India’s central bank-cum-banking regulator Reserve Bank of India relaxed the two factor authentication mandate for instore card payments below INR 2000 (~US$30). This means that you can pay with credit or debit card at a store without entering a PIN for purchases below INR 2000.

Ever since that announcement was made, card issuers and acquirers have gone on an overdrive to issue contactless cards and POS terminals. From what I hear, all credit and debit cards issued to customers in the past year or so are contactless (but have chip and magstripe in addition, just in case…) and all POS terminals supplied to merchants during the same period support the “tap” mode for contactless cards (in addition to the “dip” mode for existing chip cards and the “swipe” mode for older magstripe cards, mainly from abroad).

For the uninitiated, a contactless card uses NFC (Near Field Communications) technology and can simply be tapped over a contactless POS terminal to initiate a payment. Eligible payments will be completed without any PIN.

Visa, a leading player in this market, bills its payWave contactless card as “the fastest way to pay”, assuring customers that they can use payWave to complete a payment in “under a second”. From personal experience of using contactless cards overseas, this is not a tall claim.

The proliferation of contactless cards and terminals along with with the convenience of the technology was expected to generate massive volumes of contactless payments since 80% of instore transactions in India are below INR 2000 and qualify for the “tap-mode” (The remaining 20% instore transactions above INR 2000 happen through the “dip” or the increasingly rare “swipe” modes).

There were two sources for these expected contactless volumes:

- Migration of existing card payments from dip / swipe to tap mode

- Replacement of existing small-value cash payments by contactless since it’s way more convenient. As Finextra puts it, “Contactless technology gives shoppers a fast and easy way to pay without having to fish around in their wallet or purse for cash or tap in their PIN every time they use their card. Most users (in UK) (73%) find it more convenient than traditional forms of payment.”

Tough being a bank: If it offers contactless, it drives fraud. If it doesn't, it lacks innovation – @FinextraBlogs http://t.co/sml03bZhDU

— Ketharaman Swaminathan (@s_ketharaman) September 9, 2014

However, according to media reports, the actual volume of contactless payments has been negligible (That matches my experience on the ground – I haven’t seen a single contactless payment in India so far).

Apparently, the reason for the low volumes is that most merchants don’t know that their POS terminals support the contactless – or “tap” – mode. When customers present a contactless card, cashiers simply dip or swipe it on the POS terminal as though the card is chip or magstripe card as always.

This news brought back déjà vu feeling of PayZapp’s Loss Is PayTM’s Gain – And Lesson For PSPs. In this blog post, I’d shared my experience at stores whose cashiers didn’t know that they actually supported HDFC Bank’s mobile wallet.

But merchants’ ignorance is probably not the only factor responsible for low offtake of contactless payments.

I strongly suspect that lack of customer education by banks about the technology and its benefits is another culprit.

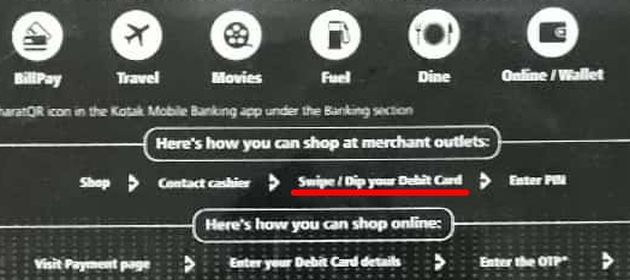

I got this feeling when I recently received a Visa payWave contactless debit card. The envelope in which the bank – a leading private sector bank in India – sent me this card had the following line on how to use this card at merchant outlets:

Swipe / Dip your Debit Card.

There was no mention of “tap”.

Duh?

The whole point of a contactless card is to “Just tap and go”. I found it strange that the bank forgot to mention this USP of payWave.

I let the bank know via Twitter that it might want to add “tap” as another way to shop at merchant outlets.

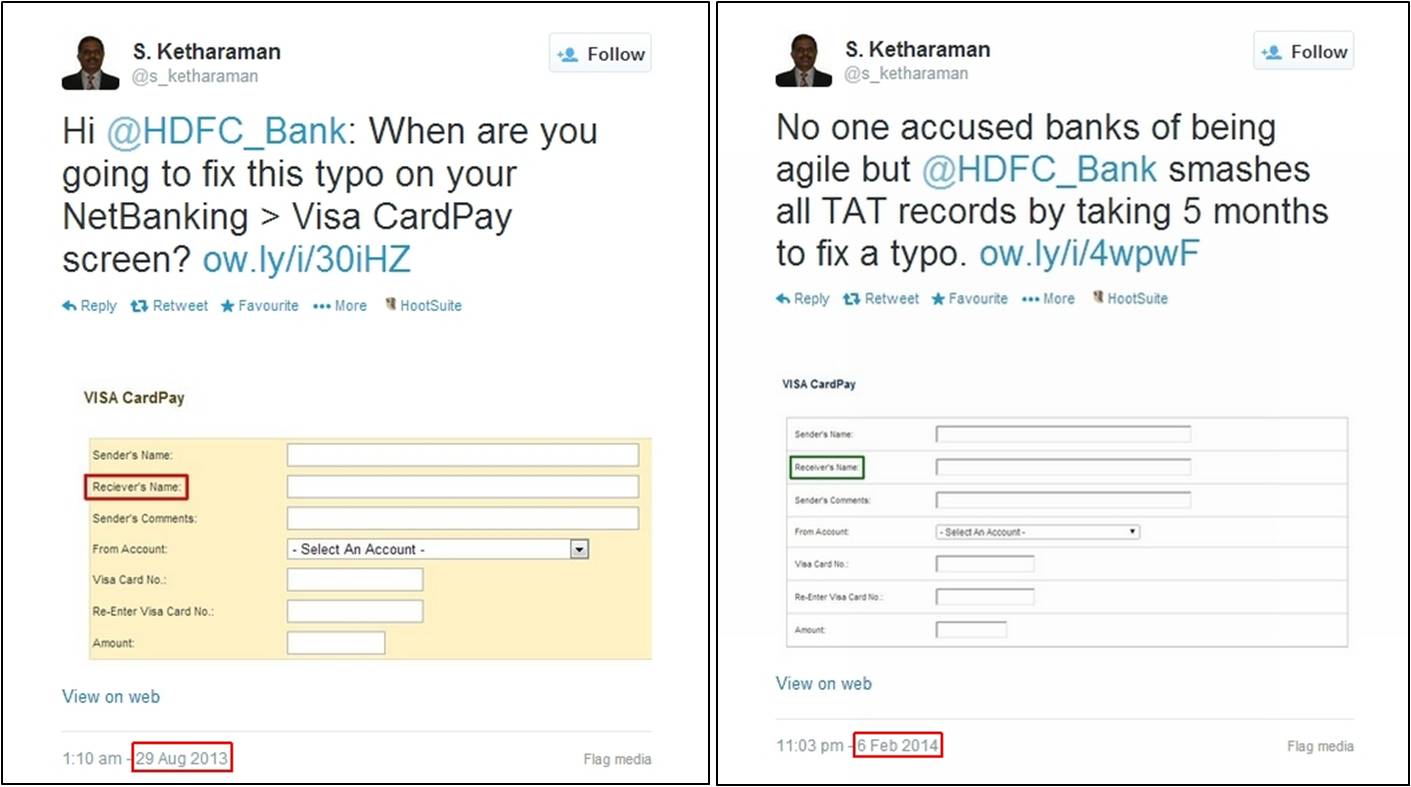

Going by my experience of sharing feedback and suggestions with the banking industry, I’m sure the bank will take action.

“When?” is the question.

Some banks won’t feel the sense of urgency to educate their customers about contactless cards and their benefits. They will add “tap” to the usage instruction on the envelope only when their current stock of envelopes is exhausted and it’s time to reprint new envelopes. They will rationalize their procrastination by arguing, “as long as contactless cards are processed via dip / swipe, what can go wrong?”

This might sound logical at first but a bank that has the blasé “tap’s loss is dip’s gain” attitude has no reason to issue contactless cards in the first place – after all, it has been making money with chip and magstripe cards for years.

So, I expect that there would be a second cohort of banks that would dismiss the above argument and recollect that they decided to get into the contactless business because they expected contactless cards to drive new card volumes – and interchange revenues therefrom – by replacing cash.

So, I expect that there would be a second cohort of banks that would dismiss the above argument and recollect that they decided to get into the contactless business because they expected contactless cards to drive new card volumes – and interchange revenues therefrom – by replacing cash.

These banks would realize that, having issued contactless cards and POS terminals, it’s in their own interest to accelerate the education of their customers (and merchants) about contactless cards (and POS) and their benefits.

In keeping with that realization, these banks will immediately print new envelopes with the “tap” instruction on it, even if that means having to junk their current stock of envelopes. (And maybe educate merchants about contactless POS.)

I predict that the bank referenced above will belong to the second cohort. Let’s see whether I’m right or wrong!

Like any other consumer product, contactless cards will need a lot of mass media advertising before they’re widely used, especially to replace cash in a variety of currently cash-only use cases. Until banks are ready to allocate big spends for such campaigns, they can at least drive modest gains in the adoption of contactless cards by educating customers about contactless technology via marketing collateral like the aforementioned envelope.