Since times immemorial, merchants have complained that banks charge exorbitant fees for processing credit card payments. Called Merchant Discount Rate (MDR), this fee is around 2% of the transaction value, as described in my blog post titled Credit Card Primer – Interchange, MDR & Surcharge.

In this post, I will shatter the myth that MDR is exorbitant.

Let’s get on with it.

Merchants Can’t Source Cheaper Credit

Since the dawn of business, shopkeepers have been giving credit to their consumers. This is because:

- They’d lose business if they didn’t.

- They’d be able to make their customers spend more if they did.

Before credit card came along 70 years ago, stores gave credit by themselves. Since the typical mom-and-pop store didn’t qualify for formal credit via banks and NBFCs, most merchants had to borrow from informal and semiformal lenders like Patha Sanstha (in Maharashtra), community lenders (in Marwari community all over India), if not outright loan sharks (in New York City). They paid usurious interest for those borrowings. If they defaulted on those loans, they risked getting ostracized by the community (if not have their knees capped in addition). On top of that, they suffered the overheads of accounting, tracking of outstandings, and chasing up with customers for collections.

Banks entered the picture and enabled merchants to outsource the whole process of credit via credit card in return for a fee aka MDR.

Merchants who complain that the 2% charged by issuer banks for this service is exorbitant should break off with credit cards and go back to the traditional method giving credit from their own book. Actually, some of them tried doing that, and the movie didn’t end well: Best Buy, Publix, Walmart and other leading American retailers with annual sales of one trillion dollars got together in 2012 to build a new method of payment called CurrentC that would charge merchants only 0.5%. They shut down the consortium created for this purpose (MCX) in 2017.

Merchants realized long ago that 2% is a steal. If they could really source cheaper credit from elsewhere, they would have killed credit cards long ago – if not nipped them in the bud in the first place. The longevity of the credit card industry is Exhibit A that merchants can’t get credit for lower than 2% cost on their own.

For all their whining about MDR, merchants have undoubtedly benefited by outsourcing their credit-giving process to banks.

A new card network with 2X Rewards & 0.5X MDR of Visa / MasterCard will be highly disruptive. It won't be profitable. But that hasn't stopped VCs from funding disruptive startups. Will we see such a startup soon? https://t.co/AUMVK1o5Ii #RuPay

— GTM360 (@GTM360) February 7, 2019

BNPL

After constantly complaining about 2% MDR of credit card, medium to large merchants have signed up with Affirm, Afterpay, Klarna and other BNPL providers in droves – and are paying them a whopping 3-6% 5-12.5%.

PayFac

Micro and nano merchants who are rejected for credit card acquiring by traditional banks have signed up with mSwipe, Square / Block, and other merchant aggregators / payment facilitators (payfacs) – who charge 2.75% fees.

False Narrative

Merchants have resorted to fake sob stories while trying to spread the false narrative that they’re poor hardworking folks badly squeezed by greedy banks.

Take the example of Bump ‘n Grind, the coffee shop featured in the Wall Street Journal article titled The Credit-Card Fees Merchants Hate, Banks Love and Consumers Pay.

For Bump ’n Grind, an independent coffee and vinyl record shop, that is a growing burden. The shop, which roasts its own coffee beans, spent less on green beans last year ($12,827) than on the card-processing fees ($18,645) it pays to the financial institutions that enable cashless payments. “That’s depressing,” said owner David Fogel.

Let’s do some math here:

- Spend on coffee beans: $ 12,827.

- Spend on credit card processing fees / MDR: $18,645.

- Sales = $18645/0.02 = $932,250 (assuming 2% MDR).

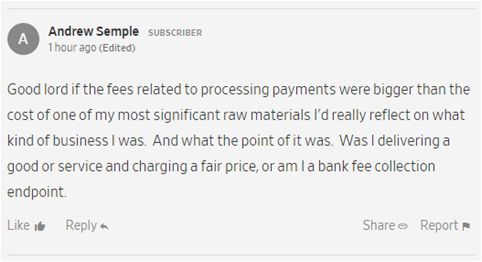

How does a coffee shop sell nearly a million dollars worth coffee after buying only $12,827 of coffee beans, its main raw material?

While the author of the article let this BS pass, one of the commenters caught it out:

One Sided Practice

Since Reg ZeroMDR came into effect in India on 1 January 2020, MDR for UPI payments has been zero (IIRC it was 0.6% or 0.8% before that). I don’t readily recall the debit card MDR figure but it’s many times lower than credit card MDR.

While they constantly whine about the 2% they need to pay banks for credit card payments and slap surcharge on consumers paying with credit card, they will never mention that they incur lower cost for cash, UPI and debit card and don’t pass it on to consumers paying with these non-credit card MOPs by way of reduced prices.

This is an extremely one-sided practice. Not passing on a reduction in tax attracts the scrutiny of anti-profiteering regulation in many jurisdictions. Not sure if failure to pass on lower costs of processing cash, UPI and debit card is illegal but the practice is definitely shady. (Not legal or taxation advice.)

Some people claim that credit card companies forbid merchants from giving discounts to customers paying with non-credit card method of payment. That’s not true.

While the No Surcharge rule stops merchants from penalizing credit card payments by levying an addtional fee (“surcharge”), it does not stop them from incentivizing cash and other modes of payments by giving a discount. More in my post entitled Credit Card Primer – Interchange, MDR & Surcharge.

Greedy Illegal Inconsistent Behavior

Back in 2011, I wrote a post titled Do American Retailers Want To Have Their Cake And Eat It Too?. 12 years later, merchants continue to be greedy.

In the Flaming the Fees podcast episode titled Merchant Fees And Surcharging, Glenbrook Partners‘ Yvette Bohanan narrates an incident at a coffee shop in New Jersey. The store had a sign saying it will charge 3% for credit card payments. On the face of it, this is kosher since No Surcharge rule was repealed in NJ years ago. However, when she scratched the surface, Bohanan discovered two things:

- The store levies 3% even for debit card. Apparently, customers are supposed to understand that “credit card” is a catch all term for all types of payment cards including debit cards.

- The POS terminal had a sign saying you can pay with Afterpay. For the uninitiated, Afterpay is a BNPL owned by Square / Block.

Debit card MDR is 10X lower than credit card MDR, so slapping the same 3% surcharge for debit card is greedy. Furthermore, levying any kind of surcharge for debit card payments is illegal. Not levying any surcharge for BNPL whose MDR is as high as 3-6% is inconsistent with charging 3% surcharge for credit card whose MDR is only 2%.

While merchants deserve respect for their unstinting hard work among other values, the body of evidence presented above suggests that they don’t need any sympathy on account of credit card processing costs. If somebody’s heart still bleeds for them despite all this, let me leave you with the following numbers:

When you pay ₹100 with a Visa / MasterCard / RuPay credit card, the merchant incurs a processing cost of ₹2, the bank collects the ₹2, its profit goes by up ₹2, being a regulated and publicly traded company, it can be trusted to pay income tax due on the incremental profit. OTOH when you pay with cash or UPI, the bank gets no revenue, has no incremental profit, pays no tax, the merchant saves ₹2 and his profit goes up by ₹2. I leave it to your imagination to guess how much tax is paid by the average streetside vendor on that incremental profit.