Fintech Mafia Carousel Pumping is the circular shilling of one another’s financial products and services by a bunch of fintech founders with least regard for truth or consumer interest.

I recently came across the following exhibit of Fintech Mafia Carousel Pumping on LinkedIn.

Why do some of us trust Barclays or Bank of America more than, say, Kitty Neobank? All three offer the same level of deposit guarantee, backed by the same government.

(While the Carousel Pumper wrote “Kitty Bank”, I’ve deliberately changed it to “Kitty Neobank” for reasons that will become clear in a bit.)

For the uninitiated, banking is a licensed activity and very few fintechs get a banking license. So most fintechs position themselves as “new-age banks” aka neobanks and work on top of a bank with a charter (aka “Sponsor Bank”). They typically don’t have branches and get by with shiny new mobile banking apps that have better UI and UX than the mobile banking apps of traditional banks.

In the past, I’ve talked about the features of neobank websites and apps e.g. Why Banks Will Never Catch Up With Fintechs On UX.

In this post, I’ll cover another aspect, namely, safety of money.

Like the aforementioned Fintech Mafiosi on LinkedIn, neobanks claim that they’re as safe as traditional banks because they deposit their consumers’ money with sponsor banks, which are covered by deposit insurance.

This is a a canonical example of obfuscation. It misses out one important fact: The deposit insurance agency will pay out only when the bank fails. But not when the neobank fails. It provides Fintech Bros with plausible deniability for running away with your money when their startups go belly up.

For the uninitiated, deposit insurance is the sum of money paid out to account holders if their bank fails. It’s provided by RBI DICGC in India, FDIC in USA and other government agencies in other countries. The amount varies from country to country. It’s up to INR 500,000 in India and USD 250,000 in USA (per person per bank).

It’s understandable that they (consumers of fintechs and neobanks) would read ‘FDIC-insured’ to mean ‘absolutely guaranteed.’ But that is not what FDIC-insured means – Banking Dive.

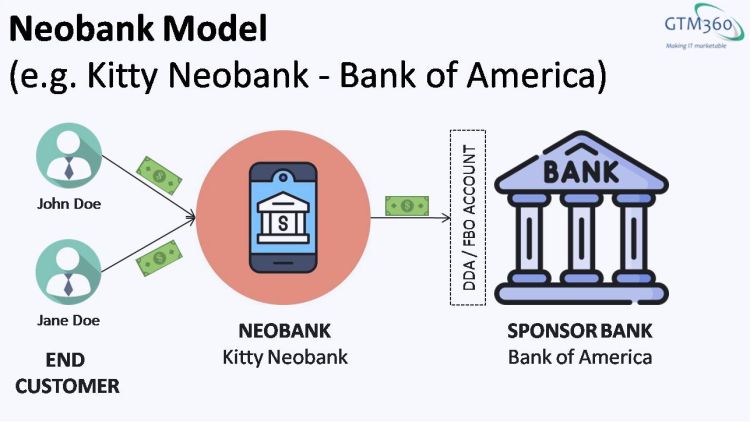

Let’s say Kitty Neobank operates on top of basic bank account provided by a sponsor bank, say, Bank of America (henceforth BofA). Since it doesn’t have a banking charter, Kitty can’t call itself a bank, ergo I changed its name to “Kitty Neobank” above. Since it’s not a bank, Kitty Neobank does not have FDIC insurance – only its sponsor bank BofA does.

If Bank of America fails, FDIC will reimburse consumers of Kitty Neobank (conditions apply, as we’ll see in a bit). But, if Kitty Neobank fails, FDIC will not reimburse them.

Evolve (Bank) hasn't gone bankrupt, so FDIC won't cover.

Juno (Broker) hasn't gone bankrupt, so SIPC won't cover.

Last year, when I asked who'd pay my balance if BaaS company in between goes bust, nobody replied. I guess we'll find out soon.— Ketharaman Swaminathan (@s_ketharaman) May 14, 2024

VC backed companies in regulated industries have a history of leveraging regulatory gaps. While the AirBnBs and Ubers have done the same, I don’t keep my money with them – if they get shut down by their regulators, I’ve nothing to lose. That’s not the case with Kitty Neobank. Besides, banking regulators are known to clamp down on errant banks and fintechs with greater force and frequency than regulators of hotel, taxi, and other regulated industries.

I’m not saying banks don’t fail but I don’t think there’s any argument that VC-backed companies have a way higher failure rate. Depending on how you define failure and which source you use, mortality rate of VC funded startups is anywhere between 73% and 95%. Regardless of the definition of failure or the source of data, mortality rate of banks is less than 1/100th of that.

In case you think failure of a neobank / fintech and the ensuing loss of money due to non-reimbursement by FDIC is an extremely hypothetical situation, welcome to the ongoing Synapse-Evolve fracas in USA.

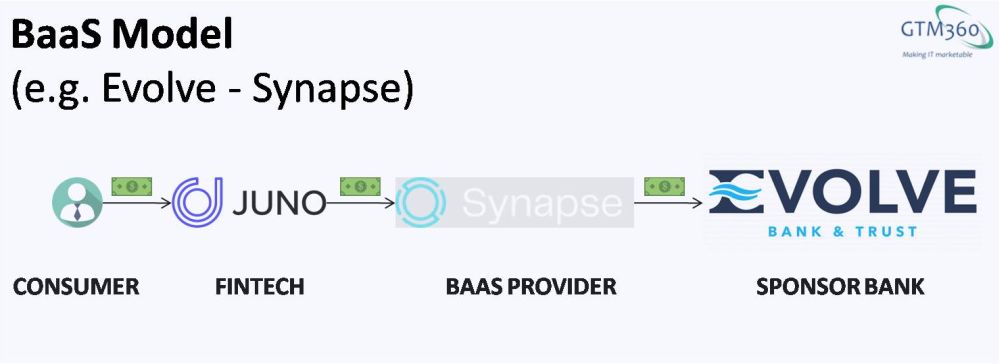

Evolve Bank & Trust is a regular FDIC-insured bank. Synapse Financial Technologies is a new-age BaaS (Banking as a Service) provider that connects fintechs with Evolve Bank. Juno Finance is one such fintech, which has its own consumers. The operating arrangement between these parties is illustrated in the following exhibit:

Synapse recently filed for bankruptcy. Suddenly, consumers of Juno – and Copper, Yotta, and many other fintech customers of Synapse – are unable to access their funds kept at Evolve Bank. Click here and here, to read horror stories of tens of millions of affected consumers.

According to a consumer of Yotta, Yotta refuses to answer any customer service inquiries. He can’t reach Synapse. Evolve says it can’t help. Federal Reserve Board says call FDIC, FDIC says call FINRA, FINRA says it’s “not aware of the issue” and says call SIPC, SIPC says… call Yotta. (H/T @mikulaja for this input.)

tl;dr: FDIC will not reimburse end consumers if Kitty Neobank fails.

If they think the sponsor bank (Bank of America) will reimburse them in that event, welcome to the murky world of FBO accounts.

When Kitty Neobank deposits its consumers’ funds in BofA, it can choose one of the following two types of accounts:

- Demand Deposit Account (DDA) account, where the neobank creates individual accounts for each of its consumers. This is also known as “oncore account” to signify that it’s configured on BofA’s core system. This might require KYC for each consumer with BofA.

- For Benefit Account (FBO), where the neobank has only one pooled account in its own name, and configures virtual accounts for its consumers. Only the FBO account is configured on the CBS of BofA. BofA recognizes Kitty Neobank, the beneficial owner of that FBO account, but may not know the identity of the end consumers of Kitty Neobank.

I’d mentioned earlier that, if Bank of America fails, FDIC will reimburse account holders of Kitty Neobank. Now is the time to add a major caveat to that: This is true only if their account has been configured as individual DDA account or as a pooled FBO account that has been ledgered and titled in accordance with the rules applicable for pass-through insurance.

If Kitty Neobank fails, and its consumers approach BofA, the sponsor bank will likely pay out the balance to them if the neobank opted for DDA option (but not FBO).

However, DDA accounts are costlier than FBO accounts. So, it’s an SOP for fintechs to use FBO accounts.

If Kitty Neobank has opted for FBO and its consumer John Doe approaches BofA after Kitty Neobank has failed, there’s no guarantee that the sponsor bank will pay out consumers of Kitty Neobank. This is because:

- BofA may not recognize John Doe if the FBO account is titled and ledgered without declaring John Doe’s identity.

- BofA may not know how much of the money in the FBO account of Kitty Neobank belongs to John Doe versus another end consumer Jane Doe.

- When Kitty Neobank moves its money to other banks in order to maximize yield, BofA has no way of knowing know how much of the departing versus remaining money in the FBO account belongs to John Doe as against Jane Doe.

- Kitty Neobank may not have placed the entire balance of John Doe in its FBO at BofA, so there could be a mismatch between what John Doe sees as his balance with Kitty Neobank and the actual amount lying in credit to John Doe’s virtual account at BofA.

Since I’ve firsthand experience of the gory details of configuration and operations of FBO accounts, I’ll never touch the non-insured Kitty Neobank with a 40 feet bargepole. I’d anyday prefer a slightly more painful – but direct – relationship with a traditional bank.

Any Fintech Mafia Carousel Pumper who tells you that your money is safe in an uninsured Neobank because it anyway puts it in an insured Sponsor Bank is either clueless, or lying, or both. As we’ve seen in the Synapse – Evolve fracas, if the neobank fails, FDIC will not pay out; the sponsor bank may not recognize you if you approach it directly; and banking regulators will wash their hands off (because no bank has failed). If the sponsor bank goes bust, whether you get your money back or not from insurance depends on how the neobank has ledgered its FBO account with it.

Either you can learn all about bankruptcy proceedings, navigate through the minutiae of FBO accounts, and finally settle for pennies on the dollar; or you can enjoy full protection for your money by depositing it directly in an insured bank. The choice is yours.

If somebody chooses to go the neobank route, here’s my unsolicited $0.02:

Get your account number and routing number on the sponsor bank’s stationery. Insist on being able to monitor this account via the sponsor bank’s online / phone / branch banking channels. Last, but not the least, get a confirmation that the sponsor bank will pay out your balance in the event the fintech / neobank goes bust.

According to Bloomberg Law article entitled Andreessen-Backed Fintech’s Meltdown Shows Bank Middlemen Risks,

Dominguez said he and his wife have account and routing numbers at Evolve Bank & Trust… But they have no way to prove that the money they deposited with Yotta – funds that went through Synapse and into accounts at Evolve – was theirs because Synapse controlled the ledger, which has disappeared since the company’s bankruptcy.

I don’t know how you can protect yourself from this risk, so I’ll conveniently assume that it’s a Black Swan event and not worth losing sleep over.

To prevent a recurrence of the Synapse-Evolve kind of debacle, I request banking / consumer protection regulators to stipulate the following rule:

Fintechs and neobanks who preempt the question of safety of money in their website and app should not be allowed to obfuscate their reply with their current declaration that they keep the money in an FDIC-insured bank. Instead, they must give the full answer: “Your money is kept in an FDIC-insured bank. FDIC will pay out if the bank fails but it will not pay out if we go bankrupt”.