This blog does not get into politics but tariffs have significant impact on business in general and sales and marketing in particular, hence this exception.

Tariffs on imports has been a major plank on which Donald Trump ran for President of the United States. Unlike many political candidates who forget about campaign promises after assuming power, Trump doubled down on them by announcing higher-than-expected tariffs on Liberation Day, 2 April 2025.

Enough and more has been written in social media and mainstream media on this topic. I’ve no interest in rehashing the basics. Instead, in this post, I’ll shine the light on a few dark recesses of tariffs that have been skipped or twisted in the public discourse.

1. Good For Others, Bad For USA?

A lot of people claim that tariff on goods imported from other countries (henceforth Rest of World or RoW) is bad for USA.

If so, why has tariff been good for those other countries that have been levying tariff on imports from USA for decades?

@s_ketharaman: When India, China, etc. have been having tariffs for ages, it’s Saul Goodman for them. But, when USA imposes tariffs, suddenly it’s Saul Badman for it.

2. Tariffs May Not Translate Into Higher Price For Consumers

The anti-tariff brigade has been portraying that tariff automatically translates into higher price for American consumers.

This is not necessarily true. A basic principle of Business 101 is that when companies are under pressure to raise prices due to external factors, the first thing they do is to reach out to their suppliers and ask them to reduce their prices so that they can partially or fully mitigate the effect of the said external factor.

This is not theory. It has already started happening although nobody seems to be talking about it.

First, Walmart reached out to its suppliers in China. US auto majors followed suit in India. Then US garment companies joined them. All of them are asking their suppliers to reduce – er “adjust” – their prices. In other words, the “adjustment brigade” is asking its Chinese and Indian suppliers to sacrifice their margins in return for continued business.

Since USA is a major market for exporters in many countries, I see many suppliers capitulating sooner or later.

3. The China Deception

The UN World Trade Organization let developing countries (e.g. India) set a higher tariff rate than developed countries (e.g. USA) to enable their domestic companies to grow. China joined WTO 25 years ago when it was a developing country. Today, China is the world’s largest economy by PPP, has a per capita income ($12663) that’s close to that of a developed country ($13205), and claims to be a superpower.

But, somehow, it still gets to keep its original high tariff rate. This is height of trickery. I’m shocked how it wasn’t exposed by anybody before Donald Trump.

According to Economic Times article titled China froths at Trump tariffs but has itself to blame,

Union Commerce Minister Piyush Goyal said China’s economic ascent was built on “unfair trade practices”, hidden subsidies, and distorted labour models, ignored by much of the world since Beijing joined the WTO in 2001.

4. USA Will Not Pay For Factories

Leading economist Peter Schiff makes the following claim on X fka Twitter:

If the U.S. is going to start building factories and developing the necessary infrastructure and supply chains, what are we going to stop doing to pay for it? One thing is shopping. Americans are going to have to sharply reduce spending and increase savings.

But this means a…

— Peter Schiff (@PeterSchiff) April 3, 2025

This is outright disinformation.

Fact is, USA is NOT going to paying for building factories etc. Private sector companies – both American ones like Apple and foreign ones like TSMC – are. Neither American individuals nor American government need to tighten their belts to save up for building factories in USA.

Don claims that he has already received commitments from companies to invest $5 trillion for Make in USA.

5. Short Term Pain For Long Term Gain

The anti-tariff brigade has been posturing that tariffs will lead to a recession. But none of them seems to be aware that, in a MAGA Conclave last September, Trump and his acolytes warned the audience that there will be a fall in GDP for 6-8 quarters before the purported benefits of tariff – reshoring of manufacturing to USA – kick in and MAGA.

I love Trump’s boldness.

When is the last time a president told the American people that we would have to suffer in the short term to become stronger in the long term? That’s leadership.

— Nicholas J. Fuentes (@NickJFuentes) April 9, 2025

6. Tariffs Are Applicable For Everyone Manufacturing Outside USA

Many people are pretending that tariff is applicable only on RoW companies. This is height of obfuscation. Fact is, tariff is applicable to goods manufactured by both American and RoW companies outside USA.

While over 70% of goods in US supermarkets are Made in China, less than 10% of them are made by Chinese companies – the rest are made by American companies in China.

Keen to know what exactly does China have that USA needs so desperately?— Ketharaman Swaminathan (@s_ketharaman) April 5, 2025

As Don has said repeatedly, if you want to avoid tariffs, make in USA. Tariff is meant to bring back manufacturing to USA but not just by American companies. To that extent, there’s a parallel between Make in USA and Make in India – neither is targeted only at American or Indian companies respectively.

7. External Revenue Service

I’ve not heard anybody talk about the use to which the money collected via tariffs will be put. Apparently Treasury Secretary Scott Bessent is setting up a new External Revenue Service department to deploy tariff collections. If ERS deploys the funds for building infrastructure and other things that benefit J6P (Joe Six Pack or Jane Six Pack aka common man or woman in USA), tariff can MAGA.

8. Whither Services Tariffs?

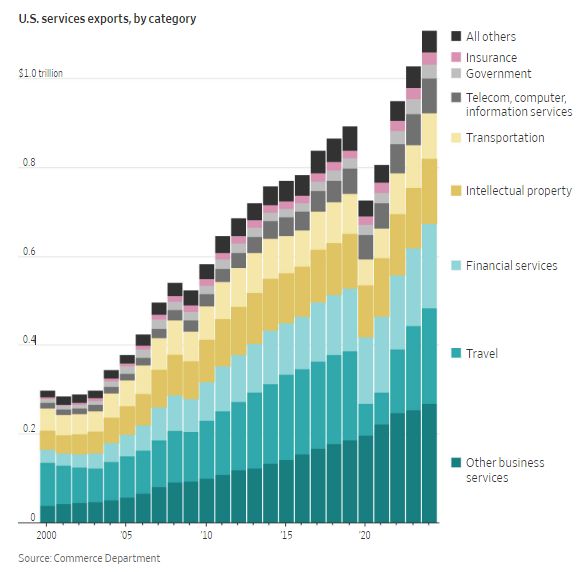

While USA has a deficit with RoW in goods ($1.21 trillion) , it has a surplus with RoW in services ($295 billion). Services span technology (sales of American tech companies in RoW), finance (sales of treasury bonds in RoW), transportation (sales of American airlines’ tickets in RoW), and so on.

While USA has a deficit with RoW in goods ($1.21 trillion) , it has a surplus with RoW in services ($295 billion). Services span technology (sales of American tech companies in RoW), finance (sales of treasury bonds in RoW), transportation (sales of American airlines’ tickets in RoW), and so on.

What will happen if RoW levies a tariff on American services?

Wall Street Journal has asked this question in its article entitled Trump’s Trade Math Ignores a Major Export: American Services.

9. Tariffs Can Drive Reshoring

Some people claim that there is a reason why goods are made in China and not the US. They argue that simply raising tariffs won’t bring manufacturing back to USA as Trump is hoping.

They are wrong about the “is”.

@s_ketharaman: There WAS a reason why stuff is made in China. Don guarantees that tariffs decimates that reason and will bring manufacturing back to USA. And he is POTUS. What others say doesn’t matter much.

End of the day, talking heads can say anything they want but only time will tell what will be the impact of Trump Tariffs on USA. Companies have committed $5T investment to Make in USA. So Don’s strategy is working so far.

10. Will Americans Be Better Off In Manufacturing Jobs?

The ideological underpinning of Trump Tariffs is the claim of MAGA that outsourcing of manufacturing to the low cost economies like China gutted entire neighborhoods in Rust Belt America. Going by the one of the largest victories won by Trump in the last elections, people in those neighborhoods must account for a vast majority of the population of USA. However, according to official figures, unemployment in USA is only 4% or so. That means all those displaced factory workers managed to land safely in services, IT, and other industries. Given that many of those jobs pay better than manufacturing, how will the new lower-paying manufacturing jobs created by reindustrialization of America raise the living standards of J6P?

I’ve not come across a peep on this topic either in social or mainstream media – except for this hilarious Chinese meme on X fka Twitter.

Chinese memes on American re-industrialization rolling in. lol the music. 😂 pic.twitter.com/GZE2jHDgWZ

— Gabor Gurbacs (@gaborgurbacs) April 7, 2025

I can’t help but wonder if MAGA is really about MEAGA (Making Elite Americans Great Again).

11. Tariffs Is Meant To MAGA, Not MEGA Or MCGA

Many people are talking about the adverse effect of tariffs on EU, China, and other countries.

Well, those countries may well get rekt by Trump Tariffs but let’s not forget that Don promised MAGA, not MEGA or MCGA.

If India plays its cards right, tariffs can MIGA.

BREAKING: Apple is shifting more iPhone production to India to avoid U.S. tariffs on Chinese goods. By the end of 2025, one in four iPhones could be made in India.

What does this mean for India, China, and global manufacturing? 🧵 pic.twitter.com/IerYlkqBo1

— Ask Perplexity (@AskPerplexity) April 8, 2025

For context, Apple manufactured close to 250 million iPhones in 2024. 90% of them (225M) were made in China. Assuming that the remaining 10% is split even between Vietnam and India, it’s safe to assume India’s share is 5% (12.5M) – although I’ve seen estimates as high as 15%. If that becomes 25% (one in four), the number of iPhones that could be manufactured in India would rise to 62.5M units.

The increase in production in India would be 50M (62.5M – 12.5M). At $1000 a piece, that would give a boost of $50 billion to the country’s GDP. That’s not a big deal in itself for a four trillion dollar economy but, if Apple’s move serves as a lighthouse for other manufacturers, the cascading effect of their shifting their production to India could be huge.

As always, Matt Levine has a unique – and hilarious – take.

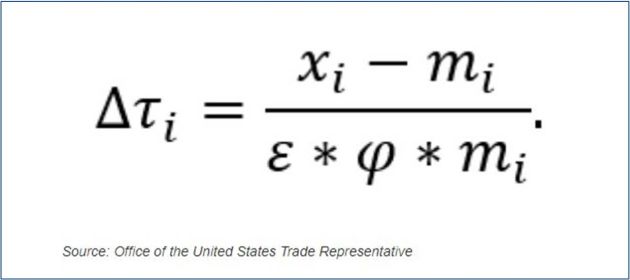

In his Money Stuff column dated 3 April 2025, he writes:

I am a financial columnist, and I have a patriotic appreciation for the US’s export industry of finance, and two of that industry’s most popular products are:

- Sprinkling some Greek letters on your work to add visual interest, and

- Making up parameters to solve for the result you want.

Even in this tariff announcement, you see the US leaning into its comparative advantage.

He was referring to the following formula used to calculate the tariffs.

LOL.