (But he did one thing right by insisting on some kind of written acknowledgement of his payment from his bank.) His college goofed up by not checking its accounts thoroughly when it cleared him for his project defence in January.

However, a customer-centric brand strives to deliver good CX even when the customer is at fault, as I’d illustrated in CX Is Not Bickering About Right And Wrong.

Well said @alainbejjani : “It may not be your fault, but it is your problem.” https://t.co/PT5mfXdHWjhttps://t.co/PuOC9mW5JV

— Ketharaman Swaminathan (@s_ketharaman) August 18, 2017

Besides, the use of digital payments will get stunted if payers have to go from pillar to post to trace their payment.

If banks and government are serious about promoting A2A EFTs, they should find a way of providing proof of receipt to users of NEFT, etc. (apart from fixing account number and IFSC code nomenclature, size of narration field and other issues I highlighted in Enhanced Remittance Data Could Multiply Electronic Fund Transfer Volumes).

One way of doing this is to replicate the tracker model used by SWIFT, TransferWise, Xoom and other payment service providers. The scheme operator (RBI in the case of NEFT) should set up a UTR Tracker System where payers can enter the UTR on a website and receive the latest status of the payment. Unlike trackers supported by some banks, RBI’s system should have statutory backing – if the website says Beneficiary Bank has credited the amount to the Merchant’s account, the Merchant must accept that as proof of receipt.

As veteran bankers and PSPs would know, it takes a lot more than technology to develop and operate such a system. So it’s not going to happen overnight.

In the meanwhile, here’s my Public Service Announcement:

As soon as you make a NEFT payment, get a receipt from the Merchant.

It’s decidedly uncool to have to do such boring tasks but it could make all the difference between attending or missing a Convocation. Or losing your Internet connection as I wrote here. Or having your electricity supply cut off, which happened to a friend’s tenant who paid her electricity bill via PayTM and got a confirmation from PayTM but the utility company said it didn’t receive her money and disconnected the power supply.

Whenever they tell you, "Why do you need a receipt, it's there in the system", remember, it's their system, not your system (@ClarkHoward)

— Ketharaman Swaminathan (@s_ketharaman) June 4, 2015

As I mentioned at the start of this post, merchant receipts are available as an integral part of credit card payments. In the light of that, you might be wondering why I’m not recommending the exclusive use of credit card for all electronic payments and shunning of NEFT altogether. That’s because all Payers can’t or won’t pay with credit card and all Merchants can’t or won’t accept credit cards.

I’ve written this post on the back of my friend’s incident with NEFT (India) and my insights on FPS (UK). But this public service announcement may be equally relevant for other A2A EFTs like IMPS, RTGS and UPI in India and Zelle in USA as well as for nonbank electronic / mobile wallets like PayTM and PayZapp in India and Venmo in USA.

UPDATE DATED 16 OCTOBER 2019:

Quora Question: What can I do if a receiver lies that he didn’t receive money on an online payment?

My Answer:

In PSA: Insist On Receipt When You Pay By NEFT & FPS, I suggested making payments as far as possible via Credit Card so that you can get a receipt from the Receiver / Payee; and, if the Payee does not accept Credit Card or you can’t make a payment with a Credit Card and you must use NEFT, IMPS, RTGS, FPS, Zelle or any other Account-to-Account payment method, then I strongly recommended that you must insist on getting a receipt from the Payee immediately.

There was a very big hole in my Public Service Advice: What if the Payee denies / lies about receiving the payment?

Not wanting to appear too cynical, I’d remained silent on this point at the time.

But, now that this question has been asked, it merits an answer.

TBH and AFAIK, you as the Payer can do nothing about it.

In fact, how do you even know that the Receiver / Payee is lying about not receiving your money? Have you seen a credit entry from you as Payer on their passbook or statement of accounts or online banking portal??