In 10 Best Answers For Peter Thiel Interview Question – Part 1, I gave five answers to the following Peter Thiel interview question:

What is the one thing that’s true but nobody believes it when you tell them?

In this second part, I’ll give five more.

Here goes.

#6. Fixed deposit beats inflation

Matt Levine once said:

One way to do fraud when you are pitching an investment is to lie about the investment. Another way is to lie about the alternatives.

I see this all the time in investment products sales.

In a bid to sell mutual funds and other financial products on which they earn fat commissions, distributors claim that fixed deposit – the alternative financial product on which they don’t earn any commission – trails inflation.

That’s a lie.

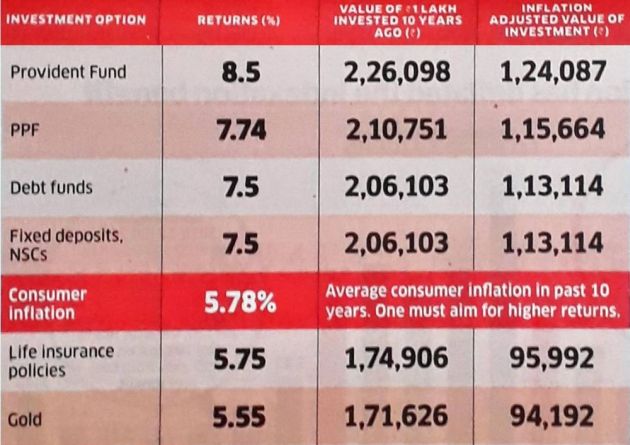

According to ET Wealth edition dated 25 July 2022, FD has beaten inflation during the last 10 years.

#7. Fixed deposit beats equity in the long term

Fixed deposit has consistently outperformed even equity over the long term. See Equity Always Underperforms Fixed Deposits for more details.

I've been doing this for a year.

When I last checked my portfolio, only 3 scrips were above water. All 3 are index ETFs.

If you're sure of beating the index, you should make billions by running a hedge fund instead of being a retail investor.— Ketharaman Swaminathan (@s_ketharaman) May 4, 2022

#8. My Google ID is not my Gmail Address

I signed up for Google Ads, Google Adsense, Google Analytics, and Google Drive before Gmail was launched.

In fact, I signed up for YouTube before it was even acquired by Google.

As a result, my IDs for many Google products are not Gmail.

People who registered for Google Drive and other Google products after signing up for Gmail find this hard to believe.

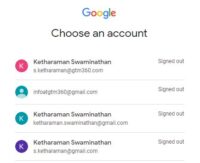

But, as you can see from the exhibit on the right, I’m not fibbing. s.ketharaman@gtm360.com is indeed my ID for Google Analytics and Google Drive (This account does not run on Google Mail).

But, as you can see from the exhibit on the right, I’m not fibbing. s.ketharaman@gtm360.com is indeed my ID for Google Analytics and Google Drive (This account does not run on Google Mail).

While on the subject, I signed up for Google Ads with info@gtm360.com (Google is not the Email Service Provider for this account, either). For years, I’ve logged in with this address. I still do but Google has recently started showing another email – infoatgtm360@gmail.com – on my Google Ads dashboard.

This gmail account must be serving some internal purpose within Google since I’ve never logged in to it and Google Ads continues to send all updates to info@gtm360.com.

#9. People don’t get free healthcare in developed countries

People don’t get free healthcare in developed countries for nothing or in return for paying income tax. They get it because they pay for health insurance.

Like all forms of insurance, they pay a fixed premium for health insurance whether or not they avail themselves of any healthcare services.

See Comparison Of Healthcare & Health Insurance Across Different Countries for more details based on personal experience and anecdata.

(1/N)

It's your money, you can do what you want but, if you propose your India premium as representative of India as a whole, I'll vehemently disagree.

My numbers below, normalized to USD/year:

DE: $18720 ("Best")

UK: $5475

IN: $1250

Big Mac Index = ~2X.— Ketharaman Swaminathan (@s_ketharaman) July 24, 2022

#10. POS is free

Many merchants would like to accept credit card because it’s a widely accepted fact in retail that every additional Method of Payment drives a sales uplift. However, according to the popular narrative, they don’t because they find the cost of POS terminal prohibitive.

This is a misconception.

As we saw in point #2 in Part 1 of this post, banks find micro and nano merchants very high risk and refuse to issue merchant accounts to them, which is why these merchants are unable to accept credit card.

SQUARE solved this problem in USA by positioning itself as a merchant aggregator. More in Three Ways To Hide Your Secret Sauce. Ditto iZettle in UK and EU.

Actually, in the larger scheme of things, POS is virtually free.

First of all, a merchant does not buy the POS – he rents it from the acquirer bank.

At the peak of re/demonetization, a govt honcho predicted that POS machine will be dead in India in 3 years. 2 years later, the count of POS has shot up from 1.5M to 4.25M. This is going to be the most harebrained prediction of all times! https://t.co/aDtFMsXQwr

— GTM360 (@GTM360) November 11, 2019

Secondly, the acquirer bank waives the rental if the merchant bills over a certain amount on credit card in a month. Over the years, I’ve spoken to around 100 stores about their POS cost. 99 of them hit the billing threshold in the very first 4-5 days of the month, and have never paid rental for their POS terminals. The sole exception is a small time grocery store in my housing complex.

Agreed. Even in India, where penetration of A2A RTP (UPI) is 10X that of Credit Card, I know only 1 merchant who has stopped accepting Credit Card in 5 years of UPI.

Apparently, Merchants believe that each additional MOP provides a sales uplift.https://t.co/9fNsOCRHqr— Ketharaman Swaminathan (@s_ketharaman) August 18, 2022

A lot of people are saying that the NPCI’s recent move to allow credit card to be added as a funding source to UPI will give a big boost to credit card volumes since merchants don’t need a POS to accept UPI payments, which are typically made by scanning a QR code at the merchant establishment.

I don’t buy this.

For one, as we saw above, POS is virtually free.

For another, BharatQR replaced POS with QR code for accepting credit card payments three years ago but failed to gather much traction.

I cited Nonprofit Company and Insider Trading here and here as canonical examples for the Mark Twain quote that appears in the opening credits of The Big Short movie.

It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.

I wonder if the ten responses to the Thiel interview question that I’ve covered in this two-part blog post can be considered as canonical counterexamples of the Mark Twain quote.