Back in the day, technology vendors used Feature Selling to sell their products. In this technique, they use product features to create interest among the target audience. As everybody and his dog talked about ERP, CRM, MA, CBS, etc., the market got crowded. As our inboxes filled up and our attention spans dwindled, this method started showing its cracks.

Then came Benefits Selling where vendors went to market with messaging around the benefits delivered by their product. This worked for a while but, over time, customers had their own pain areas and benefits touted by vendors didn’t resonate with their pain-alleviation priorities.

LOSS AVERSION PRINCIPLE

The pain of losing is psychologically twice as intense as the pleasure of gaining, therefore people try two times harder to avoid a loss than to make a profit.

The solution for this was Thought Leadership, whose core GTM was “If you stop doing X and start doing Y, you will gain $$$” (where the product would enable Y). This was effective until customers realized that running a company was a fulltime job in itself and there was a limit to how many new things they could do, no matter the $$$ gained. Eventually, thought leadership lost its sheen.

Then came Insight Marketing, which uses the following GTM: “By doing X, you’re losing $$$. Do Y instead and avoid this loss”. By leveraging the powerful Loss Aversion Principle, this negative-sounding message became very effective. It’s right now the the best practice in B2B technology business development. (But it needs kids gloves treatment. See Loss Aversion: Using Negative Messaging In Marketing for tips on when and how to utilize this technique.)

All of the above are business development tactics followed by SDRs to reach out to prospects who don’t know them. In other words, they’re Top of Funnel (TOFU) techniques targeted at prospects for whom the vendor is a stranger.

If you notice, they don’t talk about technology even though they sell a B2B technology product.

It’s implicit in the process that

- Once BDEs generate interest among prospects by using these techniques, they will hand over the case to sales

- Sales will talk about the underlying technology of the product as they walk prospects through the Middle of Funnel (MOFU) and Bottom of Funnel (BOFU) stages.

“If you ever sue the government, our new AI lawyer is ready to crush you” ~ Logikcull TOFU Email.

The company won't actually crush anyone but uses the crushing language “for the sake of starting a conversation.”

tl;dr: All is fair in business development and war!!!— GTM360 (@GTM360) June 7, 2023

Some BD influencers have started professing that customers are only interested in Job To Be Done and advocating that technology doesn’t matter at all in B2B technology sales.

Customers don’t want AI, they want to get the job done. – LinkedIn

In my opinion, they’re too drunk on the business develoment Kool-Aid.

In this post, I will walk through a few aspects of B2B technology sales and explain why technology does matter.

First, I’ll talk about why technology should matter. Then I’ll cover a few case studies where technology has mattered.

Why Technology Should Matter

In theory, customers who just want to get the job done do not buy products. They outsource their job to external service providers. And, as far as possible, they pay only for the outcome, not for the activities carried out or the tools used by the service provider to deliver the outcome. This cohort is characterized by Deng Xiaoping’s famous line:

No matter if it is a white cat or a black cat; as long as it can catch mice, it is a good cat.

Companies who buy technology products fall in five segments of the so-called Technology Adoption Life Cycle (TALC).

- Innovators and Early Adopters, comprising 15% of the total market for technology products, who buy technology for the sake of technology. This cohort buys a mouse trap for the sake of mouse trap.

- Early Majority, Late Majority and Laggards, which comprise 85% of the market, and buy technology to solve business problems. This cohort buys a mouse trap to catch a mouse.

The first cohort obviously cares for technology.

The second cohort – aka “mainstream market” – also cares about technology because it senses that the nature of technology shapes the degree to which the job can be done. In short, it believes in the concept of “better mousetrap”.

Besides, JTBD in business remains unchanged over long periods of time e.g. increase revenue, reduce cost, etc. The main reason why newer versions of the same software products continue to sell for decades (e.g. Excel for 30+ years) is not because they unearth a new JTBD but because they achieve the same old JTBD “faster, better, and cheaper” (select any two out of the three!).

To unpack this, let me take the following example related to Artificial Intelligence.

If AI can predict the container price three quarters down the line, then it could be a boon for the shipping industry – N Subramaniam, Chief Operating Officer of Tata Consultancy Services via The Register .

I once developed a model on Excel to predict the cost of CPU, RAM, HDD and other components that go into assembling a PC. As explained in MENA Distributor Grows Government Sales Sharply, this helped my old company to sharply increase win rate of government tenders.

Going by that experience, I can appreciate how predicting container cost three months down the line can be useful for the shipping industry.

The JTBD in this case is “Predict container cost”.

Excel can do the job, as it did for me decades ago. So can AI.

I was not around for it, but I assume that there was some period where most companies kept their accounts by hand, and some technologically savvy companies started using electronic spreadsheets, and maybe those companies would get on earnings calls and say “VisiCalc is a really important part of our revenue growth journey,” and then time passed and spreadsheets are just an unremarkable norm now. – Matt Levine @ Money Stuff.

In today’s world, if one vendor goes to market with “Excel-based Predictive Analytics” and another vendor goes to market with “AI-based Predictive Analytics”, which vendor do you think will appeal more to the prospect?

I thought so, too.

AI obviously appeals more now because it can do a better job at predictive analytics than Excel and can thereby predict container costs with greater accuracy than Excel. (It’s another matter that, despite believing in the superiority of AI for predictive analytics, many prospects might still settle for an Excel-based prediction model, so I’d caution vendors to avoid going head-on against Excel!)

The above illustration shows two things:

- Prospects are hooked on a product based on what its JTBD is. This happens at the TOFU. Technology does not play any role here (with one exception related to once-in-a-decade type of pathbreaking technologies that we’ll see in a bit).

- Prospects then evaluate the product for how well it accomplishes the said JTBD. This happens at the MOFU and BOFU stages. Technology plays an important role here.

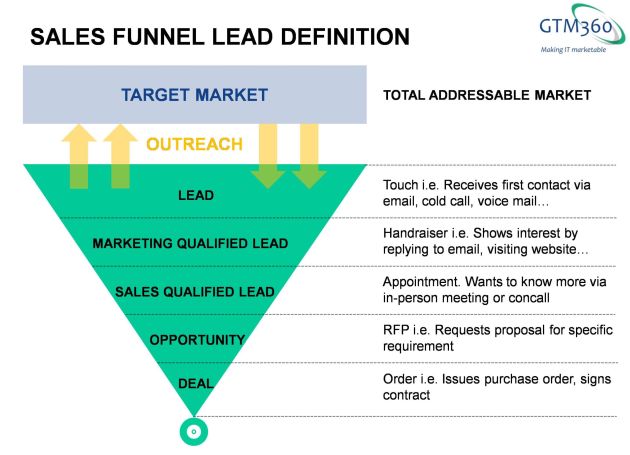

For the uninitiated, the various stages of sales funnel are illustrated in the following exhibit:

Where Technology Has Mattered

I’ll cover three case studies where technology has mattered in B2B technology purchases.

#1. Database

Back in the day, I used to sell a software that was available only on MS SQL Server. I lost deals only because the prospect’s company had standardized on Oracle RDBMS and did not want to introduce yet another RDBMS in his IT landscape and go through the headaches of different skills, teams, and licensing policies. In this case, there was no difference in JTBD and technology alone drove the purchase decision.

True but only at TOFU.

At MOFU and BOFU, customers do care about your product from pov of how it will fit their IT and cultural landscape, change management thereof.

Too much emphasis on business value can be a dealbreaker beyond a stage. https://t.co/HyPeYJVaIG— Ketharaman Swaminathan (@s_ketharaman) November 2, 2022

#2. Blockchain

I have won software deals only because my software was on blockchain and the prospect’s CEO had issued a diktat to her CIO to implement something on the blockchain pronto. In this case, the JTBD came after after the technology was purchased for the sake of technology.

#3. Artificial Intelligence

NYC subway using AI to track fare evasion ~ NBC News.

Here the JTBD is “Track fare evasion”.

Subways all over the world, including NYC, use turnstiles to let only valid ticketholders pass through to the platform. Some subway riders do try to jump over the turnstile without buying tickets. To stop them, I’ve seen “Turnstile Inspectors” standing beside the turnstile catching such people.

To that extent, the job of catching fare dodgers is already done by turnstiles and turnstile inspectors. If they’re doing their job, there shouldn’t be any fare evaders on the platforms. Why does NY Subway need an AI-based CCTV system to track them?

I can think of three reasons:

- AI can do a better job than turnstiles and turnstile inspectors.

- “Track fare evasion” is only the front JTBD. The real JTBD is to surveil terrorists and other criminals, which is obviously beyond the scope of turnstiles and turnstile inspectors.

- To encash the current AI hype.

I haven’t traveled by New York Subway but, going by my personal experience in tube / metro / subway stations in a number of other cities including London and Mumbai, turnstiles and turnstile inspectors are quite fool proof. At worst, they might let the one-odd fare dodger get past them. I doubt if there’s any ROI for a fully fledged AI + CCTV system to track the residual incidence of fare evasion. I rule out reason #1.

While reason #2 sounds like a QAnon type of conspiracy theory, I won’t dismiss it. For one, it’s advanced by a friend who has lived in NYC / Manhattan for 30+ years, so he knows how New York operates. For another, in a Lee Child novel, Jack Reacher observes rapid blinking and other tells of passengers in NY Subway to spot a terrorist suicide bomber. AI can probably do the job faster / better / cheaper than having to employ a trained human operator in each car of a subway train.

Coming to the third reason, NY transit authorities have excellent PR departments and AI is a great way to ply their trade. Back in circa 2004, I read an article that said that the Jersey City-East River Ferry company introduced NFC terminals to accept contactless credit cards for buying its tickets. At the time, NFC contactless was a totally novel technology. On my next trip to USA in 2005, I decided to check it out. I was staying in my company guest house in Jersey City. I had two options to reach my office in 37th Street in Manhattan: (1) Walk to PATH station in Jersey City, take the train to 34th St. station on Manhattan side, and walk to my office. Total fare: $2 (2) Walk to Jersey City Ferry Terminal, take the ferry to East River ferry terminal on the Manhattan side, take a taxi to my office. Total fare: $26. Despite the big difference in cost, I chose the ferry option since I was keen to check out the new tap-and-go technology and went to the ferry terminal. When I inquired about contactless cards at the ticket counter, the attendant had no clue what I was talking about! Long story short, the ferry service went contactless only 10 years later. Extrapolating from that experience, it’s quite likely that AI will have a solid business case for tracking fare evasion on NY Subway by 2033 and NY Transit has preannounced it by 10 years to cash in on the current AI hype. Reason #3 is quite plausible.

Notwithstanding the reason, AI is the driver of NY Transit’s purchase of AI-based CCTV surveillance system to track fare evasion in all three cases. In the first two cases, the customer is buying AI with the belief that it’s a faster / better / cheaper way to achieve its JTBD than its existing methods. In the third case, it’s buying AI virtually for the sake of AI.

In a nutshell, while companies rarely buy technology for the sake of technology, they always care about a particular technology in as far as it is a “better mousetrap” to get a job done as compared to some other technology (or non-technology alternative).