Whenever a new term enters the hype cycle, it’s fashionable for people to bandy it about all the time, sometimes correctly but most of the time loosely.

Embedded Finance is one such term.

In this post, we will unpack the term, specifically from the consumer point-of-view.

A consumer goods retailer in India offered installment purchase of transistors in the 1950s. I bought insurance from the Expedia.de website when I booked a packaged tour to Paris in the early 2000s. Car dealers have been offering loans for purchase of automobiles since … since forever.

@gtm360: TIL: “Buy Here Pay Here” car dealer. Puts a device that locks the car if loan repayment is late even by a day. https://qr.ae/pNBgXL.

These are all examples of embedded finance, where financial products are distributed via nonfinancial entities. But the concerned retailers, online travel agents and automobile dealers are not “embedded finance providers”. Only tech companies can be embedded finance providers.

To understand why, let’s take a look at another related and frequently-misunderstood term: Fintech.

Fintech is not financial technology but a type of company that uses technology to sell financial products like checking account, credit card, BNPL loan, etc. Ergo Fintech is a Vertical.

Embedded Finance is not a company but a technology stack that’s used by a non-financial company to sell a financial services product (in addition to selling its core product / service without using that technology). Ergo Embedded Finance is a Horizontal. By definition, an embedded finance provider will belong to the IT industry, operating directly or via BaaS LOB of a bank.

Examples of such financial services products include insurance, loan, and BNPL.

Just to be clear, payments involved in the fulfillment of purchase of a non-financial product is not embedded finance. Embedded finance must involve the sale of a financial product along with the sale of a core product on the merchant’s platform. Accordingly, a plain vanilla electronic payment gateway (ePG) solution is not an example of Embedded Finance.

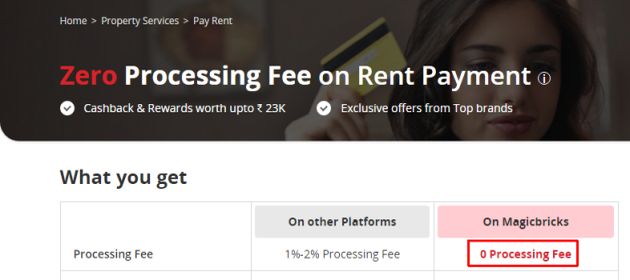

A good example of embedded finance is payment of house rent with credit card on a real estate portal e.g. MagicBricks.

In the past, a tenant would pay house rent to the landlord via cash, cheque or an A2A method of payment like NEFT / IMPS / UPI. Many tenants still do that. But some of them have switched to credit card and enjoy deferred payment, reward points, and other benefits that they did not get with their previous previous methods of payment.

Landlords cannot be expected to qualify for merchant account from an acquirer bank for accepting credit card. So, they must continue to get the rent via direct credit into their bank account, as always. Enter embedded finance provider (e.g. Red Girraffee) that converts the tenant’s credit card payment into an A2A payment. The portal charges a 0.5-1% fee to the tenant for this product.

Landlords cannot be expected to qualify for merchant account from an acquirer bank for accepting credit card. So, they must continue to get the rent via direct credit into their bank account, as always. Enter embedded finance provider (e.g. Red Girraffee) that converts the tenant’s credit card payment into an A2A payment. The portal charges a 0.5-1% fee to the tenant for this product.

@s_ketharaman: Yo @magicbricks, one section on your website says processing fees for paying rent with credit card is 0%, another section says 1%. Which is correct?

The tenant is happy to pay this surcharge since they get up to 2% rewards on select credit cards, which more than covers the cost of surcharge levied by the real estate portal.

Some other examples of embedded finance are as follows:

- Mortgage on real estate, car dealer websites (e.g. Volkswagen-Volkswagen Credit)

- Travel insurance on OTA (e.g. Expedia), rideshare apps (e.g. Ola-Digit)

- BNPL loan on ecommerce (e.g. Amazon), home improvement websites / apps

- Receivables Financing / Revenue Based Financing / Factoring on ERP invoicing module and B2B e-marketplaces (e.g. Amazon Germany-ING).

There’s no doubt that embedded finance takes customer convenience to the next level. In fact, I cited the above mentioned purchase of insurance on Expedia.de website – one of my earliest experiences of embedded finance – as a canonical example of excellent usability in my TEC article entitled Usability.

But this convenience may come with downsides in terms of opacity and dark patterns.

Maybe it’s only me but I’d like to know explicitly what financial commitments I’m taking on.

As Steve Cocheo notes in The Financial Brand article titled Crafting Amazon-Like Banking Experiences Easier Said Than Done,

There’s a big difference between Netflix recommending a movie and my bank giving me good, safe financial advice.

To that extent, I’d like to be in full control of my financial actions.

In its early days in India, Uber would automatically debit the fare at the end of the ride to the credit card on file (The rideshare numero uno still does that in countries where online payments are not subject to two factor authentication). While it was extremely convenient, I was somehow not thrilled with money leaving my account without my explicit approval. Worse still, since Uber did not display the fare estimate before I booked the ride in that era, I didn’t even know the amount that would get debited in advance. Finsurgents called this “invisible payments” and raved about it as a great example of embedded finance but I thought it was “blind payment” and close to pick pocketing. Ergo, I never opted for credit card to pay for my Uber rides, even though credit card has been my go-to method of payment for everything forever.

Cue to the present day.

According to reports, people have clicked around an ecommerce website and suddenly found their credit score was dinged or tapped around a rideshare app and suddenly found themselves on the hook for a BNPL loan.

@thekaipullai: Once upon a time when I used Ola, without my permission, put me on postpaid. And now, I apparently owe them 1000 bucks. And they have been calling me for the last 4 years to recover.

These are classical examples of embedded finance in that a non-financial platform sold a financial product along with the core product in a single seamless customer journey.

However, since the buyer had no intention of buying a financial product in either case, they are gotchas and expose the dark underbelly of embedded finance from the consumer point-of-view.

By all means, consumers should feel free to enjoy the convenience offered by embedded finance.

However, they should also use truckloads of Caveat Emptor while dealing with it.

Notwithstanding the number of ads released by companies saying they put customers at the center of whatever they do, it’s the fiduciary duty of a company in capitalism to put its shareholders’ interest above the interest of its customers – not to mention employees or suppliers – while deploying embedded finance, or engaging in any other business pursuit.

It’s only fair that consumers should reciprocate by treating it as their fiduciary duty to look out for their self interest while engaging with companies.