People regularly complain that it’s very hard to decipher bills and statements from banks.

Rant from Quora:

Why are the description info on Bank Account Statements so confusing? We cannot find what is the debit for and from whom the payment / transfer has come in. End of the month when you see the statement we have to break our heads to decipher the various entries.

Rant by a VC on Twitter:

@rajeshsawhney: Bank statements are difficult to read.

Related rant on Quora:

Imagine the amount of manpower wasted throughout the world on a simple activity like Bank Reconciliation. Banks can make an onetime change to display the details entered by the initiator of the transaction performing the transaction.

Let me add more two examples (from personal experience that go beyond banking).

EXAMPLE 1: ECOMMERCE BILL

I ordered an item from an ecommerce company and received the following bill.

This is the description of the ordered item in the bill:

Despite magnifying this section by 2X, I still cannot decipher what I ordered.

The bill is over a foot long but it still doesn’t find enough room to print the full – or even readably long – description of the ordered item.

EXAMPLE 2: BANK STATEMENT

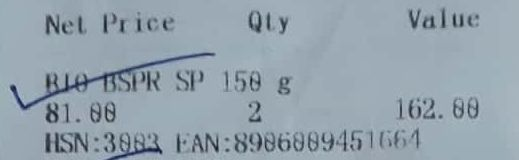

I read in a Matt Levine Money Stuff column that American companies do not know the identity of their retail shareholders because their shares are owned by DTCC, which issues IOUs to retail shareholders.

Accordingly, companies cannot send dividend warrants, proxy notices, and other communications directly to their retail customers. They send these comms to their R&Ts, who in turn send them to retail customers via brokers.

The market structure is illustrated in the following exhibit:

I was wondering whether the same was true in India. I asked the CFOs of a couple of publicly traded companies. They assured me that they do know the identity of their retail investors.

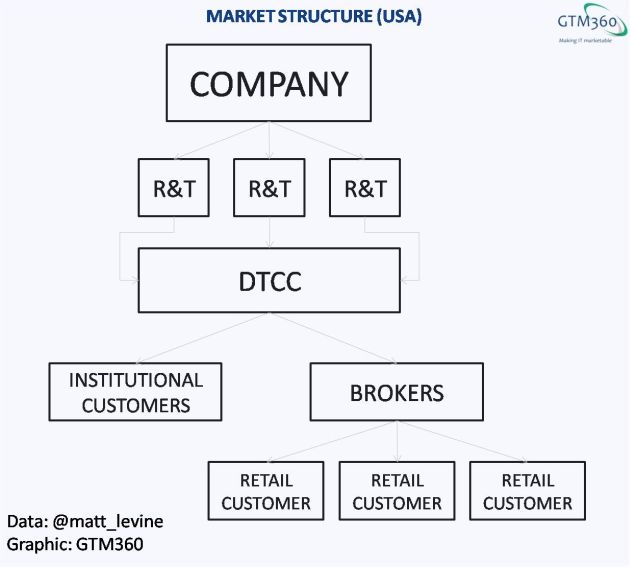

However, I became a bit skeptical about that offhandish claim when I received the very next dividend notification. It was for my shares in Wipro Limited (Disclosure: Ex-employer).

While the email had the masthead of Wipro, it came from a non-Wipro email address (wipro.cs2011@kfintech.com).

I first thought Wipro must have outsourced this email campaign to K Fintech.

But a non-Wipro email still didn’t make sense. In my company, we run email marketing campaigns on behalf of our customers. Companies who outsource their email campaigns to us inevitably insist that we send out the emails from their email address. Going by that industry best practice, if Wipro had merely outsourced this campaign to K Fintech, I should have received the email from some @wipro.com email address like investorrelations@wipro.com. Since I didn’t, it’s plausible that Wipro does not know my email address – only K Fintech does.

(For the uninitiated, as explained in Your Personal Data Is Not Sold, Just Used, the agency that runs an email campaign for a client need not share email addresses with the client. The way it works, the client hands over the creatives to the agency and the agency sends out the emails to all the addresses in its list. The agency only forwards responses, if any, to the client, so the client does not have the full list.)

To get a definitive answer, I decided to find out who had paid the dividend to my bank account.

To get a definitive answer, I decided to find out who had paid the dividend to my bank account.

Back in the day, you’d get dividends by cheques and the cheques would be accompanied by a covering letter stuffed in an envelope with a logo, so it was obvious who paid you.

But, in modern times, dividends are credited directly to the shareholder’s account via electronic fund transfer methods like ACH or NEFT, so there’s no equivalent of covering letter or envelope. Even the fund transfer advice does not mention the payor’s name. You’re left with the payment reference to figure out who paid the dividend.

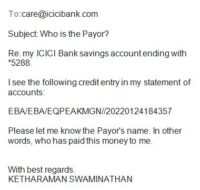

The narration in my bank statement for this payment was EBA/EBA/EQPEAKMGN//20220124184357. Like most narrations, it made no proximate sense.

I therefore reached out to my bank with a request to clarify whether the payor was Wipro or K Fintech (or somebody else).

I never heard back.

Looks like even my bank couldn’t decipher its statement of account!

It’s not only this bank. A couple of years ago, I received an unexpected payment in my company account in another bank. Even that bank wasn’t able to figure out the payor’s name from the narration. (It turned out to be income tax refund.)

The above examples make it amply clear that bills and statements are hard to decipher – not only in banking but also in ecommerce, retail and other industries.

In a follow on post, I’ll advance some reasons for poor readability of bills and statements and propose a few solutions to solve this problem. Watch this space!