The Indian capital markets recently moved from T+2 to T+1 settlement.

For the uninitiated, under T+2 regime, you got two days to deliver stock that you sold and the buyer got two days to pay you for the stock she bought. Under T+1 regime, both you and the buyer get only one day.

Many self-styled experts hail this move as a testimony to advanced technology. Take the OP of this LinkedIn Post for example. The post implies that T+1 is technically more advanced than T+2. Commenters then drink some more Kool-Aid and promote Indian capital markets technology to USA and other capital markets that operate on T+2.

While it kindles the Faux Nationalist spirit nicely, it misses that the capital markets of India is 10 times smaller than that of USA. Accordingly this narrative is as silly as other Kool-Aids like “UPI will replace digital payments infrastructure of USA” and “RBI should become the banking regulator of USA”, etc.

Whenever somebody talks about the Singapore governance model, Faux Patriots shout it down by saying that Singapore is smaller than Andheri, so its governance model can’t be applied to India. (For the uninitiated, Andheri is a largish suburb of Mumbai.)

Indian capital market is smaller than Manhattan’s capital market. So, by the same token, Indian capital market technology can’t be applied to American capital markets. Faux Patriots are making a fool of themselves by proposing this.

There are at least 10 differences in market infrastructure between capital markets in USA and India:

- The market cap of publicly traded stocks in India is 10 times less than that of publicly traded stocks in India: $4 trillion versus $45 trillion.

- Daily Trading Values are $1.75 trillion in USA versus $300 billion in India.

- There are 16 national securities exchanges in USA as against two in India (NSE and BSE). Reg NMS in USA obligates brokers to route orders to the venue offering the best price. It’s extremely challenging to determine the best price route and doing so requires specialized technologies (Cf. How Discount Brokerages Make Money by Patrick KcKenzie). In India, clients need to manually select whether they want their order to be sent to NSE or BSE, so there are no such specialized technologies like the ones that do this automatically in USA.

US markets work 24/7. Indian markets work only 6.5 hours per day (9:00AM to 3:30PM IST).

US markets work 24/7. Indian markets work only 6.5 hours per day (9:00AM to 3:30PM IST).- Broker-dealers / internalizers can settle trades without sending them to the exchange in USA. There’s no such complication in India since every trade has to go to the exchange.

- Dark Pool is a thing in USA whereas such a concept does not exist in India. There are more than 50 dark pools in USA including Euronext from NYSE, and Bloomberg Tradebook from Bloomberg. For the uninitiated:

DARK POOL

A dark pool is a privately organized financial forum or exchange for trading securities. Dark pools allow institutional investors to trade without exposure until after the trade has been executed and reported. Dark pools are a type of alternative trading system (ATS) that gives certain investors the opportunity to place large orders and make trades without publicly revealing their intentions during the search for a buyer or seller.- Investopedia

- If a broker goes bust in USA, investors are covered by SIPC insurance. There’s no such insurance in India. Contrary to another Faux Patriotic narrative, the beneficial owner of your shares in India is your broker, not you. See Who Really Owns Your Shares? for the gory details.

- Stocks have tickers in USA, which are symbols used uniformly across all brokers, broker-dealers and other market players e.g. $MSFT for Microsoft. Indian capital markets don’t have the concept of ticker symbol and each market participant uses its own notation for a stock.

- All publicly traded companies file their statutory reports in a common format on SEC EDGAR. There’s no of EDGAR for India – each company publishes its reports on its own website. This makes research and comparisons of companies easy and standardized in USA and cumbersome in India.

- Private companies don’t need to file detailed financials to the regulator in USA. In India, even startups – which are typically private limited companies – must file financials to MCA (Ministry of Corporate Affairs). And, what’s worse, the data is scraped by third parties and sold to the public, which sorta defeats the whole purpose of staying private.

Complain about the American financial system all you want, but you have to admit that its disclosure requirements are unparalleled. Company filings are made in machine-readable formats, the SEC literally tells you how to scrape them, and it’s illegal for executives to share material information with outsiders unless they immediately disclose it to everyone.1 And, on top of that, investment managers must file a Form 13F every quarter to disclose their positions for all the world to see—a world that definitely includes coattail-riders who would like to invest alongside a great manager without paying them massive fees. – Capital Gains dated 16 August 2023 via @ByrneHobart.

These differences undermine the relevance of Indian capital market technology for US capital markets.

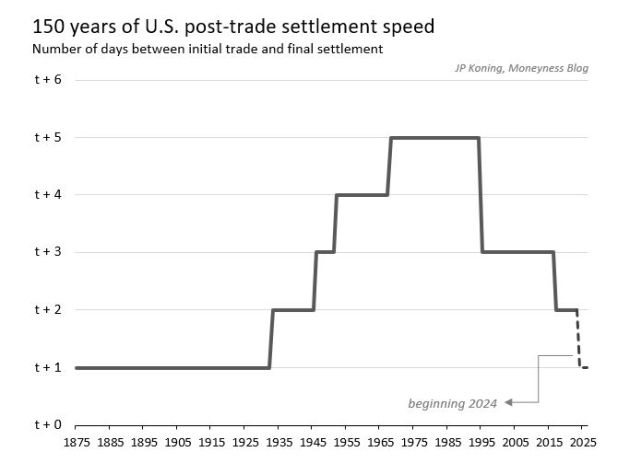

Besides, USA doesn’t need the Indian technology since it had T+1 back in 1875, when there was no capital market in India!

The natural question is:

@AlYodda: Why did the US increase the T over a period of time?

The answer is:

@s_ketharaman: For the same reason why NPCI is talking up wallet-based UPIlite now after promoting account-based UPI for the past six years: Cost versus benefit of realtime transaction processing. More at https://jpkoning.blogspot.com/2017/09/the-siren-call-of-t0-or-real-time.html

Double-clicking on settlement periods, the choice of T+n involves striking the right balance between counterparty risk and net settlement capacity:

- T+ ∞ enjoys infinite net settlement capability but suffers from infinite counterparty risk

- T+0 enjoys zero counterparty risk but has zero net settlement capability.

Different markets have chosen different settlement periods depending on their market cap, transaction value, etc.

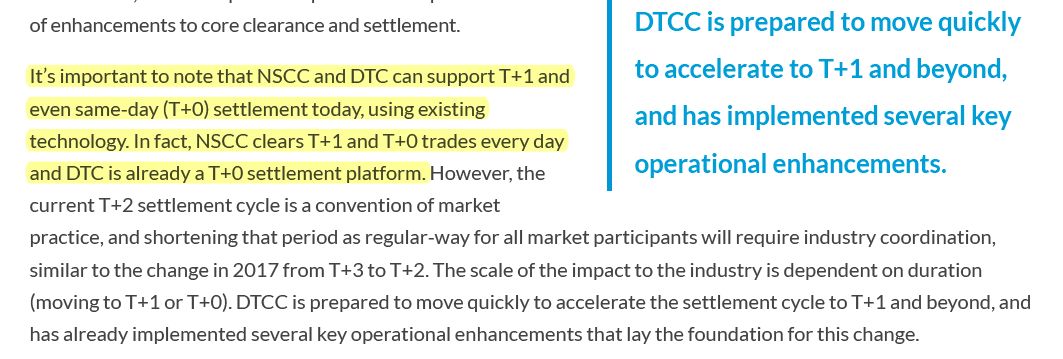

In the aftermath of Robinhood-Gamestop fracas in the US stock markets in 2022, DTCC testified that USA has the tech to support T+1 – or even T+0 – but recommended T+2 as the optimum.

As you can see, securities settlement speed is more about business than technology.

As Matt Levine explains:

Delay in securities settlement is not about archaic computer systems but financing. If trades settled instantly, you would need to keep cash somewhere accessible to the exchange at all times, so that as soon as your buy order got filled the money would be there. With T+2 or T+1 settlement, you can agree to do a trade and then go find the money. Maybe you have it invested in Treasury bills to get some yield, and the two-day delay lets you sell the bills to get the cash to buy the stock. Or maybe you need to borrow the money, from a bank or prime broker, to fund the trade. Big market makers and hedge funds are often levered, and someone else advances them the money to pay for their trades. It is helpful to have a day or two to line up that borrowing. – Matt Levine, Money Stuff, 10 May 2023.

Indian capital markets have already spotted a problem in the regulator’s mandate to migrate to T+0 in 2024.

According to Economic Times, the shift will create the problem of the same stock having two different prices depending on whether the market participant has selected T+1 or T+0. This is obviously a business, not technology, problem.

Another important point: USA has SIPC insurance, which protects investors from defaults by brokers. By underwriting a key component of counterparty risk, SPIC enables the American market infrastructure to cushion the higher counterparty risk inherent in T+2. Since there’s no SIPC of India, the Indian market infrastructure is extremely fragile on T+2 and needs T+1 to adequately mitigate counterparty risk.

In short, T+2 strikes the right balance for USA whereas T+1 makes a virtue out of necessity for India.

tl;dr: Guys who promote the playbook of a $4T market to a $45T market might appear patriotic to the gullible sheep. But, once their shill is busted by people in the know, they become a laughing stock in front of the whole world and thereby anti-national. They should be careful what they wish for!