On a marketing blog, you’d be expecting to read about five (or more) ways to attract customers. After seeing the title of this post, if you’re wondering whether you’ve landed up on an anti-marketing phishing site, worry not. This is indeed GTM360 Blog.

To attract customers, you need to repel customers.

Why?

No product can be everything to everybody, so every product has one or more market segments that it appeals to and, as a corollary, one or more market segments that it does not appeal to. Ergo every company will have some customers that it covets and some other customers that it does not want. In attracting the former, it will – directly or indirectly – repel the latter. This is Marketing 101.

Market Segmentation is a basic activity in marketing.

For the uninitiated, here’s a working definition of the term.

MARKET SEGMENTATION

Market segmentation is a way of aggregating prospective buyers into groups or segments, based on demographics, geography, behavior, or psychographic factors in order to better understand and market to them. – Investopedia.

Examples of market segments emerging from the market segmentation exercise include

- MBAs

- IIT graduates

- English speakers

- Millionaires

- Vegetarians

According to the above definition, market segmentation has two steps:

- Understanding each segment.

- Marketing to each segment.

Products have different target audiences. What works with one target group may not work with another target group, so different messaging and channels are required to target the Ideal Customer Profile (ICP). Accordingly, every marketing campaign will be designed to attract some customers and, in the process, it may repel others. Both of these actions come across as discrimination to the common man or woman (henceforth J6P), so all hell can break loose in some campaigns.

In the world of social media marketing, J6P is involved even in B2B marketing, but segmentation in B2B does not have the same dynamics as in B2C, so we are ignoring B2B marketing in this post.

Some forms of discrimination are unlawful e.g. denying bank accounts to people of a certain race or other protected classes like religion and gender. However, many others are kosher e.g. denying loans to people below a certain income.

Marketing leaders will need to target customers in the ICP; as a corollary, they will need to filter out customers outside it; which means, to attract some customers, they will need to repel some other customers. In short, they need to practise market segmentation within the framework of the law.

(The rest of this post will be full of stereotypes and politically incorrect remarks. I wish there were a different way of putting it but that’s the nature of the market segementation beast. Also nothing here is legal opinion or legal advice.)

I have come across five tactics used by B2C companies to repel customers.

#1. INTIMIDATE

@RichaSingh complains that staffers in luxury stores look intimidating:

Why are luxury showroom malls so intimidating? I hesitate to go inside the stores to even look at the products. The suited staff looks unfriendly though I am sure they must be courteous. That misfit feeling, out of place and that fear of judgement. Is it just me?

— Richa Singh (@RichaaaaSingh) March 23, 2024

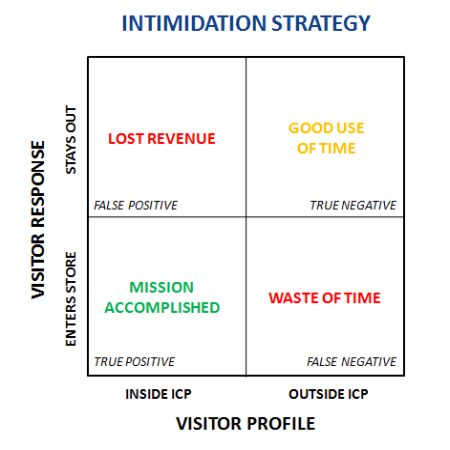

It’s not just this tweeple: Intimidation is a feature, not bug, of market segmentation. The luxury retailer in this example is obviously betting that its staff’s behavior will not intimidate visitors inside its ICP and thereby welcome them into its store (and hopefully convert them into customers); and will intimidate visitors outside its ICP and thereby keep them out of its store. The strategy followed by the luxury retailer to ensure that its staff and visitors do not waste each other’s time is illustrated in the following exhibit.

Like all non-deterministic approaches, the Intimidation Strategy followed by the luxury retailer is not foolproof, and has four states, as outlined below:

- True Positive: A visitor inside the ICP does not feel intimated and enters the store. This is the best outcome for the luxury retailer.

- True Negative: A visitor outside the ICP feels intimidated and does not enter the store. This is an acceptable outcome.

- False Positive: A visitor inside the ICP feels intimidated and does not enter the store. This leads to loss of revenue. This is the worst outcome.

- False Negative: A visitor outside the ICP does not feel intimidated and enters the store. This results in waste of time.

True positives and true negatives are good for the luxury retailer. While false positives and false negatives are bad, the luxury retailer can’t simply abandon this approach and waste everyone’s time. Any smart retailer would hone its strategy with more data so that it can minimize False Positives and False Negatives and maximize True Positives over time.

#2. APPOINTMENT

Many luxury goods retailers in Germany attend to visitors only by prior appointment. Interested people telephone the store and book an appointment. The store does a soft credit pull and grants an appointment only to visitors who fall in its ICP. (Walk in visitors, if any, don’t make it past the appointments desk.)

Many luxury goods retailers in Germany attend to visitors only by prior appointment. Interested people telephone the store and book an appointment. The store does a soft credit pull and grants an appointment only to visitors who fall in its ICP. (Walk in visitors, if any, don’t make it past the appointments desk.)

I’ve seen real estate companies in India follow a similar practice for arranging viewings of luxury homes.

(AFAIK luxury stores and real estate companies cannot access credit scores directly from credit bureaus, so I’m guessing they’re able to source this data via third party data brokers.)

#3. LIMITED OPENING HOURS

I explored a bespoke suit from one of the famous Saville Row tailors in London. Their opening hours were 9-5, Mon-Fri. It’s quite evident that their ICP is heads of states and corporations and other honchos who can easily take time off in the middle of a working day.

That said, top brass don’t take time off for every bespoke suit they buy. They visit the store once and get themselves measured. The tailor keeps their “size on file”. They place subsequent orders by phone. The tailor stitches the suits based on the size on file and FedExes them to customers’ addresses on file.

#4. AMBIENCE

I tell all my household help to shop at a big box retailer in my neighborhood since it offers a minimum of 7% discount on MRP (Maximum Retail Price) on all items. However, they feel uncomfortable visiting the swanky, air conditioned store and buy their groceries from their friendly neighborhood khirana stores. Now, this Indian version of mom-and-pop stores sells everything at MRP. It’s ironical that consumers who can least afford full price are the ones most likely to pay it aka Poverty Premium.

But it’s hard to blame this big box retailer for designing its store interiors to appeal to its ICP. Back in the day, a famous five star hotel in Cuffe Parade in Bombay launched a buffet lunch for Rs. 35. Most of the diners were cabbies who happened to be driving by the neighborhood during lunch time. The hotel shut down this buffet because its ICP did not feel comfortable in this crowd.

#5. DEMEANOR

Anecdotally, private sector banks look at the dress, language and accent of walk-in customers and decide whether to open accounts for them or divert them to public sector banks. (By law, banks in India cannot refuse to open an account for anyone with valid documents.)

There’s also reverse discrimination. I once went to open a no-frills account at a public sector bank in my home district. The branch manager told me that this account was not for people who lived in that tony neighborhood or spoke English. Apparently, the ICP for this bank account is people from lower economic strata who would only speak the local vernacular language.

On a side note, I believe only the sale is governed by anti-discrimination laws, not advertising / marketing. Take neobanks that position themselves as “Banks for Black Americans”. Race is a protected class and restricting a bank account to only African Americans is definitely unlawful. However, there’s apparently no law against advertising / marketing a bank account to Black Americans as long as the bank has some account that it will sell to people of other races. When I asked product and marketing people in American banks if the same logic can be used to launch a “Bank for White Americans”, they told me that would be too politically incorrect – I took that as a NO.

Segmentation involves Discrimination, just not of the unlawful kind.