Fintech came into existence with the charter of disrupting traditional banks. It sought to achieve its mission by democratizing finance with modern technologies and superior customer experiences. The plan was to unbundle banking into multiple products, be a CHILL entrant in each product, bring the unbanked and underbanked into its fold first, then work its way upwards to poach mainstream banking customers, and thereby inflict “death by a thousand cuts” on banks.

To qualify as Disruptor, a product must be CHILL:

CH: Cheap.

I: Inferior quality.

LL: Low end target market.Ergo:

* Uber did not disrupt yellow cab

* iPhone did not disrupt smartphone / Nokia / BlackBerry— Ketharaman Swaminathan (@s_ketharaman) May 31, 2021

Google followed this strategy with its now-defunct Google Plex bank account. You can read more about it in my blog post titled RIP Google Plex.

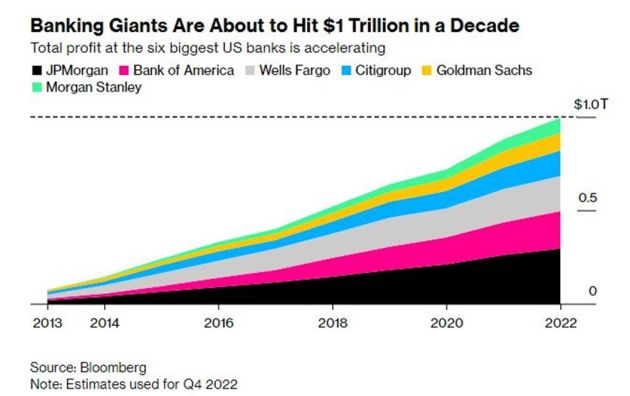

Fintech has flopped in its mission. Far from being killed by fintechs, the banking industry has grown by leaps and bounds and continued to be the most profitable sector in FORTUNE GLOBAL 500. In the last decade 2012-2022, the industry made more than a trillion dollars in profits.

I doubt if the entire fintech industry even got that many pageviews for its websites and apps, let alone revenue or profit.

It’s hard to say whether

- banks matched the modern technologies and superior CX of fintechs

OR

- banking customers didn’t care as much for modern technologies and superior CX as fintechs had anticipated.

But one thing is clear: Fintech cannot disrupt banks.

When that piece of reality dawned on the industry, fintech changed its tune to partnering with banks over technology. A bunch of finsurgents emerged, with advice to fintechs on how to go about doing that. Cf. Finextra article in 2016 entitled “Advice to Fintech Firms: How to Partner with Banks”.

Having been a supplier of technology to banks for two decades, I was very skeptical about fintech’s partnership mantra. In deluding themselves into thinking that they invented the bank-partnership concept, fintechs missed a few basic facts of business:

- Banks have successfully partnered with the Accentures, IBMs and TCSs of the world (who I call “fincumbents“) for 40-50 years. It has been a complementary relationship, with both parties crystal clear about their respective roles and responsibilities: Most banking products work on top of technology, banks can’t / won’t build core banking software, credit card management systems, and other technologies, instead they will buy them from fincumbents, who, on the other hand, will not offer checking account, debit card, credit card and other products to compete with banks.

- Banks are not fools. They will see through fintechs’ partnership ruse as a self-preservation tactic.

- Nobody likes to partner with someone who publicly threatened to kill them until recently, and still probably continues to do so in private.

In short, banks need technology, they’re getting it from fincumbents, and fintechs are the last people with whom they will partner.

It’s not only me. The very title of Ron Shevlin’s article in The Financial Brand says it all: The Foolish Fantasies of Fintech / Bank Partnerships.

Sure enough, the partnership mantra has not worked too well.

Sure enough, the partnership mantra has not worked too well.

Not wanting to fob off fintechs totally, banks are telling them to line up in front of their procurement department to get themselves enrolled as a potential technology supplier, as they’ve told all technology companies for the past 40-50 years.

Anyone who has been there and done it knows that it’s a long and cumbersome process.

A new bunch of finsurgents has cropped up now, advising fintechs to invest in SOC2, GDPR and other regulations in order to get empanelled by banks. See How Fintechs can Partner with Banks – Challenges and Opportunities for some pearls of wisdom along these lines.

In my opinion, fintechs should ignore this advice. It’s their first rodeo with bank partnership. They’re naive to think that they dislodge fincumbents who have been around the proverbial Wall Street and Canary Wharf blocks for decades by just getting a few certifications. No point throwing good money after bad.

Going by the Evening Standard article entitled UK Fintech investment drops by more than a third, it seems like fintech investors have come to the same conclusion.

Lacking any significant success on its own and absent any path to revenue and profit by partnering with banks, the fintech industry seems to have reached a dead end amidst the current funding winter.

Not surprisingly, half of fintechs surveyed recently have flagged the risk of shutting down by the end of 2023.